Events near Iran weigh on risk appetite

We’re seeing markets broadly in the red around the globe on Friday with traders continuing to respond to developments in Gulf of Oman, as the US doesn’t hesitate to point the finger of blame at Iran.

Equities have been on a good run the last couple of weeks, ever since the Fed assured investors that it wasn’t just going to sit back and watch the economy slow before its eyes. The rally has slowed paused this week, with the latest heightened geopolitical risks naturally weighing on risk appetite, albeit without dragging too heavily on stocks.

Oil remains elevated but traders not getting carried away

Oil prices remain elevated on Friday, with tensions heightening after the US blamed Iran for the attack on two ships in the Gulf of Oman. It may not come as a surprise that the Trump administration has directed the blame Iran’s way given that it was also blamed for sabotaging ships in the region last month, not to mention that it took place off its coast and the country has a motive to do so.

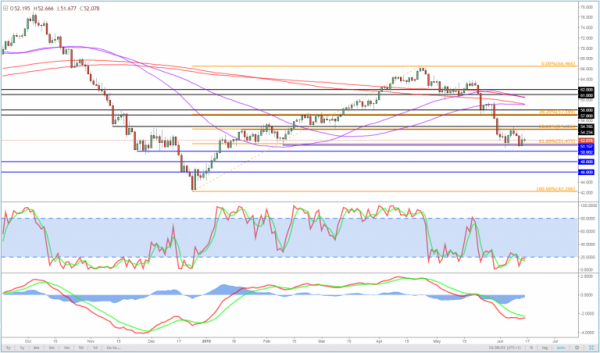

WTI Daily Chart

That said, occurring at a time when Shinzo Abe was in Iran attempting to create some form of dialogue between the two is hardly ideal. The Trump administration’s decision to withdraw from the nuclear agreement and re-imposed sanctions has caused huge economic distress for Iran and threatened to kill the deal altogether, despite other nations remaining committed to it. Unfortunately, US sanctions make their ability to do business with Iran very difficult so their participation is in many ways symbolic.

Oil prices may have spiked following the attack but they haven’t risen too much considering the risk that an escalation poses, with around 20% of global oil supply passing through the Strait of Hormuz. Perhaps this is a sign of how pressured oil prices are to the downside at the moment, with the US pumping at record levels and the global economy slowing. Still, it may be enough in the near term to keep WTI above $50 and further complicate the OPEC+ meeting which is expected to take place early next month.

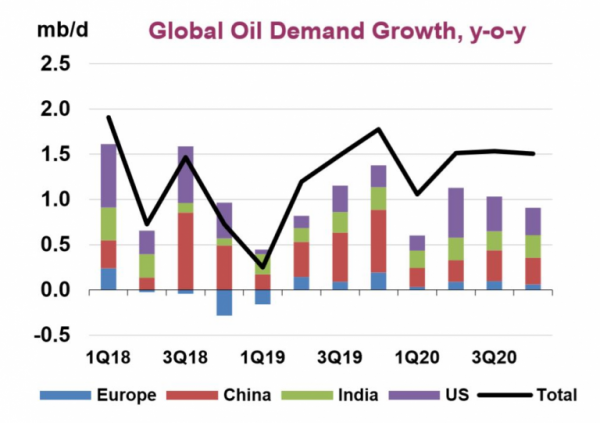

IEA concerned about growth

IEA may have also played a role in the oil rally fizzling out today, after they reported that oil demand growth this year has been revised lower by 100,000 barrels to 1.2 million, the second consecutive month it has done so. It’s interesting that we seem to be entering into a new phase of the oil story, shifting focus from supply side dynamics and battles for market share to the demand side that for so long has gone under the radar.

Global slowdown fears and trade war risks have intensified which has led to the latest downward revision from IEA and there’s a real danger than further downgrades will follow if downside economic risks materialize. This is another factor that OPEC+ will have to consider when they meet next month, with oil prices remaining under pressure even despite geopolitical risks being heightened following yesterday’s attack.