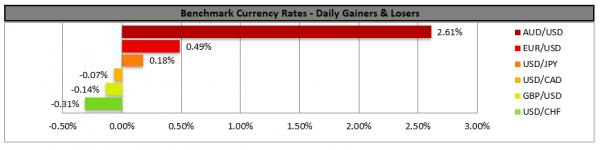

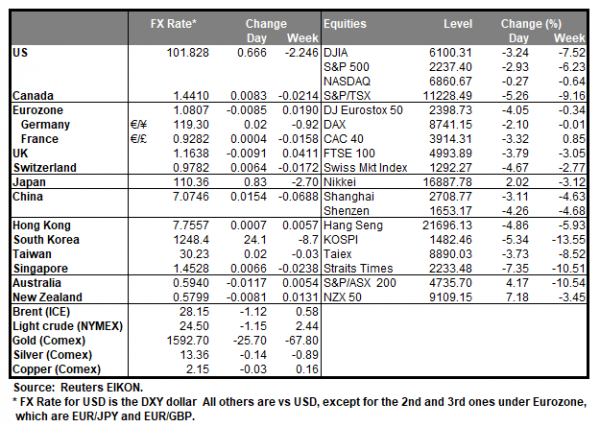

The USD eased a bit against a basket of other currencies yesterday and especially during today’s Asian session yet remained at rather high levels. Yesterday the Fed announced an unlimited quantitative easing program and plans to support credit markets “in the amounts needed”, all in a drastic move. The measures include purchases of corporate bonds as well as guarantees for direct loans for companies among other. It should be noted that despite the market reacting positively at the announcement and the USD temporarily weakening, the news was quickly digested, and uncertainty seems to remain. Stock markets continued their way >b>down hill, as more US states came under lockdown, due to the coronavirus spreading. Also, the US government’s fiscal stimulus package seems to be stuck at the US Senate and the delay tests the nerves of the market. Analysts tend to note that the market still seems nervous and investors ready to cash in, including the possible closure of existing positions. We could see the market turning its attention to today’s preliminary PMI readings for March in an effort to measure the damage done to the real economy. AUD/USD rose yesterday and especially during today’s Asian session breaking the 0.5900 (S1) resistance line now turned to support. We could see the pair continuing to find support, yet we must note that the 0.5980 (R1) resistance line had managed to contain the pair’s rise on the 20th of the month. Should the bulls keep control over the pair’s direction though, we could see it breaking the 0.5980 (R1) resistance line mentioned before and aim for the 0.6075 (R2) resistance level. Should the bears take over, we could see the pair breaking the 0.5900 (S1) support line and aim for the 0.5810 (S2) support level.

GBP stable as UK is locked down

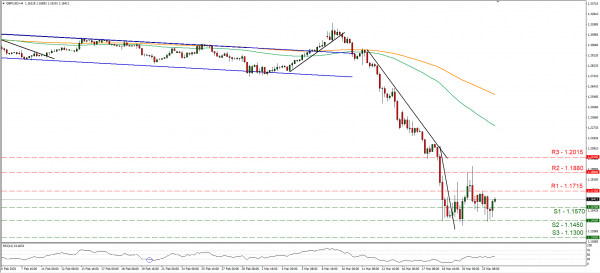

The GBP remained rather stable against the USD yesterday yet retreated somewhat against the EUR, as the UK comes in a lock down, following the example of other European countries. UK’s PM Boris Johnson ordered sweeping measures to stop people leaving their homes “at this moment of national emergency”. The measures are considered radical and are to last for at least three weeks for all unnecessary movements of people, while gatherings are to be broken up by the police and those who defy the orders are to be fined. At the same time all UK travelers were advised to immediately return home while they still can, as airlines increasingly suspend their flights. We maintain our worries for the UK, as the measures came in effect quite late, and the UK government may have failed to build the necessary mentality within the UK population. As for the UK economy, worries also intensify as a slowdown of economic activity is expected to be recorded by today’s release of the preliminary PMIs for March. We focus on the reading of the financial sector, which is the backbone of the UK economy. A possible undershooting of its target could weaken the pound. Cable maintained a sideways motion yesterday mainly between the 1.1570 (S1) support line and the 1.1715 (R1) resistance line, despite breaking the S1 at some point. We continue to maintain our bearish bias as the pair returned to the prementioned boundaries during today’s Asian session. Should the pair come under the selling interest of the market we could see it breaking the 1.1570 (S1) support line and aim for the 1.1450 (S2) support level, which held ground against yesterday’s drop. On the flip side, should cable’s long positions be favored by the market, we could see it breaking the 1.1715 (R1) line and aim for the 1.1880 (R2) level.

Other economic highlights today and early tomorrow

Today during the European session, we get France’s, Germany’s, Eurozone’s and UK’s preliminary PMIs for March. In the American session, we get from the US the Markit preliminary PMI’s for March as well as the new home sales figure for February. Just before the Asian session starts, we get from the US the API weekly crude oil inventories figure, as well as New Zealand’s trade data for February.

Support: 0.5900 (S1), 0.5810 (S2), 0.5710 (S3)

Resistance: 0.5980 (R1), 0.6075 (R2), 0.6180 (R3)

Support: 1.1570 (S1), 1.1450 (S2), 1.1300 (S3)

Resistance: 1.1715 (R1), 1.1880 (R2), 1.2015 (R3)