The price of crude oil rose sharply after the US shot down an Iranian drone in the Strait of Hormuz. This came after the drone reportedly threatened an American warship. The incident took place a few weeks after Iran shot down an American drone that it claimed was in its waters. It also came a few hours after the Iranian Revolutionary Guard said it had seized a foreign vessel near the region. It detained the crew for allegedly smuggling oil. These events have made oil shipping in the region dangerous and many vessels are now being escorted by warships. Meanwhile, the Iranian foreign minister, Javad Zarif said that his country would not negotiate with the US unless sanctions were lifted.

Sterling rose sharply in the American and Asian sessions after the members of parliament passed a maneuver to avoid leaving the European Union without a deal. The chief EU negotiator, Michel Barnier also signaled that the EU was open to alternative arrangements at the Irish border. The maneuver passed by Parliament will stop Boris Johnson from suspending Parliament in order to force through a no deal Brexit. The impossible challenge for Johnson will be to pass any legislation in the divided Parliament. Yesterday, the UK announced impressive retail sales data.

Earlier today, Iran released its national CPI data. The national core CPI declined from the previous 0.8% to 0.6% while the headline CPI remained unchanged at 0.7%. Today, Germany will release its PPI data, which is expected to show that the PPI declined from 1.9% to 1.4%. In Canada, Statistics Canada will release the retail sales numbers, which are expected to show a slight improvement. In the US, investors will receive the Michigan consumer expectation and consumer sentiment data.

EUR/USD

The EUR/USD was volatile in the American and Asian sessions. It first rose to a high of 1.1280, erased those gains and declined to a low of 1.1240 and then rose to the current level of 1.1265. On the hourly chart below, the Average True Range, which is used to measure volatility rose to the highest level this week. The current price is between the 23.6% and 38.2% Fibonacci Retracement level. The pair’s price is between the middle and the upper line of the Bollinger Bands. The pair will likely retest the previous resistance of 1.1280.

GBP/USD

The GBP/USD pair rose sharply as parliament tried a maneuver intended to avoid a no-deal Brexit. The pair is now trading at 1.2547, which is close to the highest level since July 15. The price is close to the 50% Fibonacci Retracement level. This price is above the 50-day and 25-day moving averages while the RSI remains at the overbought level of 70. The pair could continue to rally and test the 1.2600 in the next couple of days.

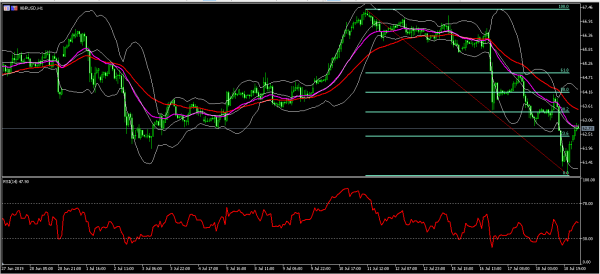

XBR/USD

The price of Brent crude oil rose sharply to a high of $62.80. On the hourly chart, the pair is above the 23.6% Fibonacci Retracement level. The price is along the 25-day exponential moving averages and slightly below the 50-day moving averages. The RSI has emerged from the oversold level to the current 48. The price is along the middle line of the Bollinger Bands. The pair will likely continue moving higher as gulf tensions rise.