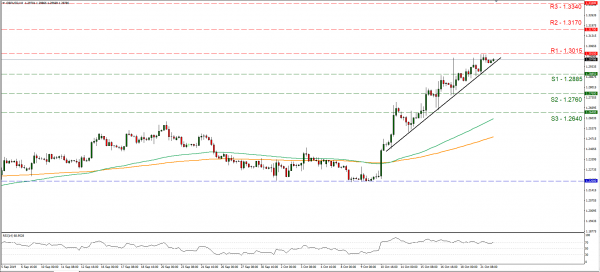

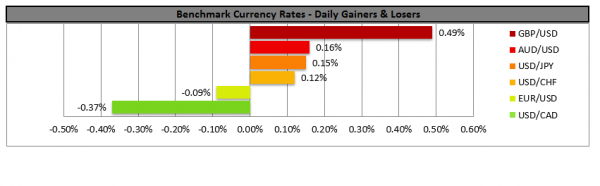

The pound remained supported against other currencies as the crucial vote in the UK Parliament about Brexit nears. Yesterday the UK Parliament’s speaker did not allow the issue to come to a vote as the Parliament had already decided once on Saturday. Hence the UK Government has introduced the Withdrawal Agreement Bill and plans to have a preliminary vote in the Parliament by 19:00 (GMT). The vote is expected to be very close and further ups and downs are expected until Thursday at least. In our opinion, the pound’s support seems to continue to depict the lowering of a hard Brexit possibility, yet we would not be surprised t osee doubts settling in trader’s hearts once again. We expect the pound to remain Brexit driven and high volatility could still be present should the markets be surprised by the political proceedings. GBP/USD continued to rise yesterday, testing the 1.3015 (R1) resistance line. We maintain a bullish outlook for the pair as the upward trendline, incepted since the 11th of the month, remains intact. Should the pair find fresh buying orders along its path, we could see it breaking the 1.3015 (R1) resistance line and aim for higher grounds. Should the pair come under the selling interest of the market, we could see it breaking the 1.2885 (S1) support line and aim for the 1.2760 (S2) support level.

… while the USD gets some support from US-Sino progress

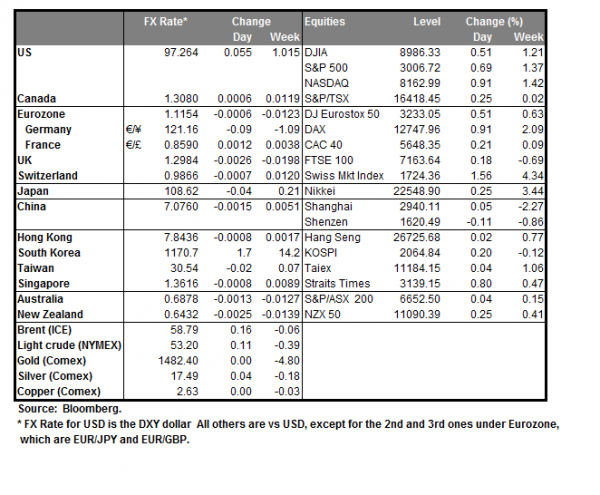

Signs that the US and China were making progress in their negotiations, supported the USD yesterday as well as commodity currencies. According to media, US President Trump stated that the work towards ending the US-Sino dispute was going well and White House economic advisor Kudlow, stated that the December planned tariffs could be withdrawn should there be further progress. Also, US Commerce Secretary Ross stated that the deal may not be finalized next month, yet the important issue is to get the right deal. The tone of the language used has softened and seems quite positive, hence we remain optimistic about the prospects of the negotiations.

… and the CAD remains also supported as Trudeau seems to remain in power

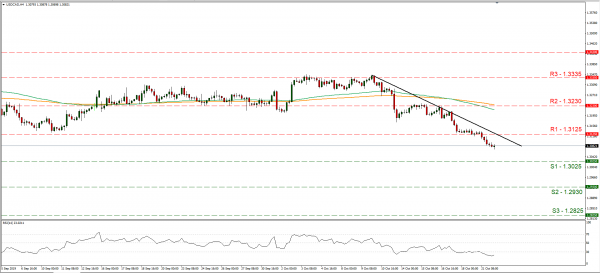

As the polls closed in Canada yesterday, Justin Trudeau seems to remain in power yet with less power as scandals took their toll. Trudeau’s Liberals, are projected by media to be forming a minority government and should that be the case, would need the support of a smaller opposition party to govern. The CAD seemed to enjoy the result as it remained supported and was able to avoid substantial volatility. Also, the CAD seems to be supported currently, from reduced global trade uncertainty and central bank interest rate differentials. USD/CAD continued tot drop distancing itself from the 1.3125 (R1) resistance line. We maintain our bearish outlook as the downward trendline incepted since the 10th of the month remains intact. Please note though that the RSI indicator in the 4-hour chart remains well below the reading of 30 implying a possible overcrowded short position. Should the bears continue to dictate the pair’s direction, we could see it breaking the 1.3025 (S1) support line other wise should the bulls take over, we could see the pair breaking the prementioned downward trendline as well as the 1.3125 (R1) resistance line.

Other economic highlights today and early tomorrow

In today’s American session, we get Canada’s retail sales growth rates for August, the US existing home sales figure for September and later on the API weekly crude oil inventories figure. During tomorrow’s Asian session, we get New Zealand’s trade data for September. As for speakers please note that RBA’s Assistant Governor Kent is speaking tomorrow during the Asian session.

Support: 1.2885 (S1), 1.2760 (S2), 1.2640 (S3)

Resistance: 1.3015 (R1), 1.3170 (R2), 1.3340 (R3)

Support: 1.3025 (S1), 1.2930 (S2), 1.2835 (S3)

Resistance: 1.3125 (R1), 1.3230 (R2), 1.3335 (R3)