U.S. Highlights

- Financial markets brushed off the record-breaking rise in COVID-19 cases, moving higher from close last week.

- If cases continue to rise at this break-neck speed, state authorities may have no other option but to shut down parts of the economy again.

- Higher frequency data suggest the U.S. labor market is under pressure once again with some businesses resuming layoffs and others planning furloughs in the months to come.

Canadian Highlights

- The Canadian economy added a better-than-expected 953k jobs in June. However, only 40% of jobs lost during the pandemic have been regained, underscoring the long road to recovery.

- Home sales in Toronto surged by 80% m/m in June while Canadian housing starts clocked in at a healthy 212k units. However, the Bank of Canada’s Business Outlook Survey flagged deep concerns on the outlook.

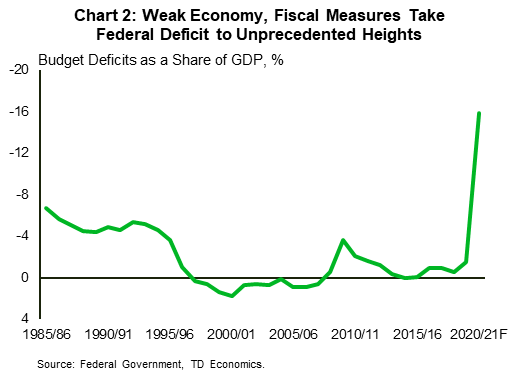

- In their long-awaited fiscal update, the federal government projected the deficit to swell to an eye-popping $343 billion (16% of GDP) this fiscal year. Missing from the update was a path back to fiscal sustainability. This will need to be clearly communicated once the recovery is on more solid ground.

U.S. – Rising COVID-19 Cases Weigh On Economy

It was a relatively quiet week for equity markets. The record-breaking rise in COVID-19 cases did little to impact markets as the S&P 500 (at the time of writing) was 1.2% higher from close last week.

COVID-19 is spreading at an alarming rate in the United States. Almost 60,000 new cases were added on Thursday, a single-day record, the sixth one in 10 days. Southern states – California, Texas, and Florida – continued to drive the increase in new infections. So far, state authorities have resisted shutting down large swathes of the economy, instead opting to either pause or roll back some reopening plans. However, if cases continue to rise at this speed and hospitals hit full capacity, there may be no other option but to mandate stricter measures.

The impact of the renewed outbreak has not yet been observed in traditional economic data. The ISM non-manufacturing index posted a 11.7-point jump to 57.1 for June. The improvement was broad-based as three of the four subcomponents and 14 out of 18 industries, reported positive growth for the month. But this data release, like other monthly indicators, is backward looking. With the pace of infections picking up in mid-June, these data will not capture the current impact of COVID-19 on the economy.

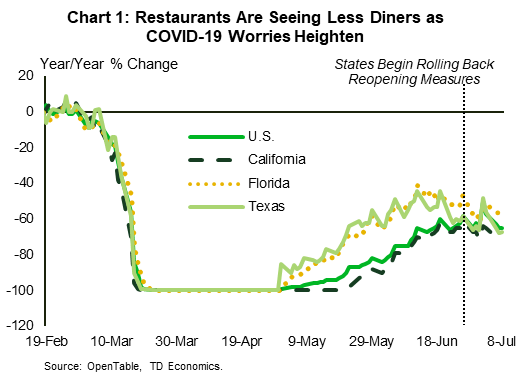

Higher frequency data provide a clearer picture of present state of the economy and it is concerning. The number of diners at restaurants have plateaued at very low levels. According to OpenTable data, there are 65% less seated diners at restaurants now then there were a year ago. In virus epicenters such as Texas, Florida, and California, restaurant visitations started declining even before state governors reversed reopening plans, highlighting the impact of the health pandemic on consumer behavior (Chart 1).

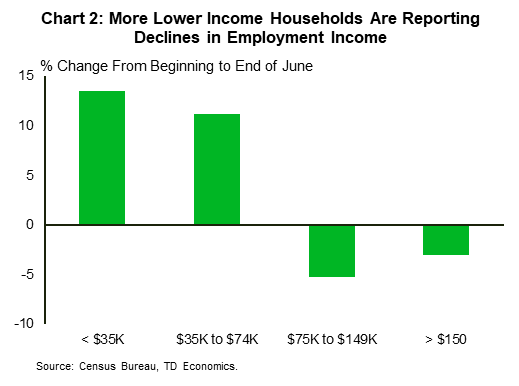

Employment is also beginning to be affected by the resurgence of COVID-19. More households, specifically lower income households, are reporting declines in their income from employment (Chart 2). According to Homebase data, small businesses are once again beginning to lay off hourly employees.

