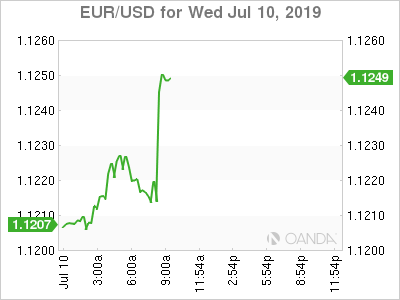

Fed Chair Powell’s prepared testimony release highlighted uncertainties since the June FOMC continue to dim the outlook. The economic outlook has not improved in recent weeks and that pretty signals a rate cut at the July 30-31 FOMC meeting. He noted, that the economy performed reasonably well over the first half of the year and jobs are healthy. Markets are convinced that the Fed will deliver a 25-basis point rate cut this month, but if we see softer than expected inflation data tomorrow and if the advance second quarter GDP reading comes in well below 2.0% on July 26th, we will see the case grow for the first cut to be a 50 basis point one. Currently markets see one cut in July and its almost a coin flip for another one in September.

Treasury yields and US dollar tanked, while US stocks turned higher on the release of the Powell’s statement. The prepared testimony release have expectations running high for Powell to go full dove today.

China

China is preparing to take measure to stabilize trade and will continue to lower import tariff levels. Once markets get passed Powell’s two-day testimony, the focus will come right back to trade. Risk appetite could continue to rip higher if we see trade progress combined with ultra-easing signaled from the Fed, ECB and PBOC.

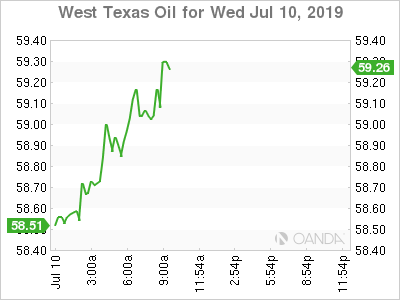

Oil

Crude prices are higher on yesterday’s third consecutive large drawdown from the API report and high tensions in the Persian Gulf. Oil may start to regain its bullish mojo on growing expected global oil markets will tighten in the second half of the year and on growing argument that Fed may have started a major reversal for the US dollar.

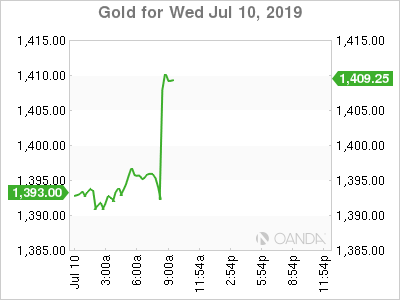

Gold

Gold prices are strongly supported on growing expectations the Fed and ECB will deliver larger than expected rate cuts. Financial markets are bracing for the next wave of easy money and that should support the case for owning bullion.