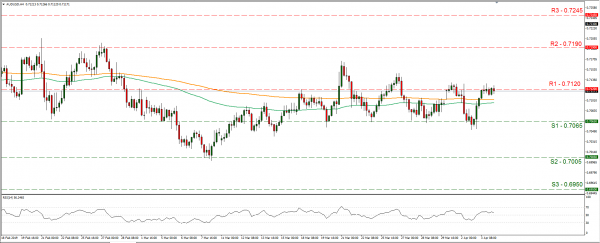

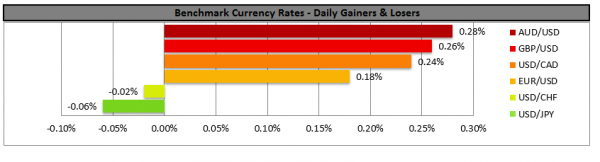

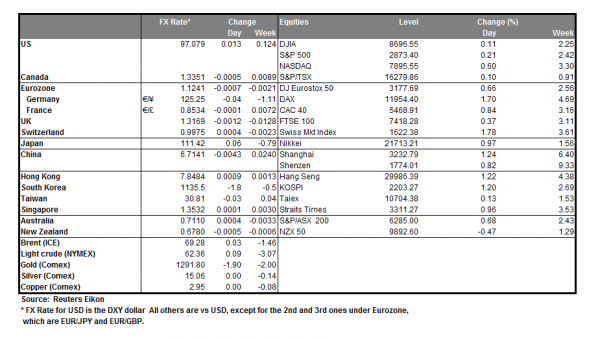

The greenback weakened yesterday as hopes on a trade deal between the US and China fueled a risk on mood for the markets. US White House economic adviser Larry Kudlow stated yesterday that the US –Sino negotiations made “good headway” last week. He also stated that the two sides aim to bridge differences over talks which could extend beyond 3 days this week. It was also mentioned that China may be recognizing the intellectual property issues among other issues, the US had raised over the years, for the first time. US President Donald Trump could be meeting with Chinese Vice Premier Liu He in Washington later today, which could be one more signal that the two sides are close to a deal. Should there be further positive headlines reeling in from the negotiations, we could see the USD’s role as a safe have retreat even further. AUD/USD had some gains yesterday and during today’s Asian session, however remained mostly in check as it continuously tested the 0.7120 (R1) resistance line. If the good news regarding the US-Sino negotiations continue to reel in, we could see the pair trading in a bullish market today. Should the pair find fresh buying orders along its path, we could see the pair breaking the 0.7120 (R1) resistance line and aim for the 0.7190 (R2) resistance hurdle. Should on the other hand the pair come under the selling interest of the market, we could see it aiming if not breaking the 0.7065 (S1) support line.

Pound gains as UK Parliament tries to block a no deal Brexit.

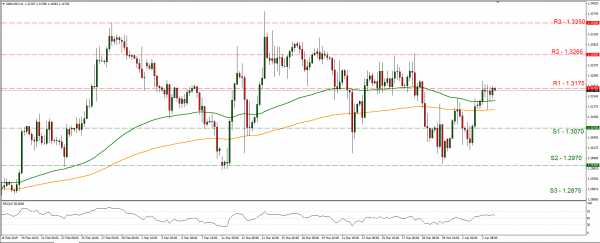

The GBP strengthened somewhat yesterday as Theresa May tried to work out a common direction about Brexit with opposition leader Jeremy Corbyn. On other news the UK Parliament voted for a legislation which would force Theresa May to ask for a Brexit delay to prevent UK crashing out of the EU. However it should be noted that despite both efforts pointing towards an agreed Brexit, they still have to bear fruits and for the time being do not lift the uncertainty surrounding Brexit. Despite both news strengthening the pound, it made little gains, hence we expect it to continue to be under pressure, as Brexit uncertainty is being maintained. Cable made some gains yesterday and tested repeatedly the 1.3175 (R1) resistance line. We could see the pair trading in a bullish market today, should there be any further positive headlines regarding Brexit. Should the bulls dictate the pair’s direction, we could see it breaking the 1.3175 (R1) resistance line and aim for the 1.3265 (R2) resistance level. On the other hand, should the bears take over, we could see the pair aiming if not breaking the 1.3070 (S1) support line.

Other economic highlights, today and early tomorrow

In today’s European session, we get Germany’s industrial orders growth rate for February and later on the ECB will be publishing the account of its last monetary meeting early March, in which the central bank had a clear dovish turn. In the American session we get Canada’s Ivey PMI for March, while in the tomorrow’s Asian session we get Japan’s household spending growth rate for February. As for speakers please note that Cleveland Fed President Mester and Philadelphia Fed President Harker, will be speaking today.

AUD/USD H4

Support: 0.7065 (S1), 0.7005 (S2), 0.6950 (S3)

Resistance: 0.7120 (R1), 0.7190 (R2), 0.7245 (R3)

GBP/USD H4

Support: 1.3070 (S1), 1.2970 (S2), 1.2875 (S3)

Resistance: 1.3175 (R1), 1.3265 (R2), 1.3350 (R3)