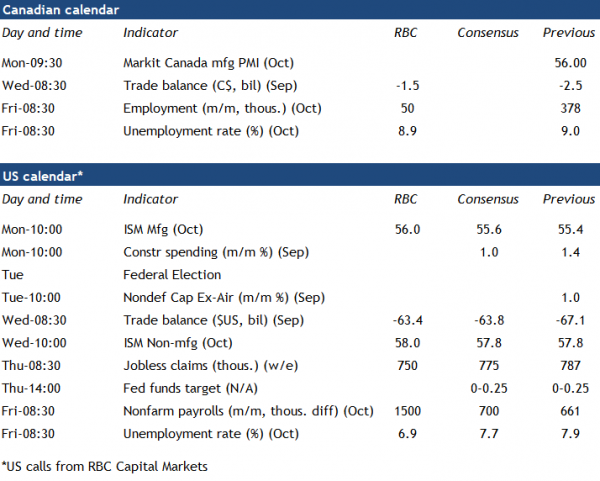

We expect the pace of job growth in Canada slowed to 50k in October after a stronger-than-expected 378k increase in September. Virus containment measures were reintroduced in Ontario, Quebec and other regions, and although much less stringent than in the spring, they likely resulted in another round of layoffs in hard-hit industries like accommodation and food services. Conversely, we expect jobs in the retail and construction industries, where employment is still well-below pre-shock levels, continued to gradually recover. We expect the unemployment rate dipped to 8.9% in October.

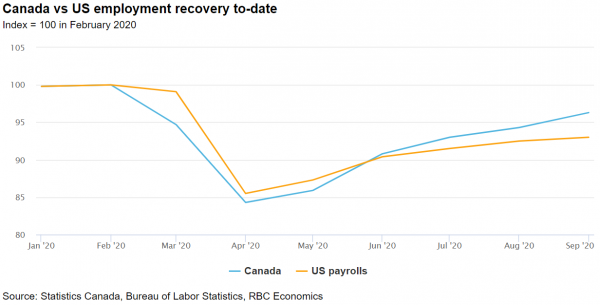

Though the Canadian economy recouped about three-quarters of the jobs lost in the spring through September, there were still over 700,000 fewer people working than in February. And of those job losses, a rising share are permanent rather than temporary layoffs, meaning it will probably take longer to match the remaining unemployed to new jobs. The number of people working part-time when they would rather have full-time work is also still higher than normal, and hours worked may have fallen as businesses cut hours before laying workers off. And we expect escalating virus spread will essentially stall the economic recovery in Q4.

If there is a consolation prize for Canadian labour markets, it’s that the jobs recovery has been notably faster here than in the United States where just over half of the 22 million jobs lost in the spring were recovered as of September. But the US economy has been showing more resilience recently – albeit largely because of a reluctance to re-impose containment measures despite a sharply escalating virus spread. The number of people receiving jobless benefits continues to decline. We have penciled in a 1.5 million increase in US jobs in October, up from the 661k gain in September. But that will still leave over 9 million people out of work relative to pre-shock February levels.

Week ahead data watch:

- The US election will take the spotlight for next week. The result remains a source of significant uncertainty on many fronts including the government’s next steps to combat the spread of COVID-19, additional fiscal support and climate policy. President Trump is trailing significantly in the polls with the Democrats also slightly favoured to regain control of the Senate.

- The US Fed is expected to leave monetary policy unchanged at the FOMC meeting, but will likely reiterate a willingness to do more to support the economic backdrop if needed.

- We expect the Canadian trade deficit to narrow to $1.6 billion in September, with exports and imports rising 3% and 1%, respectively. Trade flows have been lagging the broader economic recovery, although rising rail shipments in September signals activity started to pick up.