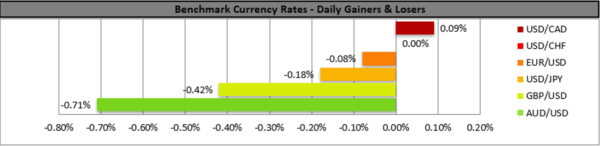

The USD tended to slip against some of its counterparts after mixed signals being sent by November’s Employment report yet opened with a positive gap early today albeit volatility seems to remain rather low.

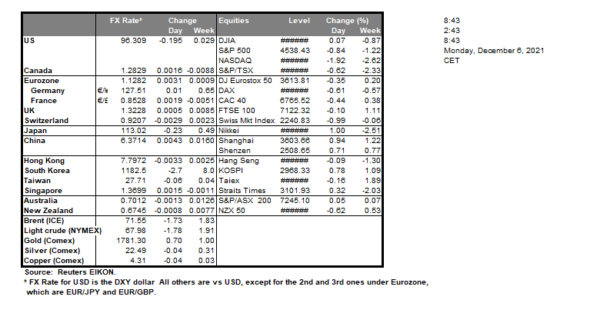

November’s employment report tended to send out mixed signals on Friday as the NFP figure came out far lower than October’s and what was expected, yet the unemployment rate dropped lower. On the other hand, Canada’s November employment data seemed to remain solid as the employment change figure rose substantially and the unemployment rate dropped, showing a tightening of the Canadian employment market. Nevertheless, a risk off sentiment and wobbling oil prices prevented the CAD from capitalising substantially from the releases. Oil prices tended to gain early this morning recovering some ground after Friday’s drop as OPEC announced that it will continue with supply adjustments “to ensure we attain stability in the oil market on a sustainable basis” OPEC’s Secretary General stated. The EUR seemed to remain steady against the USD, yet bearish tendencies exist for the pair and ECB President Lagarde on Friday reiterated her view of a temporary nature of inflation and that rate hikes are unlikely in 2022. Also we must note that the Aussie’s weakening against the USD is continuing as the Omicron variant has hit Australian soil but also the commodity currency traders are eyeing RBA’s interest rate decision, due out tomorrow during the Asian session. The bank is widely expected to remain on hold, and should it reiterate that rate hikes are not expected until end of 2023, we may see AUD slipping.

AUD/USD maintained its bearish tendencies as it broke the 0.7045 (R1) support line, now turned to resistance and continued lower to test the 0.6990 (S1) support level, thus reaching a 13 month low level. We intend to keep our bearish outlook for the pair as long as it remains below the downward trendline incepted since the 2nd of November. We also note the RSI indicator below our 4-hour chart that has dropped below the reading of 30 confirming the bears’ dominance yet at the same time may imply that the pair has reached oversold levels and is ripe for a correction higher. Should the bears actually maintain control over the pair, we may see it breaking the 0.6990 (S1) and take aim for the 0.6920 (S2) level. Should a correction higher take place, we may see the pair aiming if not breaking the 0.7045 (R1) level.

GBP/USD renewed its bearish tendencies breaking the 1.3280 (R1) support line. We tend to maintain a bearish outlook for the pair as long as it remains below the downward trendline incepted since the 29th of October. Should the selling interest for cable intensify we may see it breaking the 1.3160 (S1) support line and aim for the 1.2990 (S2) level. In an intense bullish momentum we may see cable breaking the 1.3280 (R1) resistance line, the prementioned downward trendline and aim for the 1.3430 (R2) level.

As for the rest of the week

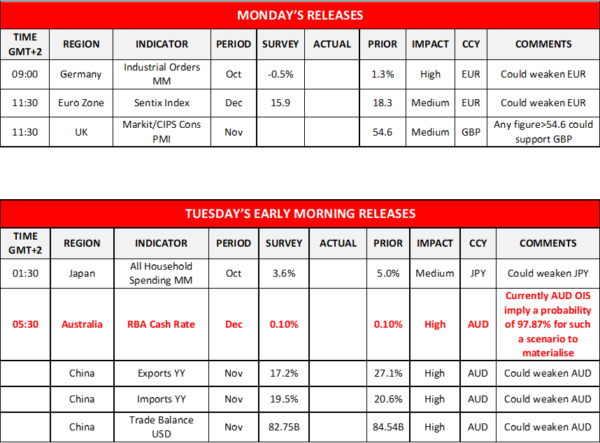

On Monday we have a light calendar with Germany’s industrial orders for October and Eurozone’s Sentix index for December. On Tuesday, we get China’s trade balance for November in the Asian session while Australia’s RBA is to release its interest rate decision. In the European session we get Germany’s industrial output for October, Germanys’ December ZEW indicators and in the American session we get Canada’s trade balance for October. On Wednesday we get Japan’s revised GDP rates for Q3 and later on from Canada we get BoC’s interest rate decision. On Thursday, China’s inflation metrics for November, Germany’s trade balance and Norway’s GDP rate both for October and in the American session the weekly US initial jobless claims figure are due out. On Friday we note the release of Japans’ corporate goods prices for November, Germany’s final HICP rate for October, UK’s GDP rate and manufacturing output rate both for October, Norway’s CPI rates for November, while later we get the US inflation measures for November and the preliminary University of Michigan consumer sentiment for December.

Support: 0.6990 (S1), 0.6920 (S2), 0.6840 (S3)

Resistance: 0.7045 (R1), 0.7100 (R2), 0.7170 (R3)

Support: 1.3160 (S1), 1.2990 (S2), 1.2855 (S3)

Resistance: 1.3280 (R1), 1.3430 (R2), 1.3600 (R3)