U.S. Highlights

- Consumer price inflation accelerated to 5.0% year-on-year (y/y) in May, once again coming in ahead of expectations. Soaring prices for used cars and trucks (up 30% y/y) were a major factor in higher inflation in the month.

- Job openings continue to soar, rising to 9.3 million in the latest April data. There are now as many job openings as unemployed people in America.

- The Federal Open Market Committee meets to deliberate monetary policy next week. No change in policy is expected but look for migration higher in economic, inflation and interest rate forecasts.

Canadian Highlights

- The Bank of Canada rate decision was the big event this week. As expected, the Bank opted to leave monetary policy unchanged.

- In a follow-up speech, Deputy Governor Timothy Lane expanded on the Bank’s thinking. He noted the resilience of the economy as well as the challenging labour market recovery up ahead.

- Inflation is on the Bank of Canada’s radar. The Bank is monitoring supply chain bottlenecks closely and will be careful not to allow persistence on this front to unanchor inflation expectations.

U.S. – Fed Meets as Inflation and Job Openings Soar

The Federal Open Market Committee meets next week and will have a lot to mull over as it determines its next policy steps. Since August of last year, the Fed has been aiming to push inflation above 2% – not for its own sake, but to allow the labor market to fully recover from the shock of the pandemic. Inflation has now pushed well above 2% – headline CPI hit 5% year-on-year (y/y) in May of this year – but the labor market is still far from full recovery – in the same month, employment was 7.6 million (5.0%) below its pre-pandemic level in February of last year.

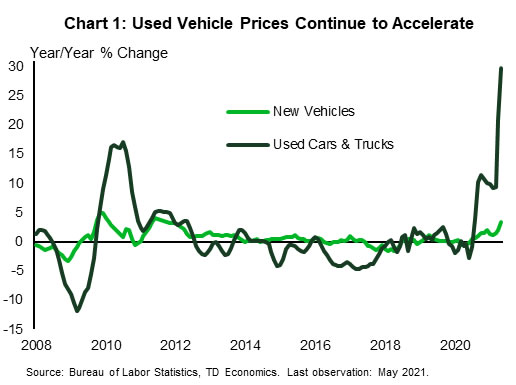

Fed officials have beaten a consistent drum that the acceleration in price growth is “transitory” and reflects the unique circumstances of an economy emerging from a one in one hundred year health shock. They point to the outsized gains in used vehicle prices (Chart 1). Vehicle demand has risen due to the lack of public transit alternatives and supply has fallen as production of new vehicles was stymied first by the pandemic and then by shortages of semiconductors (whose demand also skyrocketed).

Alongside fiscal stimulus, monetary policy has certainly helped to bring demand back to the economy. The challenge is that increasingly, what appears to be holding back the labor market is not a lack of demand, but of supply. The disappointing pace of job growth over the past two months cannot be chalked up to a lack of employer demand. Job openings in April rose to 9.3 million, the highest level on record and over 20% above its pre-crisis peak (Chart 2). There is now effectively a job opening for every unemployed person, the best ratio since January 2020, when the unemployment rate was just 3.5%. Rather, the challenge is that for a number of reasons people are either reluctant or unable to fill those jobs.

This is not to suggest that the Fed should raise interest rates next week or even a year from now. Low interest rates may not solve the supply challenges, but tightening financial conditions could worsen them. The hope is that as the pandemic ends, many of the supply-side constraints will solve themselves. For example, people will be more inclined to take jobs that require close interaction with others. Still, some of the delay in returning to full employment likely reflects deeper reallocation challenges. People who have moved from waiting tables to delivering online orders may not want to go back to their old positions. Or the jobs they used to do may simply not exist in the new digital economy.

In parsing future Fed decisions, look to the evolution of their forecasts. Fed members will clearly have to adjust their near-term inflation views, but longer-term views will be more informative. Similarly, on the economic front, the near-term is likely to see more improvement, but with an increasing chance of even more fiscal stimulus down the road – the Senate this week showed their ability to pass funding for infrastructure when the logic is keeping up with China – upgrades in future years could also come with higher expectations for the federal funds rate.

