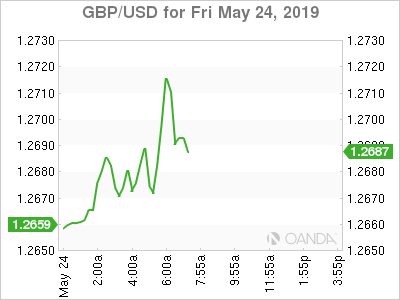

The long drawn out process for Theresa May to resign is over. PM May’s emotional speech at the doorsteps of 10 Downing Street delivered the news she will step down on June 7th. After three failed Brexit deal votes in Parliament and a fourth pitch that was dead on arrival, May had no choice but to resign.

May’s election that she called in 2017 was her biggest mistake that ended with her losing her majority and thus only having a minority government to push forward on Brexit. The problem for the next leader going forward is that the Parliamentary arithmetic is the same, EU negotiations will restart, and the British people’s frustration of Brexit angst will grow.

Now we will hear from all the candidates and markets will now try to price in the risks of a no-deal Brexit. The front-runner is Boris Johnson and if that is occurs, we could see the hardest Brexit outcome. Conservative lawmakers will hold secret votes to trim the list of interested candidates down to until two emerge, which should occur within two weeks. Then the Conservative Party, which holds about 124,000 members will vote over the next month.

Even if we do end up seeing Boris Johnson become the new PM, he will face a majority in Parliament that is against a no-deal, based on the March 27th vote of 160 to 400. One possible scenario is that we see a divisive leader in office, who will not have a majority, ruffle some feathers and have MPs push forward a vote of no confidence which could see a trigger for a general election. The other growing scenario is that we could see the new leader avoid a general election and put Brexit up to a second referendum asking for a no-deal or to remain.

Uncertainty is elevated, and the British pound volatility should grow. Since no-deal chances are increasing, we should see sterling’s rally capped.

- BOE – Hasta la vista rate hike bets

- Oil – Small bounce following two-day rout

- Gold – Still unattractive

BOE

With uncertainty remaining high on who will become the UK’s next leader, the short-end rates curve has pretty much seen all rate hike bets erased. If we see a hard exit, rate cut bets will grow rapidly and for now, the BOE will need to be on hold and wait until we see the next leader’s plan.

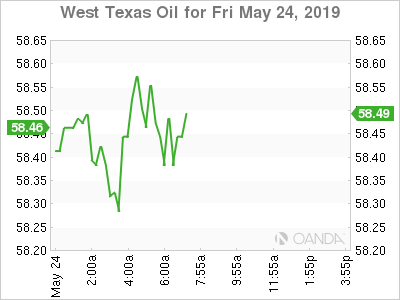

Oil

Crude prices are up 1% in early trade as we see technical buyers returning following the biggest two-day drop since December. The global growth concerns that are stemming from the US-China trade war put a cap on the recent geopolitically driven rally. As we approach a 3-day holiday, we could see the markets return some focus to the growing tensions in the Middle East.

Oil’s selloff initially was supported by consecutive multi-million barrel builds and we may need to see a third week of rising stockpiles with next week’s reading before we see another major push lower. Conciliatory comments could be expected on the trade front as we approach the holiday weekend.

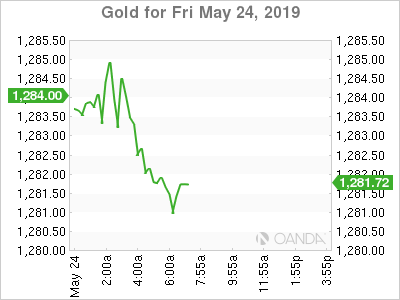

Gold

Gold prices are giving up about 1/3 of yesterday’s gains as we see most of Europe and Asia in the green. Gold’s safe-haven demand has underperformed other flight-to-safety assets throughout the recent trade war escalation. The yellow metal remains an unattractive play and we will likely see traders wait until we see price take out the $1,300 an ounce level or break below the 2019 lows at around $1,265.