The Australian dollar declined slightly after the country’s retail sales missed analysts’ forecasts. In a report earlier today, the bureau of statistics said that the overall retail sales rose by 1.4% in October, a significant reversal from the previous month’s decline of 1.1%. While these sales were strong, they missed the median estimate of a 1.6% increase. These numbers came a day after the country reported strong export and import data for October. The two rose by 5% and 1%, respectively, leading to a trade surplus of $7.45 billion.

The biggest focus among traders will be the US nonfarm payroll numbers that will come out at 13:30 GMT. In general, economists expect the data to show that the payrolls rose by 469k in November, a smaller increase than October’s 638k. They also see the unemployment rate falling from 6.9% to 6.8%. In addition, economists expect wages to rise by 4.3% in November. On Wednesday, data from ADP showed that private employers added 307k jobs during the month. But, in the past, the data from ADP and the Bureau of Labour Statistics tend to have a significant gap. Other important data from the US will be factory orders and Baker Hughes oil rigs.

The Canadian statistics office too will release the November employment numbers at 13:30 GMT. In total, analysts expect the data to show that the economy added just 20,000 jobs in November as the unemployment rate remained unchanged at 8.9%. They also expect the data to show that the participation rate rose by 65.2% during the month. In addition, the bureau will release the October export and import data.

GBP/CAD

The GBP/CAD cross is trading at 1.7296, which is slightly above yesterday’s high of 1.7400. On the hourly chart, the price is a few pips below the 14-day and 28-day exponential moving averages (EMAs). It also seems to be forming a bearish pennant pattern that is shown in yellow. Further, the pair is forming a head and shoulders pattern, which is usually a bearish sign. Therefore, the GBP/CAD will possibly continue falling ahead of the Canadian employment data.

EUR/USD

The strong EUR/USD rally stalled in overnight trading. The pair is trading at 1.2143, which is a few pips below yesterday’s high of 1.2173. On the hourly chart, the pair has been consolidating in the past few hours, which has seen the Average Directional Index (ADX) start falling. The Relative Strength Index (RSI) too has moved from the overbought level of 70 to the current level of 58. Therefore, with no major data from Europe, the pair will likely remain at the current level ahead of the NFPs.

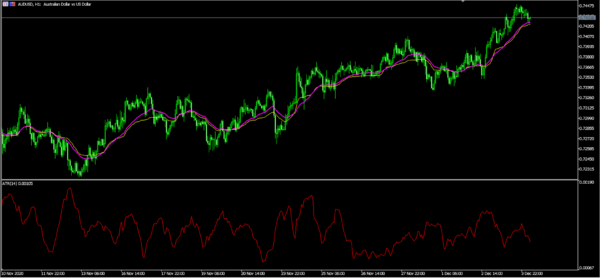

AUD/USD

The AUD/USD pair declined after relatively weak Australian retail sales data. It is trading at 0.7432, which is slightly below yesterday’s high of 0.7450. On the hourly chart, the pair remains above the 14-day and 28-day EMAs while the Average True Range (ATR) has been on a downward trend. The pair has also formed a small hammer pattern, which sends a signal that the upward trend will possibly remain.