Update: Some light at the end of the tunnel

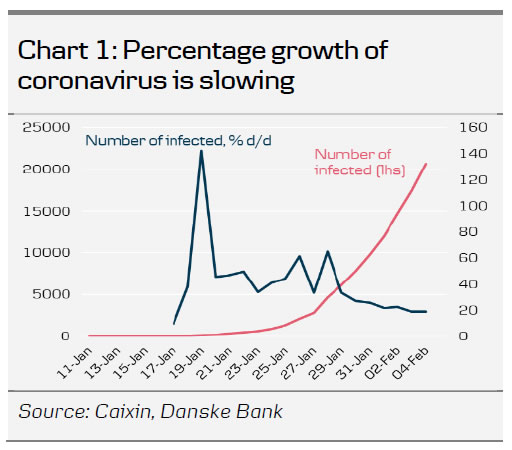

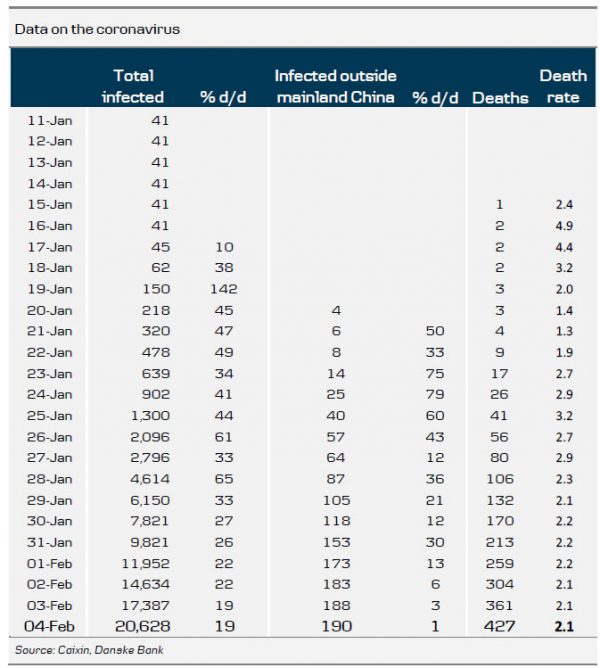

- There are increasing signs that the spread of the coronavirus is slowing down. Although the number of infected continues to grow day by day, the percentage increase is coming down (see chart 1). This suggests to us that the contagion rate has come down, hence the drastic measures taken by the Chinese authorities are starting to work.

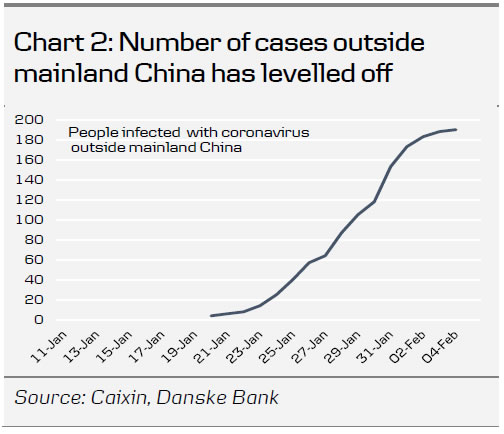

- While there is uncertainty about the true number of infected in Hubei province, the same trend of a slowing growth rate is evident outside Hubei. Notably, the number of cases outside mainland China seems to be levelling off (see chart 2).

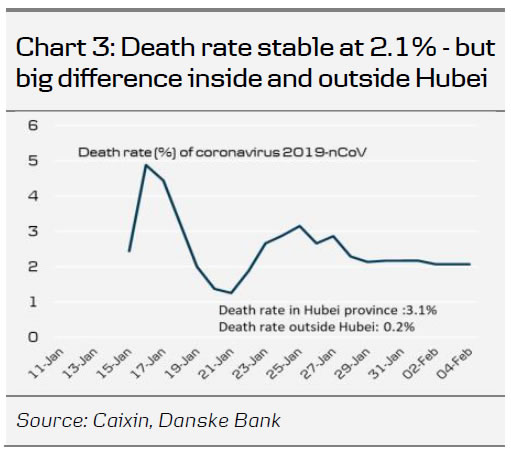

- Another positive development is that the death rate is so far very low outside Hubei province . Only 13 people have died outside the province giving a death rate of 0.2%. The death rate of normal flu in the US is 0.13%. In Hubei province, 414 people have died leading to a death rate of 3.1%.

What to watch

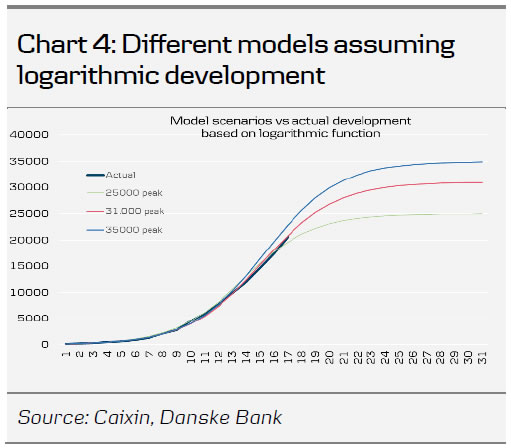

- Rate of increase in number of corona cases: Track if the positive development above continues. During SARS there was a set-back after the spread initially slowed down.

- Possible drug treatment: Reports in recent days suggest that some drugs have led to improvement in condition. If clinical trials confirm this, it would be very positive.

- Economic figures and policy coming up :

- 7 Feb: Imports and exports for January. Look for big drop.

- 20 Feb: Loan Prime Rate announcement . Look for a cut of 10bp.

- 29 Feb: Manufacturing PMI and service PMI (NBS) . Should drop

- sharply.

- 5 March: National People’s Congress set to begin (if not delayed). Growth target to be revealed. We expect it to be 5.75% instead of 6.0% as previously signalled. Fiscal stimulus and measures to alleviate the sectors hit the most may also be announced.