- Stock markets pause for breath, currencies quiet too

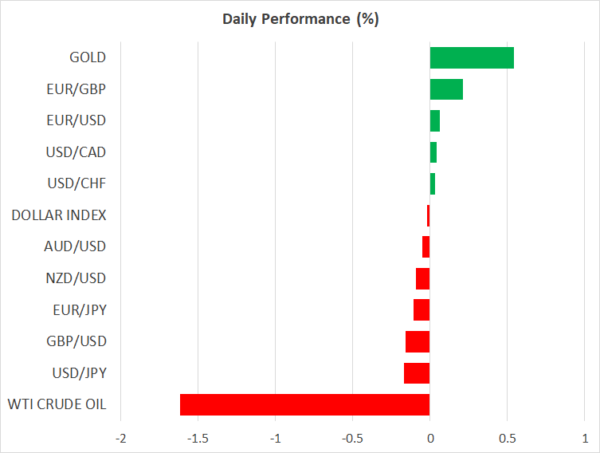

- Dollar the only notable FX mover, extends recent losses

- Crude oil retreats from highs as OPEC meeting looms

- Sterling in the spotlight as Brexit headlines turn cautious

Markets calmer on Thanksgiving

The ecstatic mood that prevailed in global markets earlier this week seems to have faded for now, with stock markets being essentially flat since Tuesday and most currency pairs confined in narrow trading ranges. There is a sense that investors are waiting for the next catalyst that will really shake things up, now that the vaccine-driven rally appears to have run out of gas.

Markets may not be powering higher anymore, but they are not correcting lower either and have stabilized at elevated levels, which suggests that cautious optimism is still the prevalent currency in town. The dollar is the notable exception in this narrative, with the reserve currency continuing to grind lower, without any meaningful news behind it.

No smoking gun in FOMC minutes

The minutes of the latest FOMC meeting did not contain any revelations. The Fed confirmed it can provide more support either by increasing the pace of its asset purchases or by buying longer dated bonds, and that it will probably link the duration of its QE program to some economic target being achieved.

The market reaction was muted, as there was no concrete signal about the December meeting. On the one hand, policymakers didn’t seem in a rush to expand their easing programs, but on the other hand this meeting took place before covid infections skyrocketed, so things may have changed. The Fed is unlikely to do nothing at all, so the real question is how much it will deliver this time, which is the wild card for the dollar and equities.

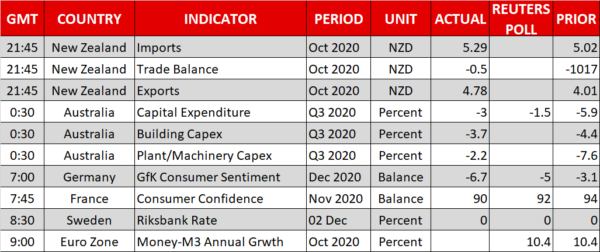

US markets will be closed today for the Thanksgiving holiday and the economic calendar is virtually empty, so things could remain quiet. However, this also implies that market liquidity will be thinner than usual with American traders away, so if we do get any fresh headlines – say on Brexit – they could have a larger impact.

Brexit news clips the pound’s wings

Speaking of Brexit, the latest reports suggest no real progress has been made these past few days. The pound mostly ignored those headlines yesterday, but some caution seems to be setting in early on Thursday. Markets have turned increasingly optimistic on a deal lately, as the economic consequences of not reaching one would be devastating for both sides in this lockdown environment. That said, the ‘last mile’ is always the hardest in political negotiations.

As for sterling, a lot of optimism has been baked in already, so if next week passes without a deal as well, investors could begin to seriously question their cheerful thesis. An agreement is still the most likely outcome, but the longer we go without one, the tougher it will be for the pound. The clock is ticking.

Crude oil pulls back – OPEC jitters?

In the commodity arena, crude oil continues to excite. ‘Black gold’ has staged a heroic rally since the first vaccine news hit the markets, as investors priced in a brighter outlook for demand next year. Prices are on the retreat today, though after six straight sessions of gains, a retracement seems natural.

Looking ahead, it will all be about OPEC’s meeting on Monday. A three-month extension of the current supply cuts seems almost fully priced in here, so if the cartel wants to boost oil prices further it needs to deliver something bigger, which may be difficult given the growing divisions within OPEC.

Finally, the minutes of the latest ECB meeting are due out today, though this is usually not a market mover for the euro.