A rather optimistic start to Tuesday trading is seeing the dollar, US equities and oil prices all advance. The European bourses are sharply higher following strong results from AMS, Hermes, Santander, and UBS. European automakers also got a boost from Faurecia’s affirmation of their outlook, Saic to a stake in Daimler, and BMW got upgraded from Morgan Stanley, while Continental finally cut their guidance. It appears the European auto stocks may have hit a bottom for now as stocks like Continental are rising even on bad corporate warnings.

US stocks are looking at a positive open, but the gains will be limited until we get through the bulk of this week’s earnings reports which will see updates from Caterpillar, Facebook, Boeing, Ford, Intel, 3M, Alphabet, Amazon, and McDonalds. The other key catalysts remains the Fed and markets are scaling back their easing bets, but that could all change after Friday’s first reading of second quarter GDP.

South Korea/Russia

Markets were surprised to see reports that South Korean jets fired warning shots when a Russian military plane said to have entered their airspace. 360 warning shots were fired at the Russian plane as it entered the airspace twice. Seoul also noted that China planes violated their airspace, in what seems to be a coordinated move by the Russian and Chinese.

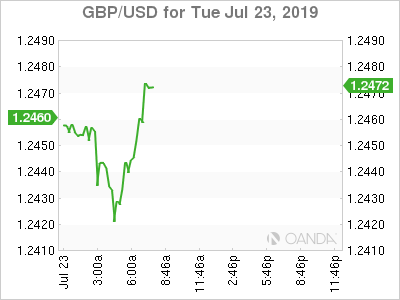

PM Johnson

Boris Johnson doubled Jeremy Hunt’s votes and will become Prime Minister after Theresa May steps down tomorrow. The British pound saw little reaction as the result was heavily baked in. Johnson is not expected to see an immediate no-confidence vote as Labour leaders would be unsure if they could win.

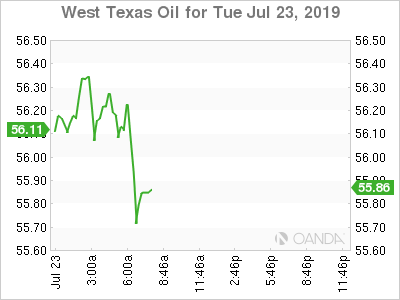

Oil

Oil prices are struggling to hold gains as a stronger dollar brings down commodities and on a relatively calm news day for tensions in the Persian Gulf. Markets will await today’s energy report from the API which is expected to see another draw with crude inventories.

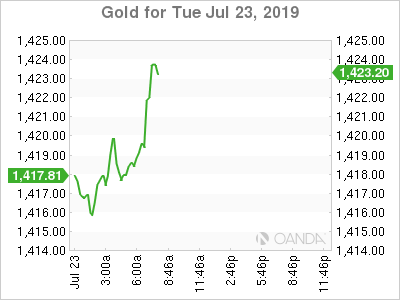

Gold

Demand for gold is waning as earnings results from both Europe and the US are coming in better than expected and as US lawmakers agreed on a debt-limit deal, removing a key risk event. Gold will likely struggle until we get to next week’s FOMC meeting, which should see policymakers cut rates and signal more are coming.

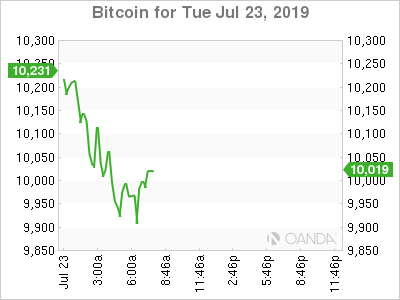

Bitcoin

Bitcoin fell below the $10,000 level as fears linger that global regulators will eventual make life impossible for cryptocurrencies to thrive. A strong dollar is also driving all risky assets lower today and if today’s bearishness accelerates, immediate support could come from the $9,300 level.