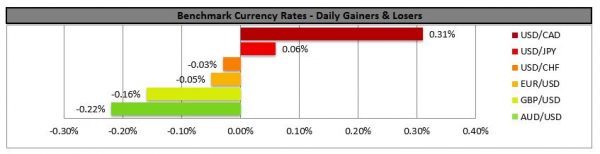

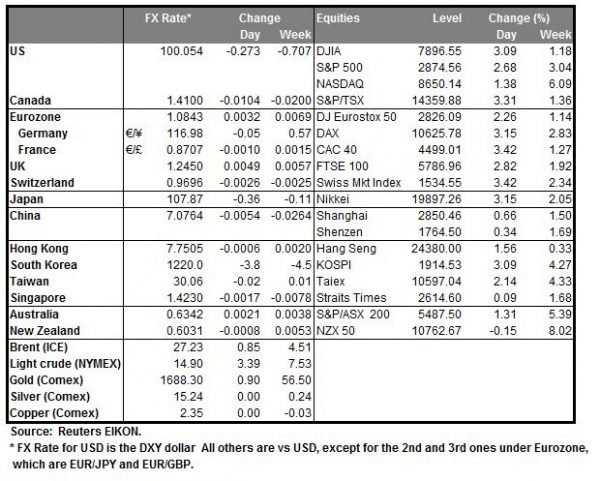

The USD remained rather steady against most of its counterparts on Friday and during today’s Asian session. It should be noted that the greenback’s safe haven qualities continue to shine as investors tend to brace for more negative updates regarding COVID 19. According to media, protests seem to be ongoing in the US about the lockdowns as imposed by each state and in favor of reopening the US economy. President Trump’s statements that governors have enough tests for COVID 19 and should quickly reopen the economy, were heavily disputed.

Analysts as Reuters mentions state that the hurdles faced by optimists in the markets remain very substantial and we tend to support the notion that unless President Trump delivers a surprise, the US economy may be slow to reopen. Given that the US has surpassed any other country by far, regarding the number of confirmed cases and also given the dire consequences for the US economy we maintain as a base scenario that the USD could gain further support as a safe haven.

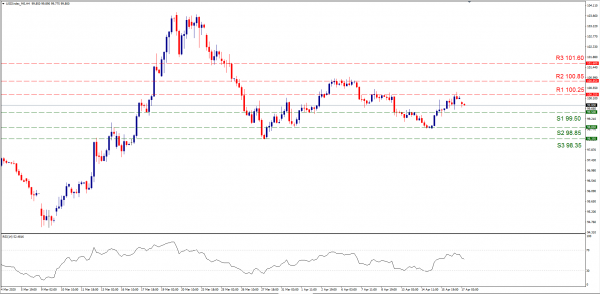

On the other hand, should the market sentiment get a lift we could see commodity currencies strengthening while the USD weakens. EURUSD maintained a sideways motion between the 1.0835 (S1) support line and the 1.0890 (R1) resistance line. Technically, we tend to maintain a bias for a sideways motion of the pair, should volatility remain low. Should the bulls take over we could see the pair breaking the 1.0890 (R1) resistance line and aim for the 1.0950 (R2) resistance level. On the flip side, if the bears dominate the pair’s direction, we could see it breaking the 1.0835 (S1) support line and aim for the 1.0775 (S2) support level.

GBP remains steady as UK lockdown is prolonged

GBP remained rather steady against the USD, EUR and JPY in the past few days as the UK government is not considering lifting its lockdown. The statements made by a senior UK minister on Sunday showed that the UK government is not considering lifting the lockdown in place in the UK, by almost four weeks now to set COVID 19 under control, especially given “deeply worrying” increases in the death toll. At the same time Johnson’s government is facing strong criticism about the lack of protective gear for health workers fighting the coronavirus. It was characteristic of the tension that the UK government answered a recent critical article in the Times with an angry rebuttal. We expect the pound to be under pressure, yet market participants may turn their attention to UK financial releases in the current week as well.

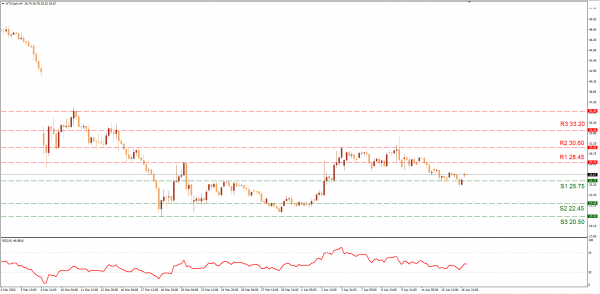

Cable also maintained a sideways motion on Friday and during today’s Asian session, remaining between the 1.2400 (S1) support line and the 1.2580 (R1) resistance line. We tend to maintain a bias for a sideways motion of the pair at the current stage. Should the pair’s long positions be favoured by the market, we could see the pair breaking the 1.2580 (R1) resistance line and aim for the 1.2770 (R2) resistance level. On the flip side, if the pair decides to go south, we could see it breaking the 1.2400 (S1) line and aim for the 1.2200 (S2) level.

Other economic highlights today and early tomorrow

With a light calendar today, we tend to focus on the release of Germany’s PPI rates and later on, Canada’s wholesale sales for February. During tomorrow’s Asian session, RBA’s minutes of its last meeting are due out.

As for the rest of the week

On Tuesday, from Australia RBA is to release the minutes of its last meeting, while from the UK we get the employment data for February, from Germany the ZEW Economic Sentiment for April and Canada’s retail sales for February. On Wednesday, we get UK’s inflation measures, Turkey’s CBRT interest rate decision, Canada’s inflation measures and Eurozone’s consumer sentiment. On Thursday, we get UK’s retail sales for March, France’s Germany’s Eurozone’s, UK’s and the US preliminary Markit PMIs for April as well as the US Initial Jobless claims figure. On Friday, we get Japan’s CPI rates for March, Germany’s Ifo Business Sentiment and the US durable goods growth rates for March.

Support: 1.0835 (S1), 1.0775 (S2), 1.0720 (S3)

Resistance: 1.0890 (R1), 1.0950 (R2), 1.1010 (R3)

Support: 1.2400 (S1), 1.2200 (S2), 1.2015 (S3)

Resistance: 1.2580 (R1), 1.2770 (R2), 1.2945 (R3)