- Vaccine headlines, Fed stimulus bets, and EU recovery package propel stocks higher

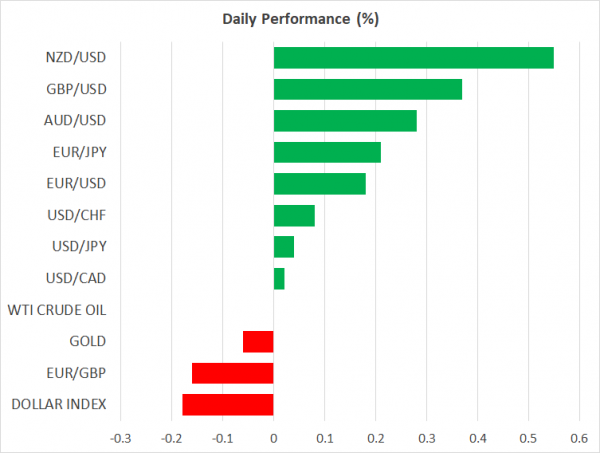

- Yen, dollar, and franc suffer as euro and commodity currencies cheer

- Fed chief testifies before US Senate today (14:00 GMT), can he keep the ‘party’ going?

Perfect storm for stocks

Risk appetite returned with a vengeance to global markets on Monday, with the S&P 500 (+3.15%) having its best day in weeks amid a perfect storm of news around a virus vaccine, more Fed stimulus, and a European recovery package. Remarks by Fed Chair Powell that ‘there’s no limit’ to what the Fed can do got investors excited early, and then headlines hit that US biotechnology company Moderna had encouraging results from its early-stage trial of a coronavirus vaccine.

The cherry on top was that France and Germany proposed a €500bn pan-European recovery fund to assist the economies most devastated by the pandemic (more below). In the FX arena, the news breathed life back into commodity-linked currencies such as the aussie, kiwi, and loonie. Meanwhile, the ‘defensive plays’ suffered, with the yen, dollar, and Swiss franc all crumbling against the revitalized euro.

S&P 500 now at key battleground level

Overall, the powerful move higher for risk assets – even in the face of a plethora of risks such as seething US-China tensions and second virus waves – underscores how thirsty this market is for any positive news. Many medical experts have cautioned that it’s premature to draw conclusions from a ‘phase 1’ vaccine trial that was conducted on a small number of patients, but investors were happy to ignore those warnings.

Why? Because if things go right and a vaccine is developed quickly, everything goes back to normal and it’s a bullish environment. If things go wrong and the recession worsens, for instance on a wave of bankruptcies or second virus waves or ‘hotter’ US-China tensions, then governments and central banks will be forced to stimulate even more.

The problem with that line of thinking is that most central banks are almost out of ammunition, most governments have little fiscal space left, and most importantly, it may take a while before consumers return to anything resembling ‘normal’. Moreover, for the Fed to step in again, things probably have to get worse first.

Of course, that’s a story for another day. For now, the S&P 500 is testing a key battleground zone that halted the recovery in March, and much will be decided by whether the bulls are rejected again or whether they overcome it. The Australian dollar is also testing a crucial resistance level that capped its advance twice in recent weeks.

The catalyst for a break or a rejection might be a testimony by Fed Chairman Powell before the US Senate today. His prepared remarks have already been released but as always, the subsequent Q&A session with lawmakers will attract attention, with investors trying to decipher how willing he is to act again and what the tools of choice might be.

EU recovery fund lifts euro, but drama lies ahead

In euro land, the single currency soared after the German and French leaders proposed a European recovery fund worth half a trillion euros to assist the economies worst affected by the pandemic. The fund’s absolute size is rather small, but the details were encouraging. The funds would be provided as grants from the EU budget, not loans, so nations with high debt like Italy will get some real relief.

Hence, a step in the right direction for risk sharing – the Eurozone’s Achilles’ heel – but still some way off from Eurobonds. A political battle now lies ahead to bring ‘fiscally conservative’ countries like the Netherlands and Austria on board.