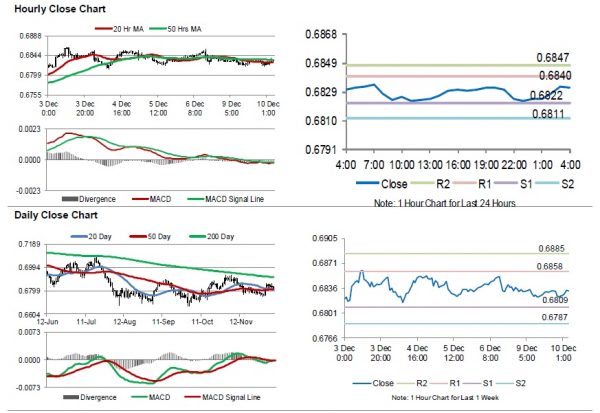

For the 24 hours to 23:00 GMT, the AUD declined 0.12% against the USD and closed at 0.6823.

LME Copper prices rose 2.0% or $117.5/MT to $5985.0/MT. Aluminium prices rose 0.9% or $15.5/MT to $1766.0/MT.

In the Asian session, at GMT0400, the pair is trading at 0.6832, with the AUD trading 0.13% higher against the USD from yesterday’s close.

Overnight data showed that Australia’s house price index climbed 2.4% on a quarterly basis in 3Q 2019, surpassing market expectations for an advance of 0.2%. In the previous quarter, the index had registered a drop of 0.7%. Meanwhile, the nation’s business conditions index remained unchanged at a level of 4.0 in November, defying market expectations of a fall to a level of 2.0. Moreover, the business confidence index recorded a flat reading in November, following a reading of 2.0 in the previous month.

Elsewhere in China, Australia’s largest trading partner, the consumer price index (CPI) advanced to an 8-year high level of 4.5% on a yearly basis in November, compared to a rise of 3.8% in the previous month. Markets had expected the CPI to record a rise of 4.2%. Meanwhile, the nation’s producer price index (PPI) dropped 1.4% on an annual basis in November, less than market expectations for a fall of 1.5%. In the previous month, the PPI had fallen 1.6%.

The pair is expected to find support at 0.6822, and a fall through could take it to the next support level of 0.6811. The pair is expected to find its first resistance at 0.6840, and a rise through could take it to the next resistance level of 0.6847.

Moving ahead, traders would closely monitor Australia’s Westpac consumer confidence index for December, scheduled to release overnight.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.