Canada – Higher Inflation On The Horizon

It was fairly quiet week on the economic front for Canada this week. The big event was the Bank of Canada (BoC) rate decision. As expected, the BoC opted to leave the overnight rate at 0.25% and keep the quantitative easing (QE) program running at its current pace of at least $3 billion asset purchases per week. The Bank’s messaging did not stray too far from what was communicated in the April Monetary Policy Report (MPR). It expects that sometime in the second half of 2022 excess slack in the economy will be fully absorbed and the 2 percent inflation target sustainably achieved.

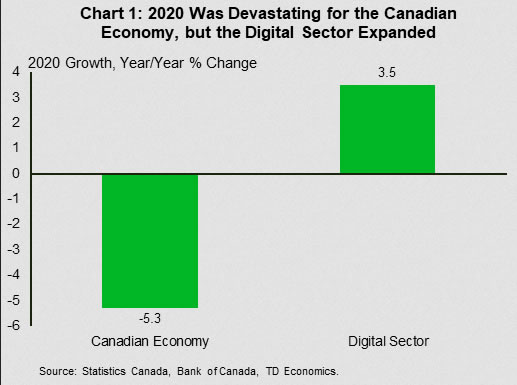

The Bank further expanded on its thinking in a speech by Deputy Governor Timothy Lane. The Deputy Governor noted that despite economic growth falling short of expectations in the first quarter this year (actual: 5.6%; MPR: 6.5%), the underlying details tell a story of a more resilient economy. A key element behind this resilience is the increasing adoption of digital technology by businesses and consumers to get around hurdles posed by the pandemic and associated restrictions. Indeed, on aggregate, 2020 was a devastating year for the economy, but the digital sector still expanded by 3.5% (Chart 1).

Still, the accelerated pace of digitalization creates challenges. In particular, the transformation could eliminate some jobs, while exacerbating skill mismatches that are likely to occur as the economy emerges out of the pandemic. Monetary policy will have to be supportive as this excess slack is reabsorbed into the economy.

At the same time, there are important risks that could leave the Bank of Canada with little choice but to remove monetary stimulus sooner rather than later. For one, the vaccination rollout in Canada has progressed at a faster clip, and as such, the economic recovery over the summer months could be stronger than anticipated. For two, price pressures are rising, increasing the chances of higher inflation in the coming months.

The BoC will be monitoring inflation developments closely. Just south of the border, May was another hot month for inflation. Consumer prices rose 0.6% m/m, taking the overall inflation rate to 5.0% y/y, the highest its been since August 2008. A big reason for this increase was the surge in used vehicle prices, which are due in large part to semiconductor chip shortages that have severely limited auto production.

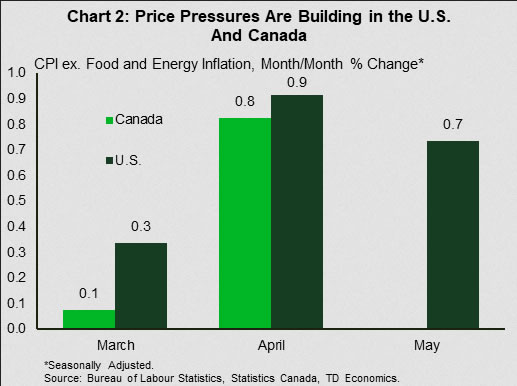

Canada could see a similar price phenomenon as provinces reopen their economies (Chart 2). Next week’s May inflation data will likely not include significant reopening impacts as restrictions were still in place across much of the country, but supply chain shocks could surface. It wouldn’t be surprising to see a pick up in vehicle prices next week.

Like the Federal Reserve, the BoC expects the supply constraints to be temporary. But the danger is that if they are more persistent, it could unanchor consumer inflation expectations, leading to a self-fulfilling cycle of rising price growth. The Bank will be cautious of this. If reopening goes well over the next few weeks, the Bank will likely further taper the QE program, perhaps as soon as July.