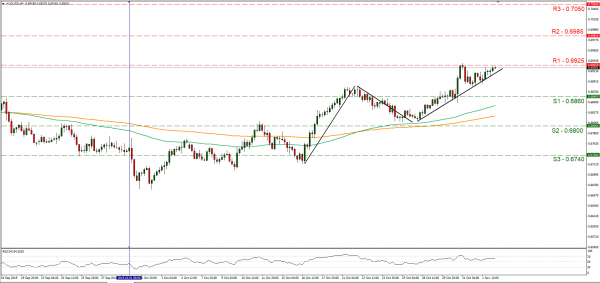

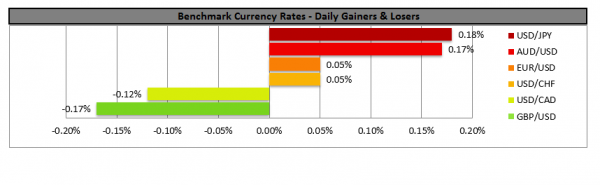

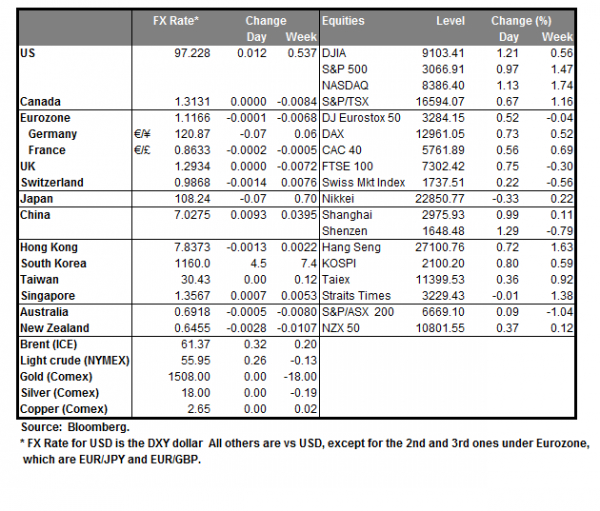

Australia’s retails sales growth rate release showed a surprise slowdown, confusing Aussie traders somewhat during today’s Asian session. Albeit there was little reaction to the release, Aussie traders are now looking towards RBA’s interest rate decision, which is due out tomorrow (03:30, GMT). The bank is widely expected to remain on hold at +0.75%, and currently AUDOIS imply a probability of 94.10% for the bank to do so. Should the bank remain on hold as expected, we could see the markets turning their attention towards the accompanying statement, at which the bank could be maintaining a dovish tone, should global trade uncertainty worries outweigh other factors and weakening the AUD. Should the bank surprise the markets by adopting a more neutral tone, due to Aussie financial releases we could see the AUD getting some support. AUD/USD continued to rise on Friday and during today’s Asian session, testing the 0.6925 (R1) resistance line. Technically, for our bullish outlook for the pair to change we would require a clear breaking of the upward trendline incepted since the 28th of October. However please note that the 0.6925 (R1) proved to be a formidable resistance line and the pair’s price action seems to be forming an ascending triangle. Should the bulls maintain control over the pair’s direction, we could see the pair breaking the 0.6925 (R1) resistance line and aim for the 0.6925 (R2) resistance level. Should the pair’s price action be controlled by the bears, we could see the pair, breaking the prementioned upward trendline and aim if not break the 0.6860 (S1) support line, aiming for lower grounds.

… while EUR sets its sights at Lagarde’s speech…

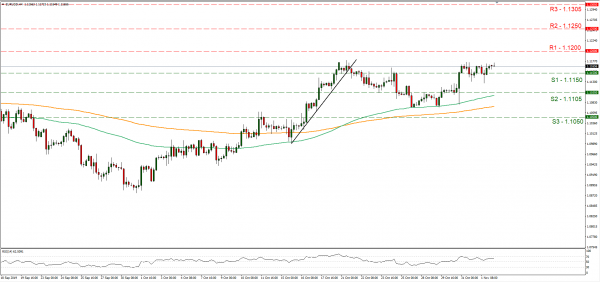

Christine Lagarde is to deliver her first speech as president of the ECB and is expected to stick to her easy policy script as left by Mario Draghi. The new ECB President may have to mend torn relationships in a split ECB as at the same time the bank’s QE program restarts. Across the Atlantic, the USD remained unimpressed as the NFP figure scored higher than expected on Friday, while Fed’s Vice Chair Clarida stated that the economy is quite resilient. We could see the common currency also remaining data dependent in the next few days, especially at German industrial data. EUR/USD maintained a sideways motion on Friday and today, hovering mostly above the 1.1150 (S1) support line. We maintain a bias towards a sideways motion for the pair albeit financial releases and Christine Lagarde’s speech could provide volatility for the pair. Should EUR/USD come under the selling interest of the market, we could see it breaking the 1.1150 (S1) support line and aim for the 1.1105 (S2) support level. On the other hand, should the pair’s long positions be favored by the market, we could see the pair, breaking the 1.1200 (R1) resistance line and aim for the 1.1250 (R2) resistance level.

Other economic highlights today and early tomorrow

Today during the European session, we get Turkey’s CPI rate, Germany’s final Manufacturing PMI and UK’s construction PMI all for October, as well as Eurozone’s Sentix investor sentiment for November. In the American session, we get the US factory orders growth rate for September and in tomorrow’s Asian session China’s Caixin Services PMI for October.

As for the week ahead

On Tuesday, we get UK’s Services PMI for October, the US trade balance for September, the ISM non Mfg PMI for October and New Zealand’s employment data for Q3. On Wednesday, we get Germany’s industrial orders growth rate for September. On Thursday, Australia’s trade balance for September, Germany’s industrial output for September and from the UK BoE’s interest rate decision are due out. On Friday, we get the China’s trade data for October, Canada’s employment data for October and the US Michigan Consumer Sentiment for November. On Saturday, we get China’s inflation measures for October.

Support: 0.6860 (S1), 0.6800 (S2), 0.6740 (S3)

Resistance: 0.6925 (R1), 0.6985 (R2), 0.7050 (R3)

Support: 1.1150 (S1), 1.1105 (S2), 1.1050 (S3)

Resistance: 1.1200 (R1), 1.1250 (R2), 1.1305 (R3)