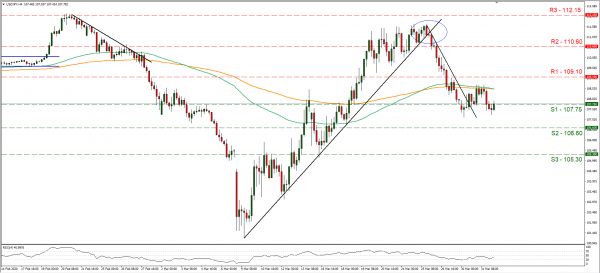

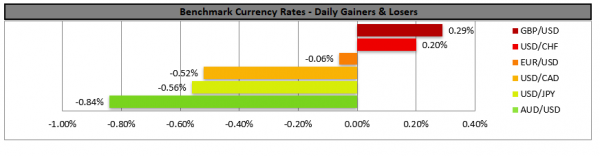

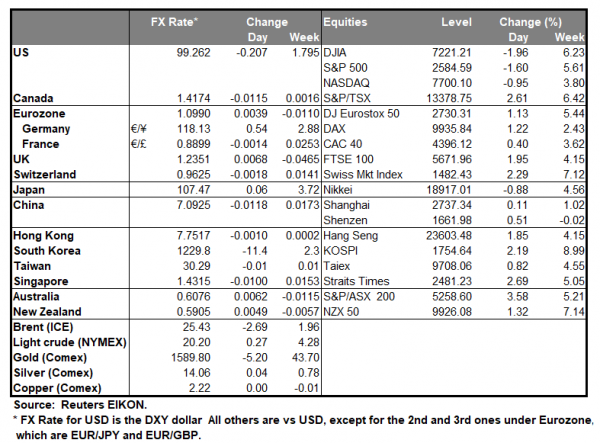

The USD as well as the JPY strengthened as markets prepared for a global slowdown in the last trading day of Q1. Yesterday the Fed widened the ability of foreign central banks to access USD by allowing the conversion of US treasuries for overnight USD loans. The idea is that central banks would be allowed to use Fed’s securities as collateral for quick overnight loans at an interest of 0.25%, and despite the loans being for one day, they can be rolled over as needed, as per a Reuter’s report. The Fed’s move weakened the USD, however the greenback firmed afterwards utilizing safe haven qualities, as the outlook for the global economy is bleak. It was characteristic that Japanese manufacturers turned pessimistic in Q1 of the year, as the Tankan Big Manufacturers index turned into the negatives for the first time in seven years, while US employment data are expected to take a negative turn. Analysts tend to warn that the economic decline in the 2nd quarter for the US economy could be even worse than initially estimated. Should there be an even wider risk-off sentiment for the markets we could see the USD strengthening further as a safe haven. USD/JPY dropped yesterday breaking the 107.75 (S1) support line, yet during the Asian session today seemed to rebound above it. The pair seems to be in a sideways motion, yet the safe-haven qualities of the JPY could put the pair under pressure. Should the bears be in charge of the pair’s direction, we could see USD/JPY breaking the 107.75 (S1) and aim for the 106.60 (S2) support line. Should the bulls take over, we could see the pair continuing the Asian session’s correction aiming if not breaking the 109.10 (R1) resistance line and continue higher.

CAD strengthens on oil market news

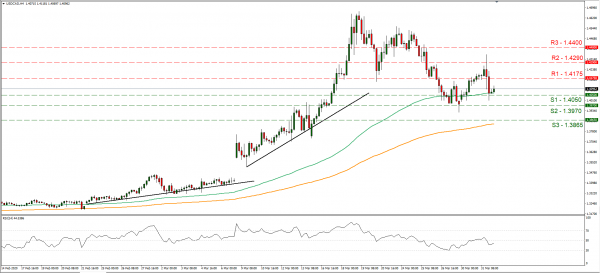

Commodity currencies such as the AUD and the NZD weakened against the USD, however the CAD strengthened as it got a boost from oil market news. The Loonie drew support from data which showed that the Canadian economy grew in January, yet the current situation may render the data as irrelevant. Also, it should be noted that the news about efforts being made to start talks between the US and Russia and stabilize the oil market strengthened the CAD. On the flip side the fact that OPEC members failed to agree on a meeting to discuss the oil market collapse tended to weaken oil prices. It should be noted that OPEC oil producers will be producing oil at will from today onwards as agreed maximum production levels are no longer in effect. Should oil prices remain weak or weaken even further we could see the outlook for CAD darkening once again. USD/CAD dropped breaking the 1.4175 (R1) support line now turned to resistance and continued lower only to bounce on the 1.4050 (S1) support line. We maintain a bias for a sideways motion technically as the pair’s prices seem to remain in a channel. Should the pair’s long positions be favoured by the market, we could see it breaking the 1.4175 (R1) resistance line and aim for the 1.4290 (R2) resistance hurdle. On the flip side, should the pair come under the selling interest of the market, we could see it breaking the 1.4050 (S1) support line and aim for the 1.3970 (S2) support level.

Other economic highlights today and early tomorrow

In the European session we get Germany’s retail sales for February, along with Germany’s, Eurozone’s and UK’s final Manufacturing PMI readings for March. In the American session, we get from the US the ADP employment figure for March, the ISM Manufacturing PMI and the EIA crude oil inventories figure. As for speakers please note that Boston Fed President Rosengren speaks.

Support: 107.75 (S1), 106.60 (S2), 105.30 (S3)

Resistance: 109.10 (R1), 110.60 (R2), 112.15 (R3)

Support: 1.4050 (S1), 1.3970 (S2), 1.3865 (S3)

Resistance: 1.4175 (R1), 1.4290 (R2),1.4400 (R3)