For the 24 hours to 23:00 GMT, the EUR rose 0.18% against the USD and closed at 1.1078 on Friday.

On the data front, Euro-zone’s seasonally adjusted trade surplus unexpectedly widened to €19.0 billion in July, amid surge in exports and defying market consensus for the surplus to narrow to €17.5 billion. In the prior month, the nation posted a revised surplus of €17.7 billion.

In the US, data showed that the flash Reuters/Michigan consumer sentiment index advanced to a level of 92.0 in September, surpassing market expectations for a rise to a level of 90.9. In the previous month, the index had recorded a level of 89.8. Further, the nation’s advance retail sales rose 0.4% on a monthly basis in August, compared to a revised increase of 0.8% in the previous month. Market participants had envisaged retail sales to climb 0.2%. Also, business inventories climbed 0.4% on a monthly basis in July, beating market anticipations for an advance of 0.3%. Business inventories had registered a flat reading in the prior month.

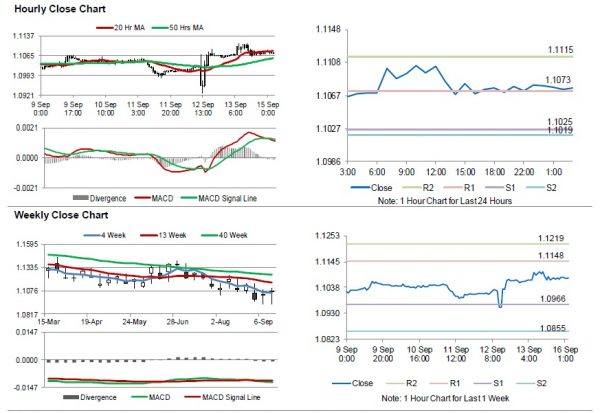

In the Asian session, at GMT0300, the pair is trading at 1.1076, with the EUR trading a tad lower against the USD from Friday’s close.

The pair is expected to find support at 1.1025, and a fall through could take it to the next support level of 1.1019. The pair is expected to find its first resistance at 1.1073, and a rise through could take it to the next resistance level of 1.1115.

Amid lack of macroeconomic releases in the Euro-zone today, traders would focus on the US Empire State manufacturing index for September, set to release later in the day.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.