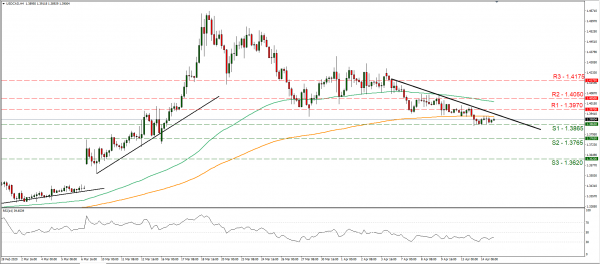

Today in the American session BoC will be releasing its interest rate decision and the bank is widely expected to remain on hold at +0.25%. Currently the market seems to have almost fully priced in such a scenario as CAD OIS imply a probability of 99.66% for the bank to remain on hold. Should the bank remain on hold as expected, we could see the markets attention turning to the accompanying statement and Governor Poloz’s press conference later on. We could see the bank mentioning or announcing a possible QE program to further support the Canadian economy, while at the same time we could see the tone being tilted towards cautiousness as uncertainty runs high. Also, we expect the Loonie to have an eye turned to the oil market and any further developments in that field as well. USD/CAD seems to be stalling at the 1.3865 (S1) support line, after the CAD rallied against the USD in the past few days. Nevertheless, we maintain a bearish bias for the pair as it remains under the downward trendline incepted since the 6th of April. Should the pair remain under the selling interest of the market, we could see it breaking the 1.3865 (S1) support line and start aiming for the 1.3765 (S2) support level. Should the pair’s long positions be favored by the market, we could see it breaking the 1.3970 (R1) resistance line and aim for the 1.4050 (R2) resistance level.

USD slips as market awaits easing of lockdowns

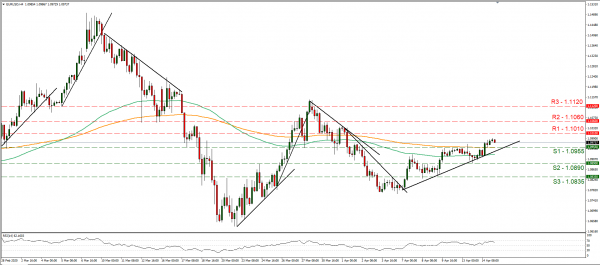

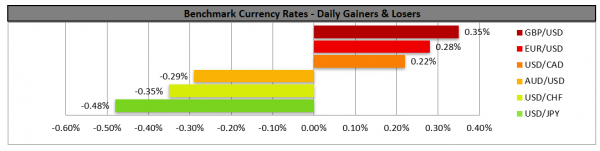

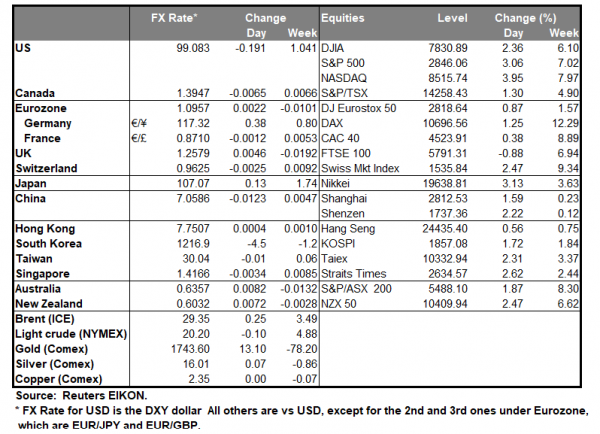

USD’s safe haven qualities seemed to weaken somewhat, as it slipped against a number of other currencies yesterday and during today’s Asian session. Analysts tend to note that investors may have turned to higher risk assets after the US President Trump seemed biased towards easing the lockdown. The Trump administration had signalled 1st of May as a possible date for easing the restrictions yet experts note that the 1st of May could be premature. Nevertheless, the US President Trump on Tuesday said he is close to completing a plan to end the coronavirus shutdown. Also, it should be noted that the US President at least temporarily, cut the US funding of the World Health Organisation, which caused considerable controversy. At the same time the USD remains under pressure after the Fed’s heavy measures to support the US economy and which caused a flood of USD as the Fed’s massive new program was launched yesterday. Uncertainty seems to still be at high levels, as the IMF stated that the global economy is to suffer a shrinking of 3%, the steepest collapse since the great depression. The USD could continue to weaken as US financial data could have an adverse effect, yet the greenback’s safe haven qualities could come to the rescue once again. EUR/USD continued to rise yesterday, this time breaking the 1.0955 (S1) resistance line, now turned to support. We maintain a bullish outlook for the pair as it seems to be guided by the upward trendline incepted since the 7th of April. Should the bulls remain in charge of the pair’s direction, we could see it breaking the 1.1010 (R1) resistance line and aim for the 1.1060 (R2) resistance level. Should on the other hand the bears take over, we could see it breaking the 1.0955 (S1) support line and aim for the 1.0890 (S2) support level.

Other economic highlights today and early tomorrow

Today in the European session, France’s and Sweden’s CPI rates for March are to be released. In the American session, we get from the US the New York Fed Manufacturing index for April, the headline and core retail sales growth rates for March, the US industrial production growth rate for March, as mentioned BoC’s interest rate decision and the US EIA crude oil inventories figure. It’s striking how sharp the shift of forecasts for the US is tilted to the downside and there could be an aggregated bearish reaction for the USD should the forecasts be realized. During the Asian session we get Australia’s employment data for March. As for speakers, BoC’s Governor Poloz and Senior Deputy Governor Wilkins are giving a press conference about the bank’s interest rate decision, while later on Atlanta Fed President Bostic speaks.

Support: 1.3865 (S1), 1.3765 (S2), 1.3620 (S3)

Resistance: 1.3970 (R1), 1.4050 (R2), 1.4175 (R3)

Support: 1.0955 (S1), 1.0890 (S2), 1.0835 (S3)

Resistance: 1.1010 (R1), 1.1060 (R2), 1.1120 (R3)