The first round of the French presidential election will be held on April 10, ahead of the runoff two weeks later. Opinion polls have narrowed significantly in recent weeks and a victory for President Macron doesn’t look so certain anymore. For the euro, this election seems like an asymmetric downside risk.

The rules

Presidential elections in France consist of two stages. In the first round, candidates from all parties can participate. If one candidate manages to secure more than 50% of the vote, they instantly win. Otherwise, there is a second round between the two most popular candidates.

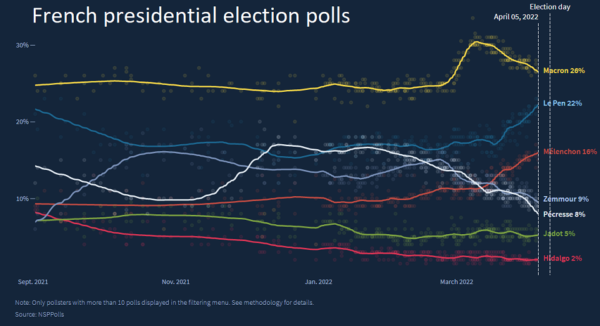

Nobody has ever won from the first round. That’s unlikely to change this time, since the field is very crowded with twelve candidates running. The frontrunners in opinion polls are the current president, Emmanuel Macron, and the opponent he defeated in the last election, the far-right Marine Le Pen.

In third place comes the leftist Jean-Luc Melénchon, followed by the ultra-nationalist TV pandit Eric Zemmour and the conservative Valérie Pécresse who are virtually tied in fourth and fifth place.

2017 repeat?

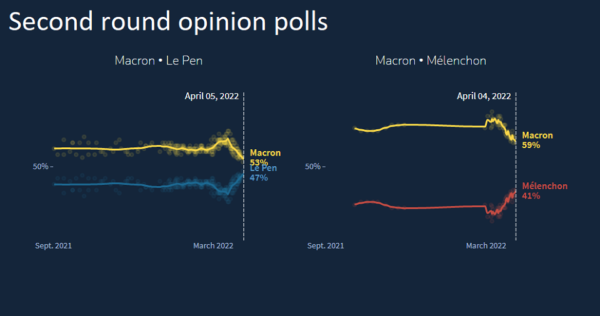

Therefore, it seems like Macron will be squaring off against Le Pen once again in the second round, only his polling lead is much smaller now. Back in the 2017 election, Macron won the final round in a landslide with 66% of the vote against Le Pen’s 34%.

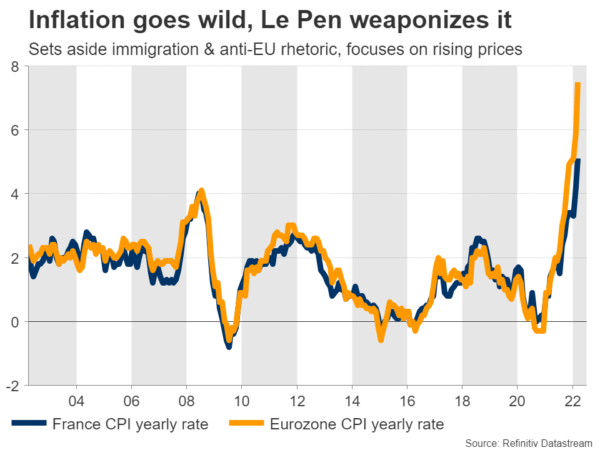

This time, polls show Macron at 53% and Le Pen at 47% – a much tighter race. That is almost within the margin of error, so surprises are entirely possible. Macron enjoyed a boost in popularity recently thanks to his diplomatic efforts to prevent the war in Ukraine, but that spell has started to fade as the war drags on and the cost of living increases.

Le Pen has taken advantage of this situation. She has rebranded herself, focusing on economic problems such as rising prices rather than the immigration and anti-EU rhetoric she campaigned on previously. The new strategy is working – she has risen dramatically in polling surveys and she has a much better chance of getting elected than 2017.

Eurozone implications

The main difference with 2017 is that an exit from the European Union or the euro is no longer on the agenda. That said, this race could still have massive implications for Europe.

