The Canadian dollar appreciated on Tuesday after Bank of Canada (BoC) Governor Stephen Poloz said the economy is picking up. The comments follow a speech by Deputy Governor Carolyn Wilkins on Monday that hinted a rate hike will be the next move by the central bank. Poloz had already taken a rate cut off the table earlier this year. The BoC has been on the sidelines since it proactively cut the interest rate twice in 2015. The government launched a fiscal stimulus program and now it appears the central bank is ready to start tightening its monetary policy.

The loonie has been one of the biggest movers gaining 1.517 in the last five days despite the price of oil offering little support. The USD has struggled in 2017 after the so called Trump trade lost momentum as the US administration overspent its political capital and got embroiled in an investigation on collusion with Russian agents to influence the results of the 2016 presidential selection.

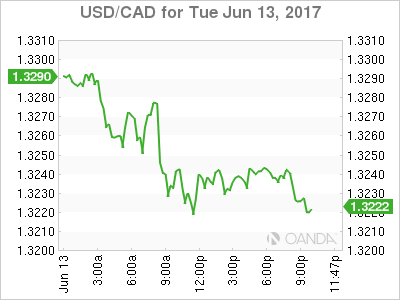

The USD/CAD lost 0.685 percent in the last 24 hours. The currency pair is trading at 1.3237 after BoC Governor Stephen Poloz followed up the comments form Deputy Governor Wilkins about the state of the Canadian economy. There is little expectation that the BoC will hike in July but the fact that the central bank is openly discussing reducing stimulus has the loonie bid.

The USD/CAD was close to breaking the 1.32 price level on Tuesday, but is now rising ahead of the FOMC decision. Oil prices have offered little support to the loonie after falling last week on a surprise buildup of US inventories. Tomorrow’s report of last week’s crude inventories will get the market to look beyond the Fed decision and the forecasts of its members.

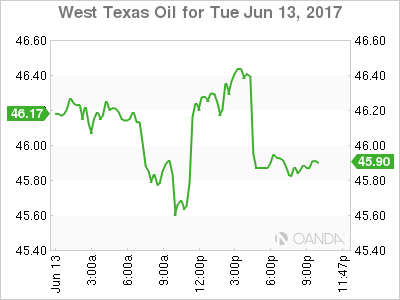

The price of oil rose 0.306 percent on Tuesday. The price of West Texas Intermediate is trading at $46.27 despite the sluggish growth of supply last year even before the Organization of the Petroleum Exporting Countries (OPEC) production cut agreement was put in place. US production has offset the efforts from the OPEC and other major producers with the major factor being stagnant demand for energy despite lower prices.

The release of weekly crude inventories will set the direction for oil prices. The American Petroleum Institute (API) oil inventories showed a surprise buildup of 2.75 million barrels beating a forecast of 2.7 million drawdown. Last week the API and the US crude inventories released by the Energy Information Administration (EIA) did not match in direction as the API showed a drawdown, while the crude inventories showed a surprise buildup. There can be an issue of how synced both oil reports are and as the OPEC have extended their production cut efforts into 2018 and US production is ramping up there will be volatility as investors will be looking for direction on the state of the US energy market on a weekly basis.

Market events to watch this week:

Wednesday, June 14

4:30 am GBP Average Earnings Index 3m/y

8:30 am USD CPI m/m

8:30 am USD Core CPI m/m

8:30 am USD Core Retail Sales m/m

8:30 am USD Retail Sales m/m

10:30 am USD Crude Oil Inventories

2:00 pm USD FOMC Economic Projections

2:00 pm USD FOMC Statement

2:00 pm USD Federal Funds Rate

2:30 pm USD FOMC Press Conference

6:45 pm NZD GDP q/q

9:30 pm AUD Employment Change

Thursday, June 15

3:30 am CHF Libor Rate

3:30 am CHF SNB Monetary Policy Assessment

3:30 am CHF SNB Press Conference

4:30 am GBP Retail Sales m/m

7:00 am GBP MPC Official Bank Rate Votes

GBP Monetary Policy Summary

GBP Official Bank Rate

8:30 am USD Unemployment Claims

Tentative JPY Monetary Policy Statement

Friday, June 16

Tentative JPY BOJ Policy Rate

2:30 am JPY BOJ Press Conference

8:30 am CAD Core Retail Sales m/m

8:30 am USD Building Permits