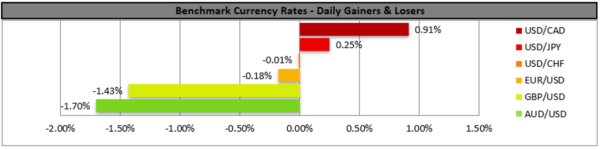

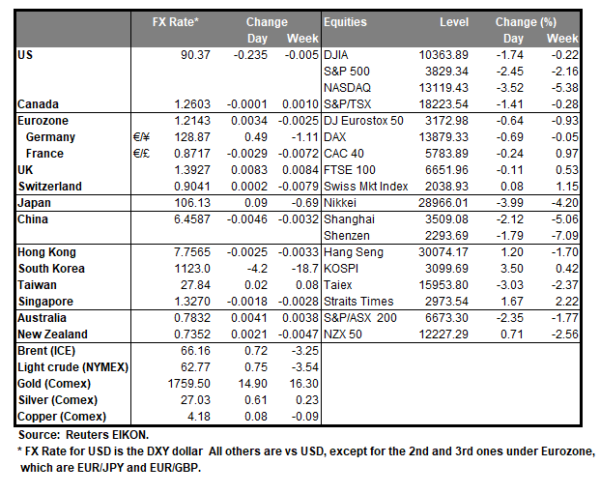

The USD tended to gain against a number of its counterparts yesterday, while US stockmarkets displayed sharp drops as USD enjoyed safe haven inflows and USD buyers were also encouraged by the rise of the US yields. Its characteristic of the bond sell off that the US 10-year treasury yield reached 1.50%, the highest level in the past 12 months. Also, it should be noted that the rise of Game Stop’s share price tended to stoke fear in the markets for a possible return of the buying frenzy spurred by Wall Street Bets traders. At the same time the USD may have gotten additional support from the better-than-expected data released yesterday. We may see fundamentals counterweighing financial releases today and the positive sentiment for the USD continuing to affect the markets and if so may provide additional support for the greenback.

EUR/USD dropped from the highs of the 1.2220 (R1) resistance line to the lows of the 1.2150 (S1) support line. As the pair has broken the upward trendline incepted since the 17th of February, we switch our bullish outlook in favour of initially a sideways movement. The RSI indicator below our 4-hour chart has dropped to the level of 50 implying an indecisive market, yet the downward slope seems to imply that the sellers have the initiative. Should the drop be extended, we may see EUR/USD breaking the 1.2150 (S1) support line which was the epicenter of the pair’s movement from the 22nd to the 24th of February and aim for the 1.2100 (S2) level, which reversed the pair’s downward movement on the 22nd of the month. Should on the other hand a buying interest be displayed by the market we may see the pair breaking aiming if not breaking the 1.2220 (R1) resistance line, which the pair failed to clearly breach yesterday.

AUD tumbles against USD on uncertainty

The Aussie tumbled against the USD yesterday, as the market’s cautious stance also adversely affected commodity currencies AUD and CAD. It was characteristic how the bond selloff forced RBA to intervene in the markets in order to stop the carnage performed on government debt. RBA performed an unscheduled offer to buy three-year government bonds yesterday as yields rose above its target. On the fundamentals it should be noted that news feeds of Australian sites restarted appearing on Facebook after the Australian government agreed to amend media regulation laws, which could be considered a win for Facebook. Should the market sentiment continue to be cautious we may see AUD loosing further ground while Sunday’s and Monday’s manufacturing Chinese PMIs could be of interest for Australian exporters of raw materials, as well as Aussie traders.

AUD/USD tumbled yesterday breaking consecutively the 0.7950 (R2) and the 0.7875 (R1) support lines both now turned to resistance and continued even lower. As the pair broke the upward trendline characterising the pair’s motion from the 5th of February we switch our bullish outlook temporarily in favour of a sideways bias. However, it should be noted that the RSI indicator below our 4-hour chart seems to be rapidly approaching the reading of 30 and given also the steep slope of the drop yesterday and during today’s Asian session we are reminded of the presence of the bears. Should the bears actually maintain control over the pair’s direction as expected, we may see the pair breaking the 0.7785 (S1) support line and aim for the 0.7725 (S2) level. Should the bulls take over, we may see AUD/USD reversing course and breaking the 0.7875 (R1) resistance line aiming for the 0.7950 (R2) level.

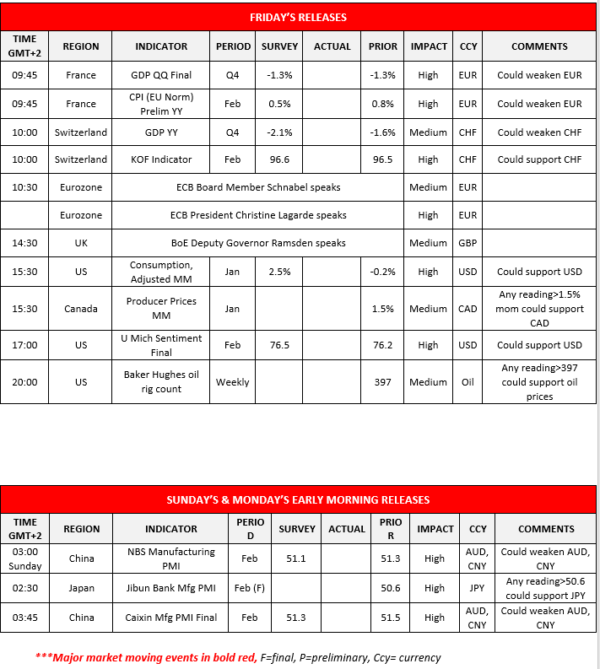

Other economic highlights today and next session’s Asian morning:

Among a slew of data today we note the release of France’s preliminary HICP rate for February, Switzerland’s GDP and KOF indicator and the US consumption rate for January. Also note that on the monetary front ECB President Christine Lagarde and Lane as well as BoE’s deputy governor Ramsden are scheduled to speak. Please bear in mind that on Sunday early Asian morning, China’s NBS PMIs are due out for February and on Monday Asian session, we get the Caixin Manufacturing PMI for the same month.

Support: 1.2150 (S1), 1.2100 (S2), 1.2050 (S3)

Resistance: 1.2200 (R1), 1.2285 (R2), 1.2350 (R3)

Support: 0.7785 (S1), 0.7725 (S2), 0.7665 (S3)

Resistance: 0.7875 (R1), 0.7950 (R2), 0.8030 (R3)