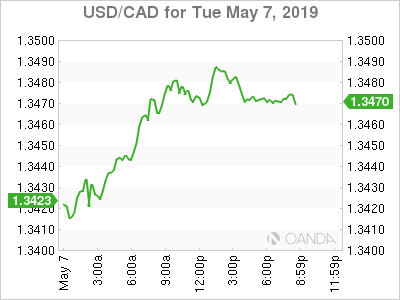

The Canadian dollar is lower against the greenback. The loonie is under pressure as trade war concerns have pressured oil prices lower and has made the dollar a safer destination for investors. The confirmation from US trade representative that tariffs could come into effect on Friday added to the woes of the Canadian currency dropping a further 0.18 percent on Tuesday.

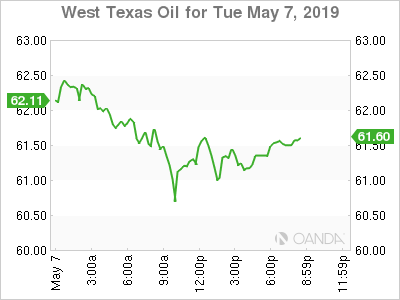

Large crude inventories in the US and trade war escalation have energy prices under pressure despite ongoing sanctions against Venezuela and Iran. The OPEC+ pact to cut production has stabilized prices and even served as a steady platform for higher prices, but as the end of the agreement ends there are high probabilities that Russia might not sign up again, leaving Saudi Arabia with a heavy load to carry.

The US has pressured OPEC members to close the supply gap created by Iran and Venezuela disruptions and a Russian exit would put the Saudi’s in a difficult spot by themselves.

The Canadian economic calendar will feature high profile data until Thursday with the trade balance data and Friday with the anticipated employment report. Trade negotiations between the US and China will steal the spotlight if there are any significant developments that could either increase risk aversion or increase appetite for riskier assets.

The US dollar is mixed against major pairs. The Japanese yen and the Australian dollar are trading higher while the greenback has risen against the New Zealand dollar, euro, pound, Swiss franc and the Canadian dollar.

OIL – Trade War Pressures Energy Prices

Energy prices dropped as trade war concerns put downward pressure on global energy demand. The US and China appeared to be close to a trade deal ending their dispute until last weekend it was revealed that that China was walking back some of its commitments which sparked tariff threats from the US that could go into effect this Friday.

The market has found a way to cover the supply gaps caused by sanctions against Venezuela and Iran and the lack of strong signals from the OPEC+ on an extension to the production cuts beyond June have left prices sensitive to inventory data.

Higher US crude inventories and the uncertainty of the US-China trade talks which resume on Thursday will keep prices under pressure with higher US production expected.

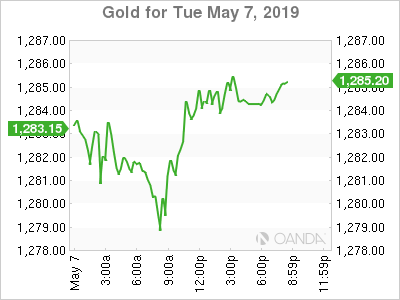

GOLD – Gold Higher on Safe Haven Flow

A rise in volatility after the trade war comments boosted gold prices as investors sought the safety of the yellow metal. The sudden negative comments from the US on China’s changes to their trade talks triggered a selloff in equity markets worldwide. Despite the market reaction the Chinese delegation is still headed to Washington for the next round of talks on Thursday and Friday.

Gold was also bid by the news of the US military ready to deploy air support for troops in the Middle East.

Commodities were mixed after the news of a disagreement between China and the US on their trade talks. Positive comments were plenty as the two super powers sat down to negotiate, but the lack of details on the proceedings came back to haunt markets as the US returned to a combative tone by threatening to increase tariffs against Chinese goods.

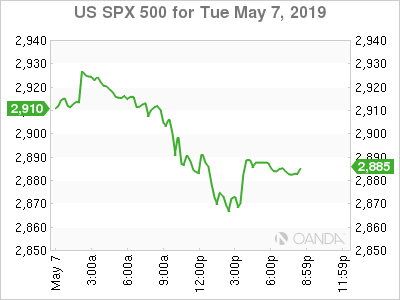

STOCKS – Global Growth Concerns Hit Stocks

Global stocks fell as investors remain anxious about the outcome of a trade deal between the US and China. Everything seemed to be headed to a positive announcement, but this weekend comments from the US eroded confidence that a deal can be struck and a new Friday deadline looms.

Previous trade disagreements have resulted in sell offs, and this week closely resembles the end of 2018 and early 2019 as markets hit a wall with investors flocking to safe havens as risk factors became unavoidable in the short term.

Global growth was impacted by a rise of trade tariffs and disappointing economic indicators in major economies have not changed the narrative. Apple made sure to mention the negative connotations of a protectionist agenda in January and market sentiment forced the U.S. Federal Reserve to pause its interest rate hike plans.