It’s another week and another round of negotiations are taking place between UK and EU officials to try and clinch a deal on a post-Brexit trade agreement. With the transition period set to end on December 31, Thursday’s EU summit is seen as a potential date for a draft text to be agreed upon. But although pound traders remain optimistic, there’s already speculation that the latest “deadline” may slip away, dragging the negotiations into December. In the meantime, Britain’s economic recovery is fast losing steam and Friday’s retail sales numbers (due at 07:00 GMT) will probably underscore the worsening trend.

So close and yet so far

When two of Boris Johnson’s closest aides resigned last week in an apparent power struggle, there was hope in Brussels that their departure would transpire into a softer Brexit stance. However, David Frost, the UK’s chief negotiator was quick to dismiss this, saying his stance will “not be changing”. But as we head towards another Brexit crunch moment, there’s growing indication that barring the two remaining sticking points – fisheries and a level playing field – a deal is nearly complete. Frost has pretty much admitted as much, tweeting that “We also now largely have common draft treaty texts”.

The question now is, will either side be willing to bend in the coming days when it’s not quite the 11th hour for the negotiations, or will end of the month/early December be targeted as the new ‘make or break’ moment? The answer to that should be revealed soon. But as things stand, another delay is more than possible as Johnson is standing firm on his red lines. The UK has long been arguing that the EU has not been treating it as a ‘sovereign equal’ in the negotiations as Brussels has been attempting to curb London’s ability to set its own policies in a post-Brexit world.

Would Johnson risk a ‘hard’ Brexit?

As far as hardline Tories are concerned, regaining full sovereignty is what Brexit is all about and they would certainly not be happy about sacrificing it for what the EU is willing to offer in return. If a basic free-trade deal is the best the EU can do, many in Johnson’s government would prefer the UK walked away from the talks and not be tied in any way to the bloc. However, Johnson also has to consider the economic consequences of UK-EU trade defaulting to World Trade Organization terms on January 1, 2021 as the impact of such a shock could be augmented multi-fold when the economy has already taken a devastating hit from the pandemic.

Retail sales may point to double-dip recession

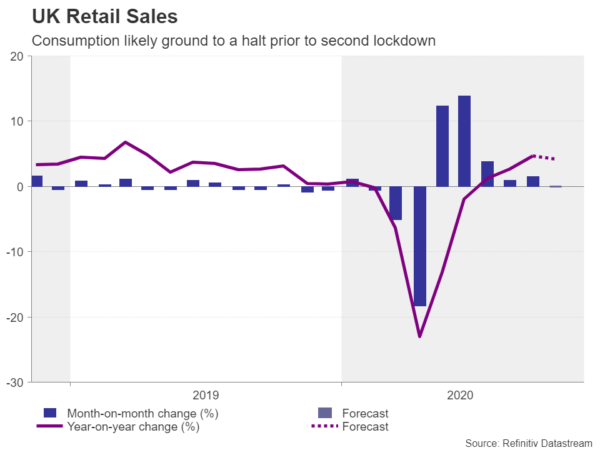

With most countries now having published Q3 GDP data, it’s clear Britain’s services-based economy is worst-off among its peers from where it was prior to the pandemic, highlighting the long road to a full recovery. Retail sales figures due on Friday are expected to flag more trouble for the recovery. Sales are forecast to have stayed unchanged in October compared to the prior month, with the year-on-year rate predicted to ease to 4.2% from 4.7% in September.

The projected slowdown would have come just before tighter virus restrictions were enforced in November and would add to fears of a double-dip recession.

Pound could jump on Brexit breakthrough

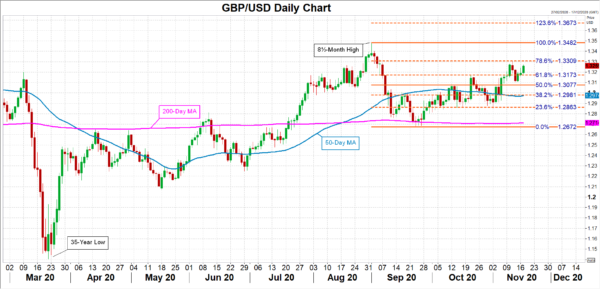

Nevertheless, traders are likely to look past the short-term gloomy outlook if a Brexit deal is announced in the next week or so, or at the very least, significant progress is made and a compromise agreement appears to be only a matter of time. The pound could rush higher on positive Brexit headlines to climb back above the $1.33 level, which lies just underneath the 78.6% Fibonacci retracement level of the September down leg. Clearing this hurdle would bring the September top of $1.3482 back into range, while a more powerful rally could see the bulls target the 123.6% Fibonacci extension of $1.3673.

However, if the talks don’t produce a positive outcome and the economic data is worrisome, cable could slip towards the 50% Fibonacci of $1.3077, opening the way for the 50-day moving average around $1.2975. A sharper sell-off would turn attention to the September low of $1.2672.