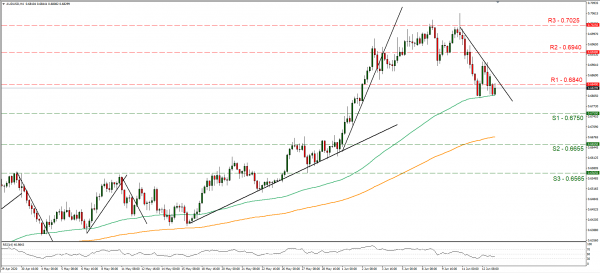

The Aussie continued to weaken against the USD during today’s Asian session, as worries about a possible second wave of COVID 19 tended to increase. Worries intensified as after Friday, Beijing reported that cases tended to increase, while reports surfaced about six markets in Beijing being closed on concerns of a new COVID 19 outbreak, while also about the parts of the city being under lockdown. It should be noted that Beijing seems to be ramping tests after a cluster of new cases were reported at one of the largest food markets. Analysts tend to hope that this will not be a big outbreak, and this downward move of AUD as well as NZD will not last long, albeit it should be noted that Chinese data for May released early today underperformed market expectations. Should concerns prompt a new cautious stance on behalf of the markets we could see AUD weakening further while USD may have safe-haven inflows. AUD/USD dropped on Friday and early today breaking the 0.6840 (R1) support line, now turned to resistance. As the pair’s price action seems to be forming a downward trendline incepted since the 10th of June and the pair, we switch our bias for a sideways motion in favor of a bearish outlook. If the selling momentum persists, we could see the pair breaking the 0.6750 (S1) support line and aim for the 0.6655 (S2) support level. If the pair’s long position is favored, AUD could break the 0.6840 (R1) line and aim for the 0.6940 (R2) level.

BoJ’s interest rate decision

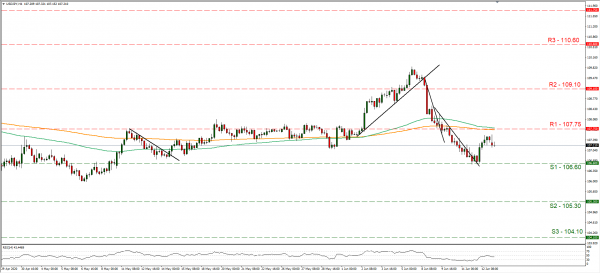

Tomorrow during the Asian session, we get BoJ’s interest rate decision and the bank is widely expected to remain on hold, keeping rates at -0.10%, with JPY OIS currently implying that the market has almost fully priced in such a scenario. The bank has already stated that it will buy unlimited amounts of government bonds as well as more exchange traded funds. Some further easing of its monetary policy may be applied by the bank, should it launch its loan programs and possibly extending them. It should be noted though, that the bank reportedly stated that it sees no pressing need for major action at the next policy meeting. We could see JPY having a slight boost from the overall meeting should the bank not fail the markets. USD/JPY dropped today yet remained between the 106.60 (S1) support line and the 107.75 (R1) resistance level. We maintain our bias for a sideways motion, after the pair broke the downward trendline on the 11th of the month. If the bulls take over, USD/JPY could break the 107.75 (R1) line and aim for the 109.10 (R2) level. If the bears prevail, the pair could break the 106.60 (S1) support line and aim for the 105.30 (S2) level.

Other economic highlights today and early tomorrow

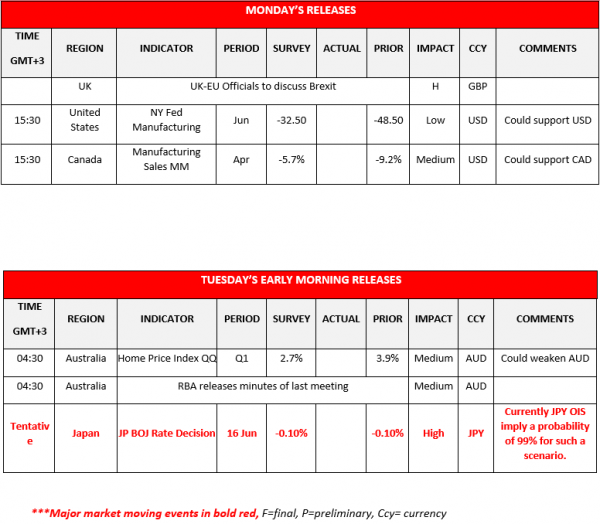

Another risk event noted for today, are the discussions for Brexit between UK Prime Minister Johnson and EU Commission President Von der Leyen. Any signs of a breakthrough in the deadlock in the Brexit negotiations, could strengthen the weakening pound and vice versa. It was characteristic that the GDP rates for April, released on Friday were shocking and may still way on the pound as well. Also, today we get the US NY Fed Mfg Index for June as well as Canada’s manufacturing sales, while during tomorrow’s Asian session, we get from Australia the Home price index for Q1 and RBA releases the minutes of its last meeting.

As for the rest of the week

On Tuesday, UK’s employment data for April, Germany’s ZEW economic indicators for June and the US retail sales for May are due out, while Fed Chairman Powell testifies before the US Congress. On Wednesday, we get Japan’s trade data for May, UK’s, Eurozone’s and Canada’s inflation rates for May, while Fed Chairman Powell has his second testimony before US Congress members. On Thursday, New Zealand’s GDP for Q1, Australia’s employment data for May, SNB’s, Norgesbank’s and BoE’s interest rate decisions as well as the US initial jobless claims figure are to be released. On Friday, we get Japan’s inflation rates for May, UK’s and Canada’s retail sales for May and April respectively, while later Fed Chair Powell speaks.

Support: 0.6750 (S1), 0.6655 (S2), 0.6565 (S3)

Resistance: 0.6840 (R1), 0.6940 (R2), 0.7025 (R3)

Support: 106.60 (S1), 105.30 (S2), 104.10 (S3)

Resistance: 107.75 (R1), 109.10 (R2), 110.60 (R3)