Canadian jobs report up ahead

Amid the rumblings of US-China trade which remains the headline event through NY, there are still two important data points that hit the wires for USDCAD traders tonight at 11.30pm AEST. These are, of course, Sep. Employment Change with consensus at 10k and Sep. Unemployment Rate forecast at 5.7%.

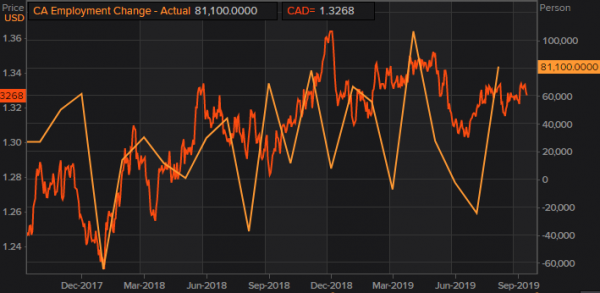

Last month, CAD saw an exceptionally strong Aug. print to the tune of 81k jobs added. This momentum is likely to carry over to Sep’s job print, and as a result, further strengthen the BoC’s resolve to keep monetary policy relatively tighter in comparison to the global downward shift we’ve seen across major G10 central banks. While the BoC were fairly tight-lipped about forward guidance back in early September, you only have to sift through previous comments where Governor Schembri suggests “Canada is operating close to full potential” to recognise the relatively hawkish position the country is in. Elsewhere, an unemployment rate at 5.7% would be a print similar to the prior two months but generally draws less focus unless wildly different.

Global downside risks still a concern for BoC

Effectively a rinse and repeat operation across most statements put out by major central banks with BoC no different – global economic and geopolitical risks remain a steady concern. The continued presence of US-China trade risks and slowing economic growth certainly puts pressure on the BoC to cut. However, despite these external uncertainties, the Canadian domestic economy is far from recession territory. July’s GDP was decent while Canada’s housing market remains ahead of schedule with stronger pricing and activity outcomes.

Reaction

Net positive jobs report: USDCAD to weaken and breach 1.3267. Could also try for 1.3240 to the downside.

Net negative jobs report: USDCAD to strengthen and pull back towards 1.3288. Though, you’d have to balance this with US-China trade headlines which have been net positive as of late and putting bearish pressure on USDCAD price action.