The Japanese yen gained against the US dollar as traders reacted to mixed economic data from the country. According to Markit, Japan’s manufacturing PMI rose to 40.1 in June from the previous 37.8. This number implied that manufacturers made some gains in June as the country started to reopen. Another from Tankan presented a mixed picture of the economy. The large manufacturer’s index declined to -14 in the second quarter from the previous -1. The large non-manufacturers index declined by -17, which was worse than Q1’s 8.

The Australian dollar rose against the US dollar as traders reacted to the latest Chinese and Australian manufacturing PMI data. According to Markit, Australia’s manufacturing sector returned to growth in June as the economy reopened. The PMI came in at 51.2, up from the previous contraction of 44.0. Another PMI number of AIG rose to 51.5 from the previous 41.6. Meanwhile, the Chinese PMI rose to 51.2 in June from the previous 50.7. While the June numbers were good, the biggest challenge is whether the momentum will continue as more coronavirus cases emerge.

The economic calendar will be relatively busy today. From Europe, we will receive the interest rate decision from the Swedish central bank, manufacturing PMI numbers from the eurozone, German retail sales, and employment numbers. Analysts expect the Riksbank to leave the interest rates unchanged and possibly boost its quantitative easing program. The eurozone’s PMIs are expected to be better than those produced in June. Meanwhile, from the United States, we will receive the ISM manufacturing PMIs and crude oil inventories.

EUR/USD

The EUR/USD pair is trading at 1.1237. On the four-hour chart, the price is along with the 50-day EMA and slightly below the 100-day exponential moving averages. It is also slightly below the 23.6% Fibonacci retracement and inside the triangle pattern that has formed in the past two weeks. Also, the signal line and histogram of the MACD are below the neutral line. As such, the pair is likely to remain inside this triangle ahead of the US employment data tomorrow.

AUD/USD

The AUD/USD pair rose after the upbeat manufacturing and services PMI numbers. The pair is trading at 0.6906, which is higher than yesterday’s low of 0.6833. On the four-hour chart, the pair has moved above the 50-day and 100-day exponential moving average. As with the EUR/USD pair, it is also inside the triangle pattern that has been forming in the past two weeks. Therefore, the pair is likely to have a breakout in either direction in the past few days.

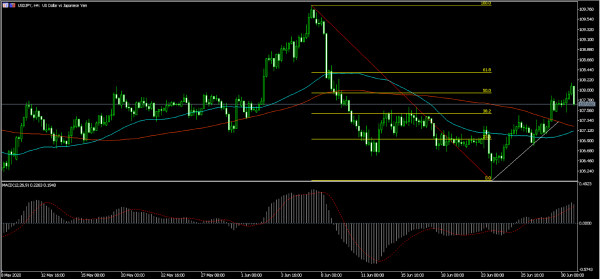

USD/JPY

The USD/JPY pair declined from yesterday’s high of 108.16 to the current low of 107.66. On the four-hour chart, the price is above the 50-day and 100-day exponential moving averages and between the 50-day and 38.2% Fibonacci retracement. The signal and histogram of the MACD are moving higher. Therefore, the pair may move lower as bears attempt to move below 107.00.