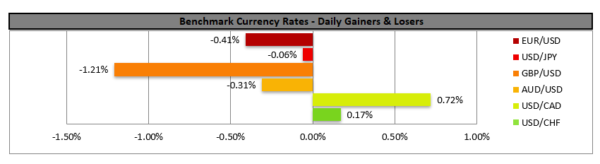

The pound weakened against the USD, EUR,CHF and JPY, opening with a negative gap during today’s Asian session, as negotiations about Brexit missed another deadline yesterday, while at the same time the mutated coronavirus in the UK intensifies worries. EU-UK negotiations about their post Brexit trade relationship failed to reach a breakthrough and are to restart today Monday and both sides seem to be hardening their stance on the remaining issues, providing little hope for a possible deal. Also, it should be mentioned that in a sudden move UK’s PM Boris Johnson abandoned plans to allow families to see each other over the holiday season as the UK government warned that a new strain of the coronavirus, we had mentioned in earlier reports, is “out of control”. It’s characteristic that European countries have started to suspend flights to the UK, worrying of a possible spread of the mutant virus in their countries as well. Given that fundamentals are weighing on the pound we could see UK’s economic outlook darkening and the pound could weaken even further, unless positive headlines about the Brexit negotiations start to reel in.

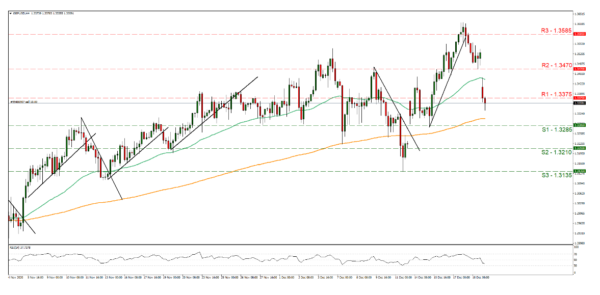

GBP/USD tumbled against the USD and during today’s Asian session opened with a negative gap breaking the 1.3470 (R2) line and continued lower to also break the 1.3375 (R1) level, both support levels now turned to resistance. We tend to maintain a bearish outlook for the pair given the intensity of the weakening as well as the fact that RSI indicator below our 4-hour chart is below the reading of 50. Should the pair’s descent lower continue, we could see it breaking the 1.3285 (S1) line and aim for the 1.3210 (S2) level. If a buying momentum is displayed, we could see cable breaking the 1.3375 (R1) line and aim for the 1.3470 (R2) level.

USD strengthens on safe haven demand

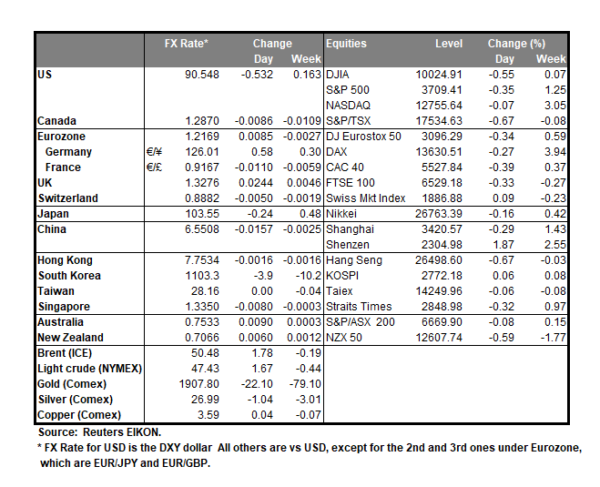

The USD trended to strengthen against a number of its counterparts during today’s Asian session, as safe haven demand tended to push it higher. Increased lockdowns in a number of countries tended to intensify worries for their possible adverse effects on global trade and the recovery of the global economy, despite vaccination being allready underway. At the same time the cautious market sentiment practically overshadowed news that the US Congress reaching a deal for a fiscal stimulus of $900 billion which could had removed some uncertainty from the markets, boosting US stock markets and causing some safe haven outflows for the USD. The actual voting is scheduled for today, in the American session and could affect the USD direction yet as news are allready out the effect of the voting may be somewhat limited. If the cautious market sentiment continues, we could see the USD getting further support and vice versa.

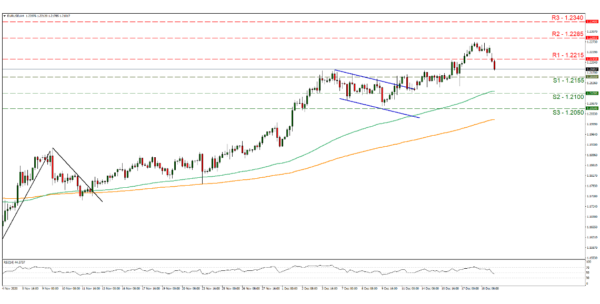

EUR/USD weakened since Friday, breaking the 1.2215 (R1) support line, now turned to resistance. We tend to be bearishly inclined for the pair, yet the fundamentals on both sides of the pair could alter EUR/USD’s direction. Should the bulls regain momentum, we may see EUR/USD breaking the 1.2215 (R1) resistance line and aim for the 1.2285 (R2) level. Should bears maintain control, we could see EUR /USD breaking the 1.2155 (S1) support line and aim for the 1.2285 (S2) support level.

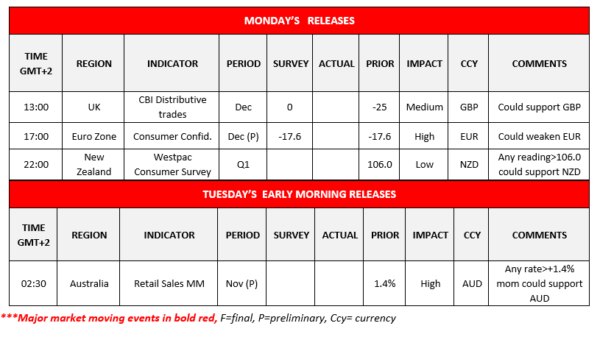

Other economic highlights today and early Tuesday

Today during the European session, we note UK’s distributive trades indicator for December. In the American session we get Eurozone’s preliminary Consumer Confidence for December. During tomorrow’s Asian session we get Australia’s preliminary retail sales growth rate for November.

As for the rest of the week

On Tuesday, we get UK’s final GDP rate for Q3 as well as the final GDP rate for Q3 for the US. On Wednesday, we note from the US the durable goods orders growth rate for November, the weekly initial jobless claims figure and the final UoM Consumer Confidence for December, while from Canada we get the GDP rate for October. On Thursday, we highlight from Turkey CBRT’s interest rate decision. On Friday, no major financial releases are expected.

GBP/USD H4 Chart

Support: 1.2155 (S1), 1.2100 (S2), 1.2050 (S3)

Resistance: 1.2215 (R1), 1.2285 (R2), 1.2340 (R3)

EUR/USD H4 Chart

Support: 1.3285 (S1), 1.3210 (S2), 1.3135 (S3)

Resistance: 1.3375 (R1), 1.3470 (R2), 1.3585 (R3)