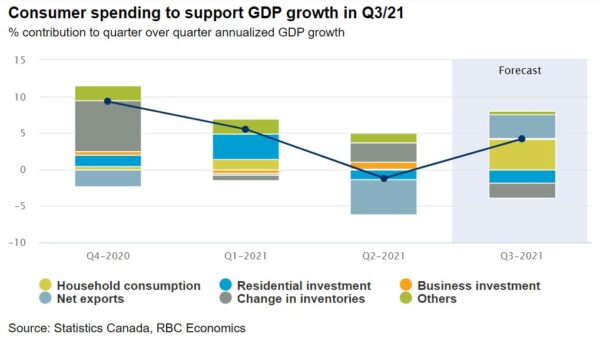

We expect GDP rose 4.0% (annualized) in the third quarter, picking up after a 1.1% decline in Q2 when COVID-19 restrictions were more stringent. That Q3 increase would be stronger than the 2% early estimate from Statistics Canada a month ago with improved labour market data leaving some upside risk—hours worked increased at an almost 7% rate in Q3. Residential investment likely pulled back for a second consecutive quarter as home resale markets cooled. But consumer spending rebounded. The volume of retail merchandise purchases increased 6.3% and spending on high-contact services is beginning to recover from pandemic-restrained levels. Exports are tracking higher too, gaining 10% after plunging 15% in Q2. On a monthly basis, the preliminary estimate from Statistics Canada was that output was unchanged in September, in part due to supply chain disruptions that drove motor vehicle manufacturing sales down more than a third from August. The early reading for October is expected to look substantially better. The advance manufacturing sales report pointed to a temporary reprieve in auto production disruptions, and early retail and wholesale trade estimates were also up.

Labour market indicators have been consistently firmer. Employment was back to pre-pandemic levels as of September— compared to a 1.5% shortfall in GDP. We estimate that employment rose by another 40,000 jobs in November, led by further improvement in high-contact services sectors where the bulk of remaining labour market weakness remains. Even in those industries though, labour shortages look set to intensify. Employment in those hardest-hit high-contact service sectors is still down almost 280,000 from pre-pandemic levels, but the number of remaining unemployed workers out there above longer-run ‘normal’ levels is smaller at under 150,000. The threat of virus spread remains and global supply chain bottlenecks will continue to disrupt goods production. But even as those start to dissipate, shortages of labour are expected to remain a significant constraint on further GDP growth into next year.

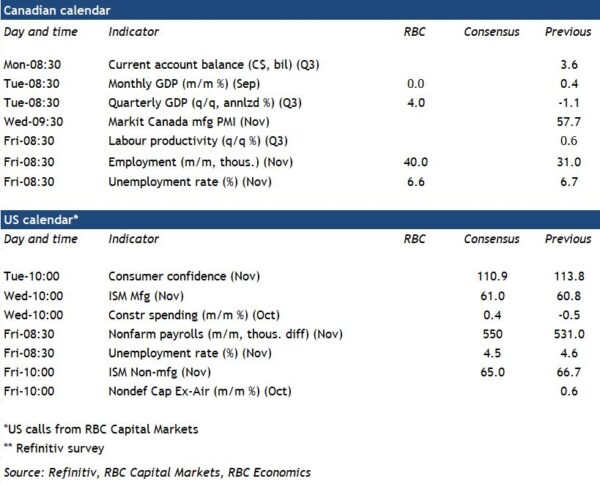

Week ahead data watch:

Canadian GDP is expected to have remained flat for September from August, with declines in manufacturing, retail and wholesale sales tied to a weaker auto sector. These were offset by ongoing recovery in hospitality and travel. Growth likely reverted back to positive in October, as suggested by more positive advance data releases.

We expect a 40,000 increase in Canadian employment in October, lowering the unemployment rate to 6.6%. The improvement was likely supported by the ongoing recovery of close-contact service sector industries, where employment is still weaker than pre-pandemic but demand continues to resume.

The US employment report next week is expected to show continuous improvement in payroll in November, with consensus currently expecting a larger than 500k gain for a second month in a row and a tick lower in the unemployment rate to 4.5%. Rising demand for workers, without adequate inflow into the labour force will likely keep market tension elevated and further add to wage pressure, which has been increasingly present in earnings data in recent reports.