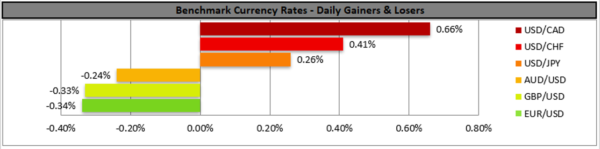

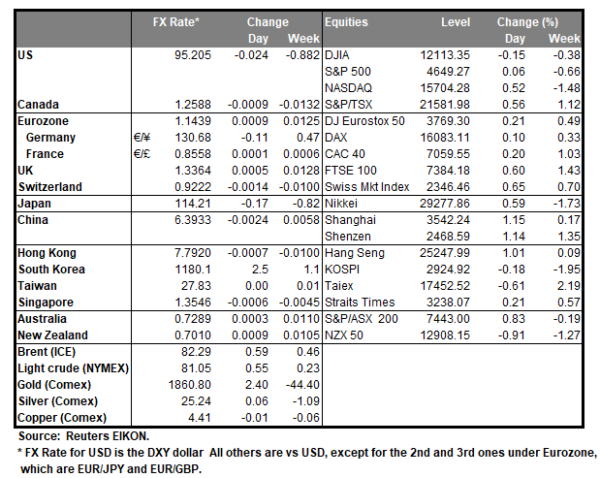

The USD continued to gain against a number of its counterparts yesterday in the aftermath of the release of October’s US CPI rates. Overall market mood remained unchanged also given that no high impact US financial data were released yesterday. On a fundamental level we note the thawing of tensions in the US-Sino relationships which started with the announcement of the collaboration of the two countries in an effort to reduce emissions. The issue though may continue as US President Biden and Chinese Leader Xi Jinping are scheduled to address leaders of the Pacific Rim late today and should the tensions in the relationships of the two countries ease further, we may see the USD experiencing some safe haven outflows. On the other hand, markets today may be more interested in the release of the preliminary US University of Michigan for November and the JOLTS job openings figure for September. On the monetary front we highlight the speech of New York Fed President Williams, and should he maintain the Fed’s usual narrative about the temporary nature of inflation we may also see the USD retreating somewhat due to the bank’s dovishness.

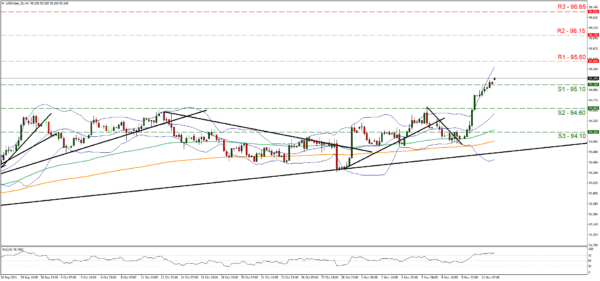

The USD index continued to rise yesterday breaking the 95.10 (S1) resistance line, now turned to support. We tend to maintain our bullish outlook for the index currently, yet we note that the RSI indicator below our 4-hour chart has clearly surpassed the reading of 70, implying that the index is overbought and could have a correction lower. Should the bulls actually maintain control over the index’s direction, we may see it aiming if not breaking the 95.60 (R1) resistance line. Should the bears say enough is enough and take over, we may see the index breaking the 95.10 (S1) support line and aim for the 94.60 (S2) level.

EUR remains soft

The common currency continued to weaken against the USD yesterday and JPY yet gained against the pound as UK’s GDP rates for September and Q3 seemed to disappoint pound traders. The path of the pandemic is once again worrisome for the Zone and especially Germany as the number of daily cases in the largest economy of the Eurozone has reached record high levels. Fundamentally the energy crunch and supply shortages may still be clouding the economic recovery of the Zone. On a monetary level we highlight ECB’s dovishness. We emphasize ECB’s chief economist Philip Lane’s comments earlier this week, implying that a rate hike could prove to be counterproductive and note that he could be making some statements today, and should he reiterate the same narrative, we may see EUR slipping. On the other hand EUR traders may be keeping also an eye out for today’s release of the Eurozone’s industrial production growth rate for September.

EUR/USD continued to weaken yesterday breaking the 1.1445 (R1) support line now turned to resistance. We tend to maintain our bearish outlook yet please note that the pair has reached a 15 month low, and the bears seem to have slowed their pace. Also the RSI indicator below our 4-hour chart has reached below the reading of 30 also implying that the pair may be oversold. Should the selling interest be maintained we may see the pair aiming if not breaching the 1.1370 (S1) support line. If the current trend is reversed, we may see the pair breaking the 1.1445 (R1) resistance line and aim for the 1.1520 (R2) resistance level.

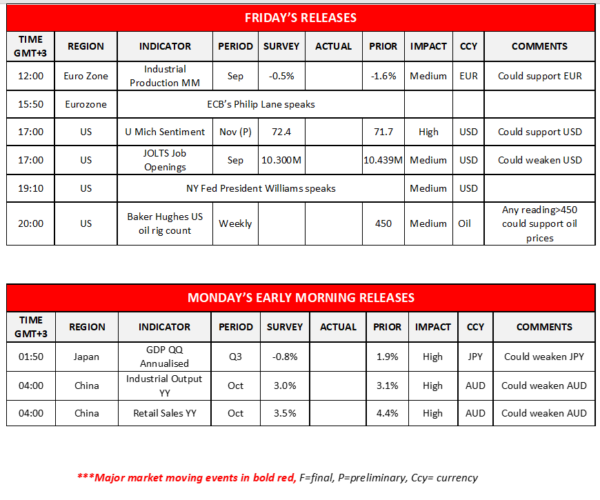

Today’s events and expectations

Today during the European session we note Eurozone’s industrial production for September and ECB’s Lane speech later on. In the American session, we note the release of the preliminary University of Michigan consumer sentiment for November and September’s JOLTS Job openings figure while oil traders may keep an eye out for the weekly Baker Hughes oil rig count. On the monetary front please note that NY Fed President Williams is scheduled to speak. During Monday’s Asian session we highlight the release of Japan’s GDP rates for Q3 and from China we get the industrial output growth rate as well as the retail sales rate, both being for October.

Support: 95.10 (S1), 94.60 (S2), 94.10 (S3)

Resistance: 95.60 (R1), 96.15 (R2), 96.65 (R3)

Support: 1.1370 (S1), 1.1300 (S2), 1.1215 (S3)

Resistance: 1.1445 (R1), 1.1520 (R2), 1.1615 (R3)