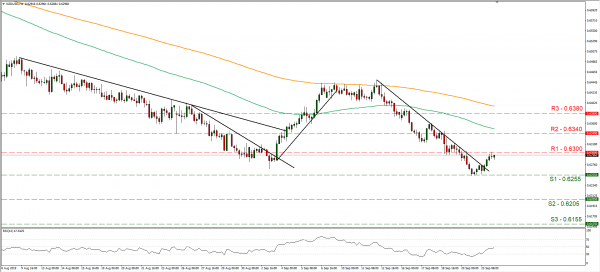

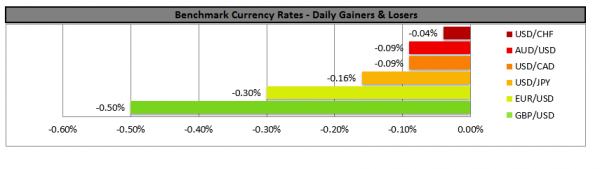

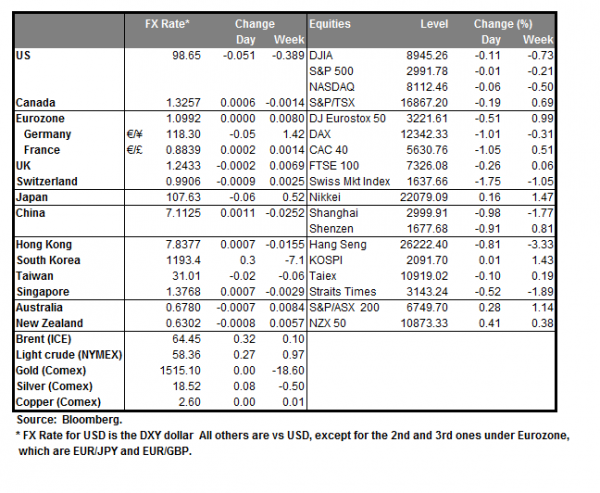

Tomorrow during the Asian session (02:00, GMT) RBNZ’s interest rate decision is due out. The bank is expected to remain on hold at +1.00% and NZD OIS imply a probability of 78% for the bank to do so. Consensus seems to rely among other factors on the fact that the bank had cut rates by a surprise 50 basis points, in its prior meeting and could be waiting for the dust to settle down. As for the accompanying statement we expect the bank to maintain some easing bias, while at the same time the tone could be shifted more towards a neutral tone, however the bank is no stranger to surprises. Given the markets’ dovish inclinations, as it may be expecting a further rate cut until the end of the year, a possible neutral tone could ease the market’s bias somewhat providing some support for the Kiwi. On the flip side should the bank be clearly tilted on the dovish side we could see the Kiwi weakening. NZD/USD rose yesterday breaking he downward trendline incepted since the 12th of September and tested the 0.6300 (R1) resistance line. As the pair broke the prementioned downward trendline, we switch our bearish outlook in favour of a sideways movement, yet at the same time the bulls seem to be slowly asserting control over the pair’s direction. Also please bear in mind that tomorrow’s RBNZ interest rate decision could switch the pair’s price action to any direction. Should the bulls be in control, we could see the pair breaking the 0.6300 (R1) resistance line and aim for the 0.6340 (R2) resistance level. Should the bears be in charge, we could see the pair aiming if not breaking the 0.6255 (S1) support line and if (S1) is broken continue lower aiming for the 0.6205(S2) support level.

EUR weakens on soft data

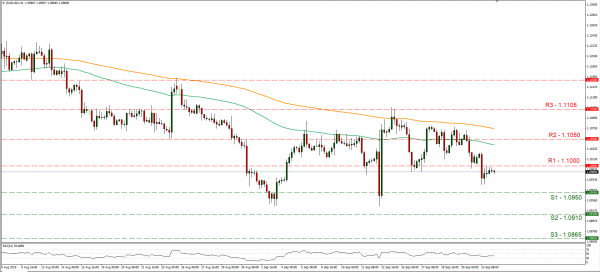

EUR suffered some losses yesterday as the preliminary September PMIs for countries in the zone, showed another weakening of economic activity. Especially Germany’s manufacturing PMI, which is considered key, missed its target, sparking a wave of short positions against the common currency. The surprise widened contraction of economic activity in Germany’s manufacturing sector, evident by yesterday’s PMI drop, could drag the largest economy of the trading bloc into a recession. Analysts tend to note that the release dashed hope that the worst was over and strengthened arguments for a bolder action from the ECB. We could see the common currency correcting somewhat, yet the outlook remains negative. EUR/USD dropped yesterday at the release of the PMI’s, breaking the 1.1000 (R1) support line, now turned to resistance. As the pair’s correction later on failed to break (R1), we could see the pair maintaining a sideways motion for the time being. Should the pair find fresh buying orders along its path, we could see it breaking the 1.1000 (R1) resistance line and aim for the 1.1050 (R2) resistance barrier. Should the pari come under the selling interest of the market, we could see it breaking the 1.0950 (S1) support line and aim for the 1.0910 (S2) support level.

Other economic highlights today and early tomorrow

In today’s European session, we get Germany’s Ifo business climate for September and UK’s CBI trends for September. In the American session, we get the US consumer confidence indicator for September and later on the API weekly crude oil inventories figure. In tomorrow’s Asian session, we get New Zealand’s trading data for August, before the release of RBNZ’s interest rate decision. As for speakers, BoJ Governor Kuroda, ECB’s Villeroy de Galhau, RBA governor Lowe and ECB Vice President Luis de Guindos speak. Also bear in mind that BoJ will be releasing the minutes of its July policy meeting.

Support: 0.6255 (S1), 0.6205 (S2), 0.6155 (S3)

Resistance: 0.6300 (R1), 0.6340 (R2), 0.6380 (R3)

Support: 1.0950 (S1), 1.0910 (S2), 1.0865 (S3)

Resistance: 1.1000 (S1), 1.1050 (S2), 1.1105 (S3)