Large companies are also planning to let more workers go. United Airlines has told 36,000 employees they could be furloughed starting October 1st. Brooks Brothers permanently closed 50 stores, and Apple and McDonald’s have either delayed reopening stores or announced new store closures due to rising COVID-19 cases.

With the labor market under pressure and expanded unemployment benefit payments expiring at the end of this month, Congress needs to provide further aid to households and businesses.

Talks are underway and Treasury Mnuchin said he supports another round of stimulus checks to individuals and an extension of the Paycheck Protection Program under narrower eligibility criteria. However, he was less supportive of relief funding to state and local governments. On the whole, it is clear, without additional fiscal support, we could see more economic turbulence in the second half of this year.

Canada – Federal Fiscal Update Takes Centre Stage

Economic data and developments this week highlighted two themes: that Canada remains on the recovery track, although the return to some semblance of normalcy will be challenging and prolonged and, that the price paid to backstop the economy has been tremendously steep.

The week brought a dose of good news on housing markets, as sales jumped by 80% m/m in Toronto during June, boosted by the release of pent-up demand. Homebuilding was also robust in June, as starts clocked in at a healthy 212k units (see our summary). Homebuilding has held up well during the pandemic, although as we noted this week, lower population growth will be a medium-term headwind.

The Bank of Canada also released its summer Business Outlook Survey (BOS) early in the week (see commentary). With responses garnered between May 12th and June 5th, the survey missed the worst of the slowdown (April), but also some of the re-openings, particularly in Ontario. Respondents were quite pessimistic. Indeed, sales and investment expectations were downgraded, helping push the summary BOS Indicator deeper into negative territory and highlighting the tough road ahead for Canadian firms. The one silver lining was that hiring intentions remained firmly positive, with most firms planning on bringing workers back in the next 12 months.

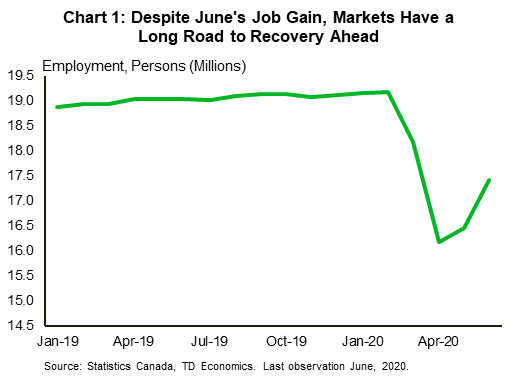

Employers are so far keeping their word. Employment expanded by 953k in June, according to the Labour Force Survey report released this morning (summary here). Hiring increased in every province and was up in almost all industries, coinciding with the broadening out in provincial re-opening plans that took place in June. Hours worked also rose, climbing 9.8%. However, StatsCan’s measure of labour market “underutilization” remained elevated, as did the unemployment rate at 12.3% (despite dropping 1.4 ppts). Overall, while certainly on the right track, only about 40% of the three million jobs lost during the pandemic have been recouped (Chart 1). And, with many businesses likely to operate below capacity for some time yet, Canada’s recovery has a long way to go.

While data released this week was mostly of the top-tier variety, it was the federal government that stole the show. In their much anticipated fiscal update, the government revealed a projection for an enormous $343 billion deficit for this fiscal year, clocking in at a significant 16% of GDP (Chart 2). As noted in our summary, this forecast was largely put down to $212 billion in direct support measures that, according to government’s calculations, are part of a package about 1.5 times as generous as the “average” G-7 country. And, with calls for additional support and/or stimulus, further upward pressure on the deficit could be forthcoming.

While the pandemic and the government’s response have blown a huge hole in the federal fiscal position, support programs fueling the shortfall are temporary. As the recovery solidifies, a path to fiscal sustainability will need to be outlined, particularly when the Bank of Canada winds down its bond purchase programs. Failure to do so risks further credit downgrades and higher future borrowing rates.

U.S: Upcoming Key Economic Releases

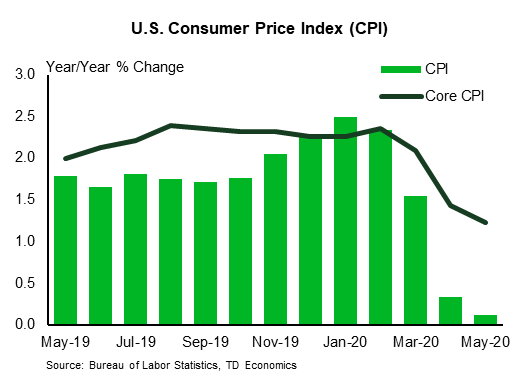

U.S. Consumer Price Index – June

Release Date: July 14, 2020

Previous: -0.1% m/m, 0.1% y/y

TD Forecast: 0.5% m/m, 0.5% y/y

Consensus: 0.5% m/m, 0.6% y/y

The overall Consumer Price Index was likely boosted by a bounce in gasoline prices (TD 0.5% m/m). Core inflation probably also turned positive again on a m/m basis, due to a reversal of some of the recent plunge in travel-related prices (TD 0.2%); over the last three months, airfares fell 29.5%, lodging away from home fell 14.7% and car and truck rental rates fell 25.0%. The data will likely still show significant net slowing: Our forecast implies y/y readings of 0.5%/1.1% for overall/core prices, down from 2.3%/2.4% four months earlier (pre-COVID).

