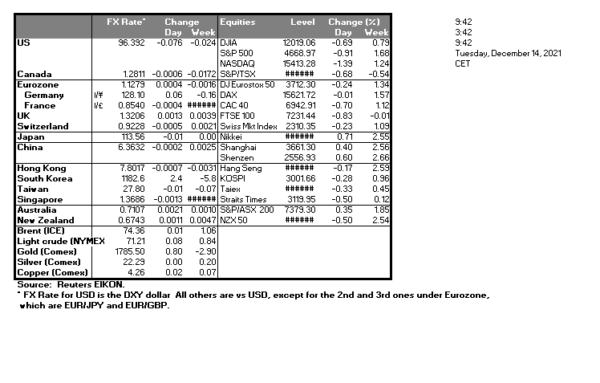

US Stock markets tended to be on the retreat yesterday and during today’s Asian session as the Omicron variant continues to spread at a fast pace and seems to create some worries among investors. On the other hand, the USD remained relatively stable against its counterparts yesterday as the markets zoom in the Fed’s interest rate decision which is due out tomorrow given that the bank’s meeting starts today. Inflationary pressures were reaffirmed on Friday tilting the market’s expectations for the Fed towards a more hawkish direction. Yet today, we would like to also note the release of November’s US PPI rates which also are expected to accelerate and if so, could imply more pressure for CPI rates to accelerate further. Gold’s price tended to remain stable as the USD presented little movement yet lower US yields could provide some support for the precious metal should they continue to drop.

Dow Jones was on the retreat yesterday breaking the 35965 (R1) support line, now turned to resistance. Despite the bearish tendencies the index seems to show some signs of stabilisation. Given also that the RSI indicator below our 4-hour chart is at the reading of 50, which could imply a rather indecisive market, we tend to maintain a bias for a sideways motion for the time being, yet the situation seems to remain volatile. Should the bears actually regain control over the index’s direction we may see it breaking the 35600 (S1) support lien and aim for the 35340 (S2) support level. Should the bulls say enough is enough and take the initiative, we may see the pair breaking the 35965 (R1) resistance line and aim for the 36260 (R2) level.

AUD also slips on Omicron variant

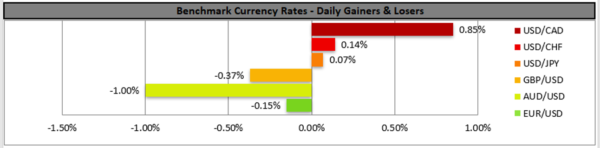

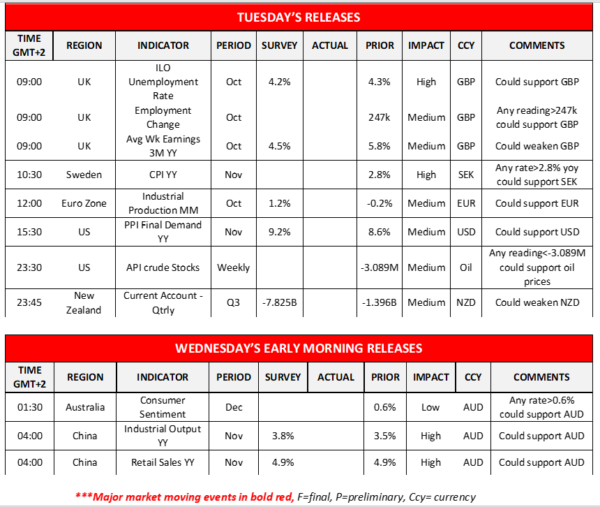

AUD seems to have restarted its weakening against the USD as the market sentiment turned to be more cautious and the Aussie along with the Kiwi and the Loonie tend to reflect such shifts. The uncertainty for the Omicron variant tended to have an adverse effect for the commodity currency as the spreading of the disease could have a disruptive role for international trading conditions. In general we would also note the path of oil prices for CAD traders, while NZD traders should take a look at the current account balance for Q3 due out just as the Asian session is about to start. Aussie traders could be focusing also on the release of China’s industrial output and retail sales growth rates for November, due out tomorrow as well as Australia’s December Consumer sentiment. A possible acceleration of the Chinese production rate could provide some support for the AUD as it could imply a higher amount of exports of raw material from Australia to China while a healthy retail sales growth rate could imply strong demand side in the Chinese market.

AUD/USD seems to have restarted its bearish movement as it tests the 0.7100 (S1) support line. Please note that the RSI indicator below our 4-hour chart is between the readings of 50 and 30 also implying a rather bearish sentiment for the pair, yet the 0.7100 has proven its worth on the 30th of November as it withstood the downward pressure of the pair’s price action and could do it again. Should the pair actually remain under the selling interest of the market, we may see it breaking the 0.7100 (S1) support line and take aim of the 0.7045 (S2) support level. Should the pair find extensive buying orders along its path we may see it reversing course and aiming if not breaking the 0.7170 (R1) resistance line.

Today’s events and expectations

Today we note the release of UK’s employment data, Sweden’s CPI rates for November. Also, we would also like to highlight our worries for Turkey. TRY tumbled once again yesterday forcing the Central Bank of Turkey to intervene in the markets, buying the Lira and reducing its foreign exchange reserves for another time reversing the losses at least temporarily. Reports coming out of Turkey about the situation on the ground are particularly worrying with waiting lines for basic goods, while protests have erupted.

Support: 35600 (S1), 35340 (S2), 35030 (S3)

Resistance: 35965 (R1), 36260 (R2), 36570 (R3)

Support: 0.7100 (S1), 0.7045 (S2), 0.6990 (S3)

Resistance: 0.7170 (R1), 0.7230 (R2), 0.7290 (R3)