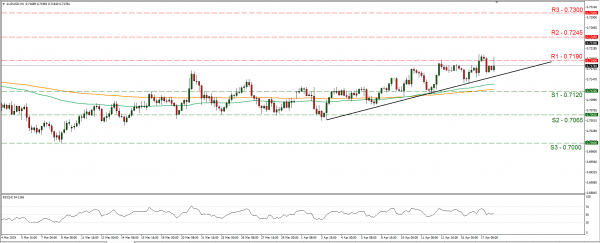

The AUD strengthened during today’s Asian session as the Australian employment data pointed towards a tight labour market. Despite the unemployment rate ticking up, the employment change figure provided more confidence as it rose more than expected. The Aussie may also be bolstered by progress in the US-Sino talks, as media report that a deal may be announced by early May. The recent Chinese data may have strengthened its negotiating hand and some hardening of the Chinese stand could be in the cards. The next round of negotiations seems set to begin near the end of the month as US representatives are to travel to Beijing. Should there be further headlines about progress in the US-Sino talks, we could see the AUD strengthening. AUD/USD rose during today’s Asian session, temporarily breaking the 0.7190 (R1) resistance line and correcting lower later on. We could see the pair having some bullish tendencies during today’s session, yet the US financial releases and any fresh headlines from the US-Sino negotiations could affect the pair’s direction. Please note that the upward trendline incepted since the 3rd of April still supports the pair’s price action. Should the pair find fresh buying orders along its path, we could see it breaking the 0.7190 (R1) resistance line and aim for the 0.7245 (R2) resistance hurdle. On the flip side, should the pair come under the selling interest of the market, we could see it breaking the 0.7120 (S1) support line and aim for the 0.7065 (S2) support barrier.

EUR weakens ahead of PMI release

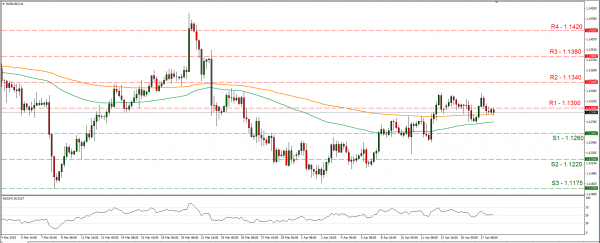

The EUR weakened against the USD during the European session yesterday, as the markets prepare for the PMI’s to be released. The PMI’s are expected to show some improvement and the big question is whether their results will be able to convince investors about the prospects of growth in the area’s economy. Media report that the German government is expected to slash its forecasted GDP growth rate to +0.5% yoy for 2019, weighing on the EUR. Please note that the 10 year German Bund yield rose and could provide some support for the EUR. Also analysts point out that a rebound of the Chinese economy could support the prospects of growth for the Eurozone as it may support German exports more. We expect today’s release of the April preliminary PMI’s for the area, to provide an indication of the European economy’s strength. The common currency weakened against the USD during the European session yesterday, breaking below the 1.1300 (R1) support line (now turned to resistance). Should Eurozone’s PMIs show some improved readings the pair could have some bullish tendencies today. Should the bulls dictate the pair’s direction, we could see the pair breaking the 1.1300 (R1) resistance line and aim for the 1.1340 (R2) resistance hurdle. Should the bears take over, we could see the pair breaking the 1.1260 (S1) support line and aim for lower grounds.

Other economic highlights, today and early tomorrow

In today’s European session, we get Germany’s producer price index for March, Eurozone’s preliminary PMI’s for April and UK’s retail sales growth rate for March. In the American session, we get the US retail sales growth rate for March, the Philly Fed business index for April, Canada’s retail sales growth rate for February and the US Markit preliminary Manufacturing PMI for April. In tomorrow’s Asian session, Japan’s inflation rates for March are to be released. Also please note that Atlanta Fed president Raphael Bostic is to speak today.

EUR/USD H4

Support: 1.1260 (S1), 1.1220 (S2), 1.1175 (S3)

Resistance: 1.1300 (R1), 1.1340 (R2), 1.1380 (R3)

AUD/USD H4

Support: 0.7120 (S1), 0.7065 (S2), 0.7005 (S3)

Resistance: 0.7190 (R1), 0.7245 (R2), 0.7300 (R3)