For the 24 hours to 23:00 GMT, the EUR rose 0.06% against the USD and closed at 1.1079.

On the data front, Euro-zone’s seasonally adjusted current account surplus narrowed to €28.2 billion in September, less than market anticipations for a surplus of €24.5 billion. In the prior month, the region had recoded a revised surplus of €28.5 billion. Meanwhile, the seasonally adjusted construction output unexpectedly fell 0.7% on a yearly basis in September, defying market expectations for a rise of 2.7%. Construction output had recorded a revised rise of 0.8% in the prior month.

In the US, data showed that housing starts advanced 3.8% on monthly basis to an annual rate of 1314.0K in October, less than market expectations for a rise to a level of 1318.0K. In the prior month, housing starts had registered a revised level of 1266.0K. Moreover, the nation’s building permits unexpectedly climbed to a 12-year high level of 5.0% on monthly basis to an annual rate of 1461.0K in October, defying market consensus for a drop to a level of 1381.0K. In the preceding month, building permits had recorded a revised level of 1391.0K.

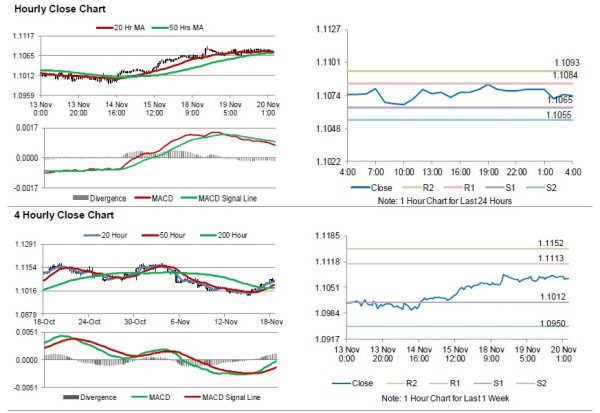

In the Asian session, at GMT0400, the pair is trading at 1.1074, with the EUR trading 0.05% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1065, and a fall through could take it to the next support level of 1.1055. The pair is expected to find its first resistance at 1.1084, and a rise through could take it to the next resistance level of 1.1093.

Moving ahead, traders would keep an eye on Germany’s producer price index for October, set to release in a few hours. Later in the day, the FOMC meeting minutes along with the US MBA mortgage applications, will be on traders’ radar.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.