- Sterling retreats lower despite Parliament voting to extend Article 50 as investors eye EU summit and third meaningful vote next week

- Risk sentiment boosted by ‘substantive progress’ in US-China trade talks but disappointment that there will be no March summit

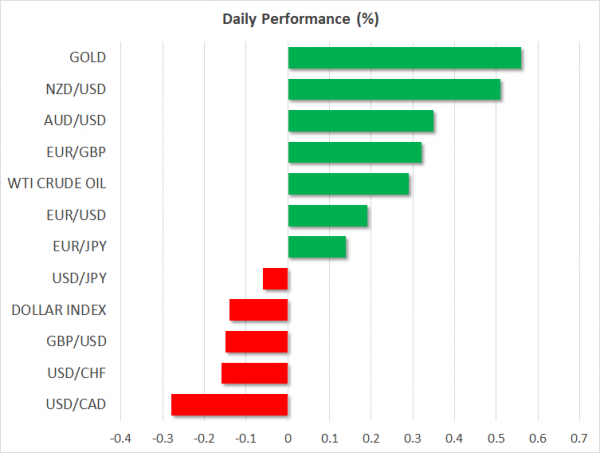

- Gold back above $1300 after North Korea says may suspend denuclearisation talks with US

Pound fails to resume rally after MPs vote to delay Brexit

British lawmakers on Thursday voted to extend the Article 50 process as expected, which, together with Wednesday’s vote to reject a no-deal Brexit, significantly minimises the risk of the UK crashing out of the European Union without a deal. However, with the outcome of the two votes already priced in, there’s been little fresh upside triggers for the pound over the past couple of days.

In fact, there was some disappointment that all of the amendments put forward yesterday were defeated in a victory for Prime Minister Theresa May. MPs rejected the amendments calling for a second referendum and to hold indicative votes on the different Brexit options. This keep’s May’s deal alive and there will now be a third meaningful vote on the Withdrawal Agreement, most likely on March 20.

In what could be a possible game changer for the government, the attorney general is reportedly preparing to update his legal advice on the Irish backstop, which could state that the UK would be able to use the Vienna Convention to leave the backstop unilaterally. If this was able to secure the backing of the small Northern Irish DUP party who are propping up May’s government, Brexiteer Conservatives may also decide to support the deal.

However, not all investors are holding their breath given the deep divisions in the Conservative party. Plus, apart from talking round her own party, May will also need to convince EU leaders to grant her an extension to the exit date at an EU summit next week.

The pound was last trading flat at 1.3235 versus the dollar, while against the euro, it was 0.2% weaker at 0.8554 pounds per euro.

Stocks rise on China tax cuts, progress in trade talks

Asian and European stocks were mostly in positive territory on Friday, lifted by trade headlines, as well as from China pledging additional support for the economy. US Treasury Secretary Steven Mnuchin told a Senate Committee hearing that the US and China are trying to reach a deal ‘as quickly as possible’ but said a summit in March between the US and Chinese presidents will not go ahead because more time is needed for the negotiations. Chinese media also reported that further ‘substantive progress’ has been made, while President Trump suggested that it could be another ‘three to four weeks’ before an announcement comes.

The news helped the Australian dollar move higher, climbing to $0.7087, though the market response was somewhat muted given the lack of clarity on the timeline. In the meantime, China’s Vice Premier Li Keqiang said it will implement the recently announced VAT cut for manufacturers from April 1 and promised more measures to boost the economy.

Gold and yen up as North Korea may pull out of denuclearisation talks

Gold prices rose 0.5% on Friday, recovering back above the $1300 level on reports that North Korea is considering suspending talks with the US on denuclearising. Furthermore, a North Korean official was reported as saying the country may soon resume missile tests.

The safe-haven yen also rose on the news, which was additionally supported from the Bank of Japan standing pat at its March policy meeting. Although the BoJ raised concerns in its statement about slowing exports and weak overseas growth, there were no clues of an imminent easing in policy. This briefly helped the yen firm to 111.48 per dollar before easing to 111.68 per dollar.

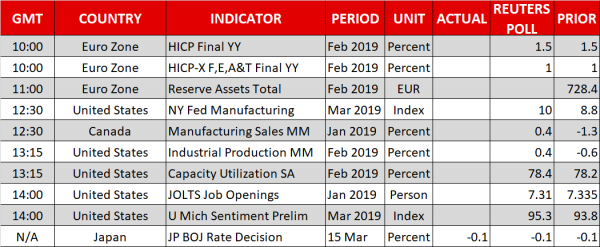

The dollar/yen pair is likely to be sensitive to a raft of data releases due out of the US later today as recent numbers have been painting a mixed picture for the US economy.