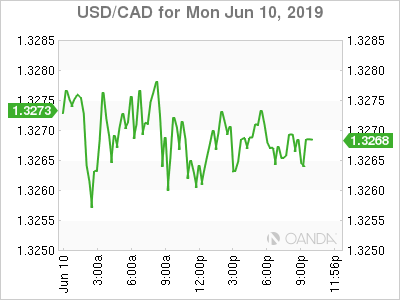

The Canadian Dollar is flat against the US dollar on Monday after the greenback rebounded against the loonie. The Trump administration reached a deal with Mexico after threatening to issue tariffs against Mexican imports if immigration requests were not granted. The soft dollar had been a positive for commodities, but with a boost from once again closing a trade war front, oil and gold tumbled more than one percent.

Economic data in Canada has been mixed. A stronger than expected jobs report on Friday contrasted with lower housing starts. US employment underperformed last week giving the Canadian dollar an edge against the dollar as investors are pricing in multiple rate cuts if American indicators continue to disappoint.

The biggest indicators this week won’t be domestic as US inflation and retail sales will take the spotlight as the market awaits the crucial data to see if it validates a rate cut from the Fed in June.

The US central bank is still hawkish on the economy, but its aware of the negative effects a prolonged trade war between the US and China will have on both economies. Various think-tanks have given their estimates and only the White House sees it as a positive for the American economy.

Rate cut estimates are rising as the Fed will be put on the spot if US data continues to lose momentum. It is still too early to call, but June becomes a crucial month as the G20 meeting in Japan could see a meeting between Xi and Trump materialize and hint to an agreement on trade.

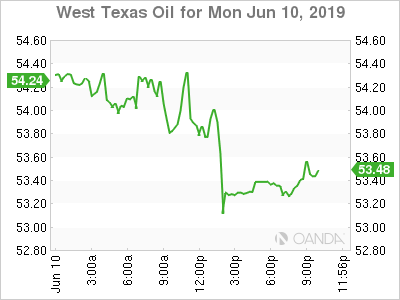

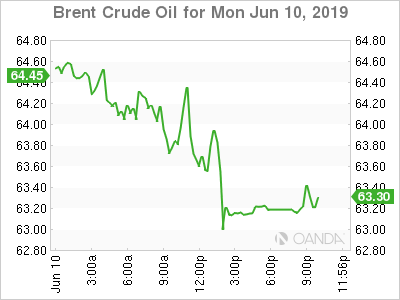

OIL – Crude Prices Fall on Russia Indecision and Strong Greenback

Oil prices dropped on Monday after a quick recovery from the US dollar and more tough talk from China on trade. The negotiations between the two super-powers don’t have a date, and with the G20 in Japan fast approaching the chance there is a positive announcement is uncertain. The impact on oil prices from further downgrades in global growth could lead to further losses.

Russia is playing hard to get and remains not committal about extending the OPEC+ deal to cut oil production. The deal has been the major stabilizing force for crude prices, but rising US production and a prolonged trade war are close to offsetting the balance. Russia could be improving their position to seek leverage out of Saudi Arabia before agreeing to rejoin the major producers.

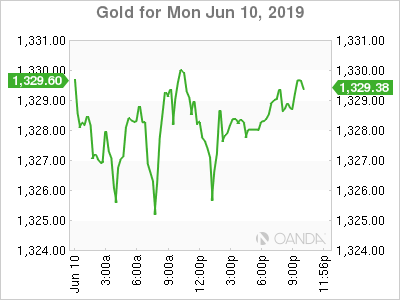

GOLD – Gold Drops on US Dollar Comeback

Gold fell more than 1 percent at the start of the week as the short lived US-Mexico tariff dispute once again put emphasis on the US-China trade war. The US dollar rebounded despite mixed economic indicators putting investors on alert of possible rate cuts from the Fed.

Equities were the main beneficiaries of closing the US second trade war front and investors sold commodities. Gold remains bid as the main dispute between US and China remains unresolved. If there is no sit down between leaders at the G20 the yellow metal will rise as investors will be on the look out for a safe haven.