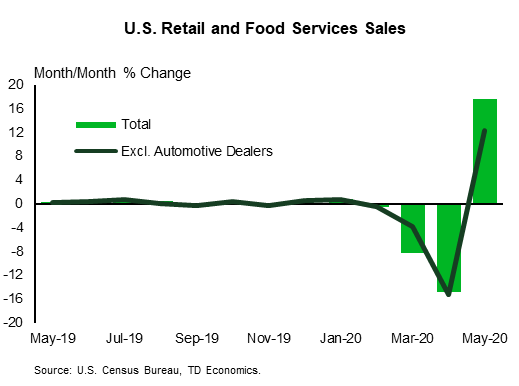

U.S. Retail Sales – June

Release Date: July 16th, 2020

Previous: 17.7% m/m, ex-auto: 12.4%

TD Forecast: 6.3% m/m, ex-auto: 7.2%

Consensus: 5.0% m/m, ex-auto: 5.0%

Retail sales likely rose strongly again in June, even with stalling late in the month. The stalling likely reflects the renewed uptrend in COVID cases as well as the boost from stimulus payments starting to fade. The stimulus payments, along with expanded unemployment benefits, led to income rising, even with employment down sharply. In turn, retail sales appear to have reversed much of their initial COVID-related plunge, at least temporarily, even as employment still shows a sizable net decline.

Canada: Upcoming Key Economic Releases

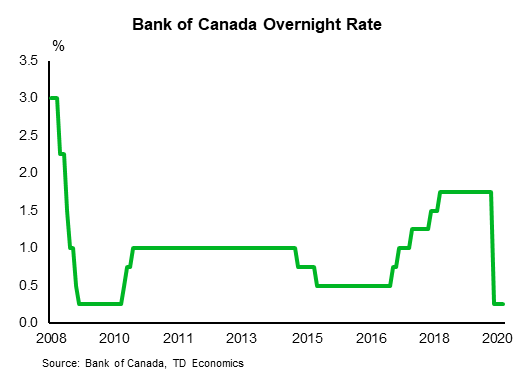

Bank of Canada Rate Decision

Release Date: July 15, 2020

Previous: 0.25%

TD Forecast: 0.25%

Consensus: 0.25%

We do not expect any change to BoC policy at next week’s meeting which should keep the focus centered around the Bank’s messaging and updated forecasts in the July MPR. The latter will be key to the overall tone and we expect the Bank’s central scenario to project a contraction of roughly 6.0% in 2020 with the economy returning to pre-COVID levels around the end of next year. The statement should continue to emphasize heightened uncertainty and a widening output gap that will weigh on inflation. While we expect the Bank to maintain its messaging that LSAPs will continue until the recovery is well underway, there is some scope for the Bank to announce further scaling back of its smaller and less utilized liquidity programs.

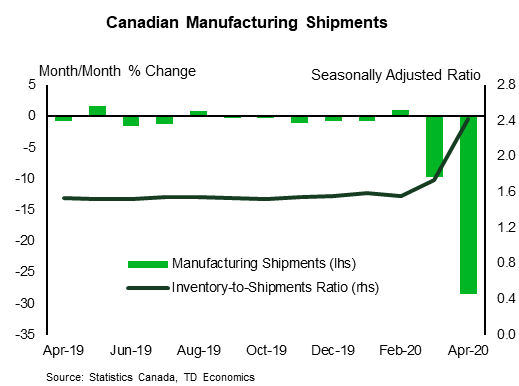

Canadian Manufacturing Sales – May

Release Date: July 15, 2020

Previous: -28.5%

TD Forecast: 9.0%

Consensus: 8.5%

TD looks for manufacturing sales to rise by 9.0% m/m in May for their largest increase on record, led by a rebound in durable goods. Shutdowns across the automotive and aerospace sector weighed heavily on April, with transportation shipments down 75% m/m, and the resumption of auto production will provide a key tailwind to manufacturing activity in May. Petroleum sales will provide another source of strength on a combination of higher gasoline prices and more driving, while other categories should see more modest gains. Volumes should underperform the nominal increase due to higher factory prices, but we still look for manufacturing activity to make a significant contribution to industry-level GDP.