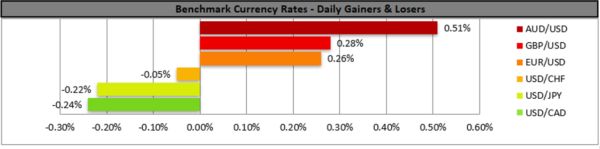

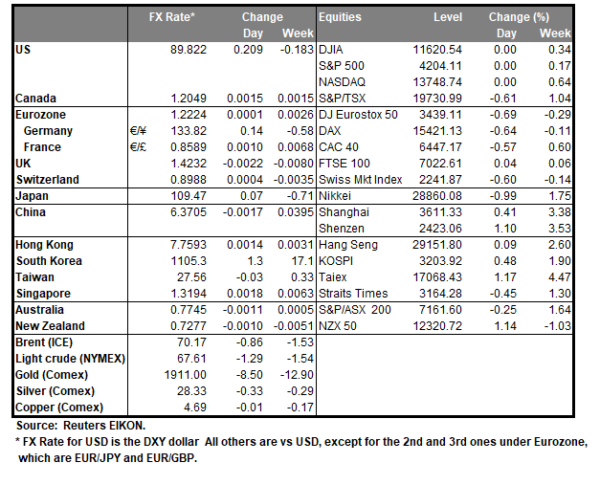

The USD tended to weaken against a number of its counterparts yesterday, yet the situation may change as a long weekend in the US due to Memorial Day comes to an end. Given the acceleration of inflation the market’s attention turns to the employment market which consists the other half of the Fed’s mandate, with May’s employment report coming to the epicenter of attention on Friday. Before that, though traders may keep an eye out for other employment data such as the ADP employment figure for May and the weekly initial jobless claims figure, both due out on Thursday, while the ISM PMI figures for May will provide a view on the expansion of economic activity in the US today and on Wednesday. Fed officials in the near past had repeatedly stated that they expect the inflationary pressures in the US economy to remain transitory in nature and any planned speeches starting with Fed Vice Chair Quarles and Board Governor Brainard are expected to be closely watched for any hints regarding the Fed’s intentions.

The USD Index retreated yesterday aiming for the 89.65 (S1) support line. Despite the index’s retreat we still maintain our bias for a sideways motion of the index, given that the its price action seems to remain between the 90.25 (R1) resistance line and the 89.65 (S1) support line. On the other hand, the RSI indicator below our 4-hour chart is below the reading of 50 and maybe implying a slight advantage for the bears. Should the bears actually keep control over the index, we may see it breaking the 89.65 (S1) support line and aim for the 89.15 (S2) level. Should the bulls take over, we may see the index rising, breaking the 90.25 (R1) resistance line and aim for the 90.75 (R2) resistance level.

Oil traders turn their attention to the OPEC+ meeting

Oil prices continued to rise yesterday as there seem to be high expectations for the demand side of the commodity given that summer is approaching and consumption in the US is expected to rise. However also data from China early this morning, also implied that economic activity from China’s manufacturing sector expanded the most for the year, also providing a signal for higher demand. Oil traders now turn their attention to the OPEC+ meeting today and the organisation is expected to maintain the policy of gradually easing production cuts in the next months, which under normal circumstances should weaken oil prices, as it would imply greater supply. High demand expectations though could offset the easing policies and in such a case we may see oil prices getting support.

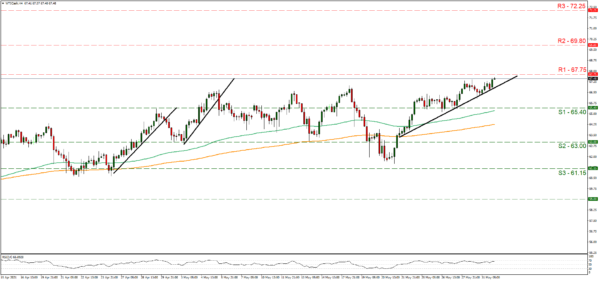

Oil prices continued to rise yesterday aiming for the 67.75 (R1) resistance line. We keep our bullish outlook as long as WTI’s price-action remains above the upward trendline incepted since the 21st of May. Please note that the RSI indicator below our 4-hour chart is aiming for the reading of 70, which could imply that bulls have further room for advancement. Should buyers actually continue to be in control of WTI’s direction, we may see it breaking the 67.75 (R1) line and aim for the 69.80 (R2) level. Should the commodity come under the market’s selling interest, we may see it reversing course and aim if not break the 65.40 (S1) line.

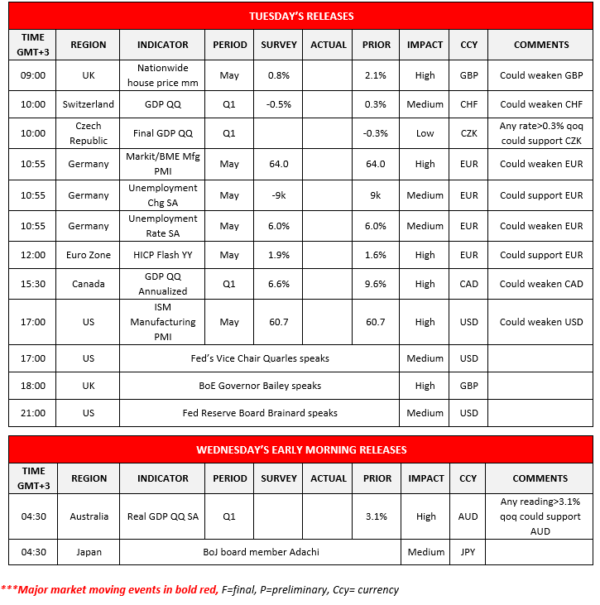

Other economic highlights today and the following Asian session:

Today during the European session we note from the UK the Nationwide House price for May, Switzerland’s GDP rate for Q1, the Czech Republic’s GDP rate for Q1, Germany’s final manufacturing PMI for May, Germany’s unemployment data for May and Eurozone’s preliminary HICP rate for May. In the American session, we get Canada’s GDP rate for Q1 and the US ISM manufacturing PMI for May. Please note that during the American session on the monetary front, Fed’s Vice Chair Quarles, BoE Governor Bailey and Fed’s Reserve Board Governor Brainard are scheduled to speak and could create volatility with their statements. During tomorrow’s Asian session we note the release of Australia’s GDP rate for Q1, while BoJ board member Adachi is scheduled to speak

Support: 89.65 (S1), 89.15 (S2),88.55 (S3)

Resistance: 90.25 (R1), 90.75 (R2), 91.30 (R3)

Support: 65.40 (S1), 63.00 (S2), 61.15 (S3)

Resistance: 67.75 (R1), 69.80 (R2), 72.25 (R3)