Macron has spearheaded the push towards greater economic integration. He pushed for the creation of common debt instruments in the height of the pandemic to finance the Recovery Package and has routinely criticized the Eurozone’s strict fiscal rules.

He essentially tried to fix the two main problems with Europe’s economic architecture – the absence of Eurobonds and the rules that prevent governments from running large deficits, which ultimately enforce austerity on indebted nations.

Hence, Macron is clearly the most growth-friendly candidate. If he loses this election, there would essentially be a European leadership vacuum and the drive to reform could fade, keeping the economy stuck in slow gear. That would be bad news for the euro.

Think of it this way – back in 2017, euro traders worried about Le Pen getting elected because she wanted to exit the EU. This time, the question for markets is not whether Le Pen will be defeated, but rather whether Macron can stay in power.

Market nerves

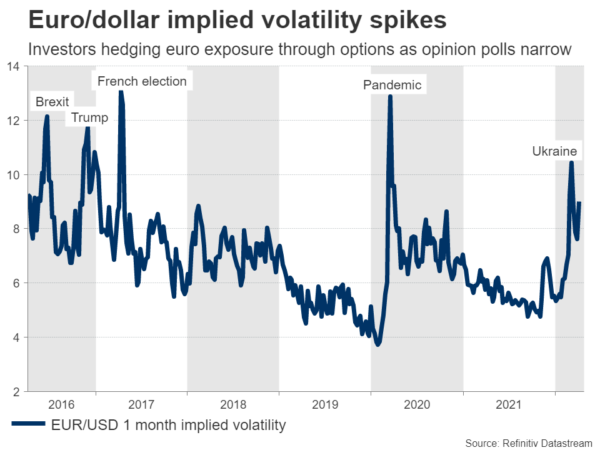

In the markets, the cost of hedging the euro has spiked lately as opinion polls continue to tighten. Implied volatility in euro/dollar options for the next one month has risen to 9%, reflecting growing demand for protection against sharp moves in FX markets.

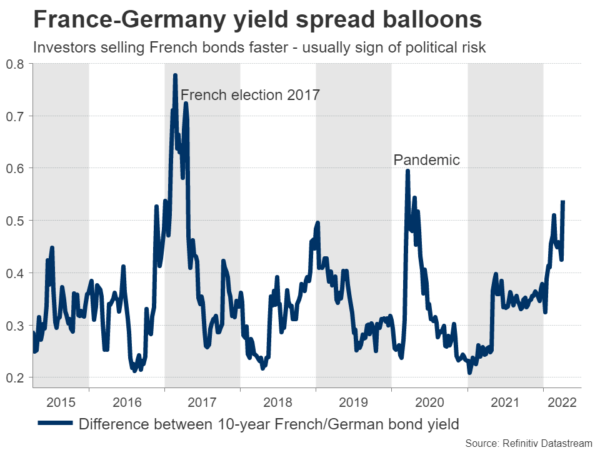

The bond market tells a similar story. The difference between French and German 10-year borrowing costs has ballooned, which means investors are dumping French bonds faster than German ones as the political risk gets baked into the cake.

In the FX arena, the euro has tanked but it is difficult to blame election nerves for that. Between the ongoing war, escalating sanctions, surging energy prices, and the darkening economic outlook for the Eurozone economy, euro traders had a lot to digest.

Trading playbook

All told, this event presents an asymmetric risk for the euro. A victory for President Macron is already the market’s baseline scenario, so if he really wins, the single currency is unlikely to receive a huge boost. It’s already the most probable outcome.

On the flipside, a victory for Le Pen could come as a shock, injecting a new air of uncertainty into European politics and generating a much greater negative FX impact. Investors have been hedging against this outcome but implied volatility in the euro is lower than it was back in 2017, while Le Pen’s chances are probably better now.

Of course the stakes are not so high this time, since she isn’t threatening to exit the euro. Still, if she does win, the drive to integrate the Eurozone economically would slow or even disappear, which is negative for the bloc’s longer-term prospects.

The first round will be telling. If traders sense that Le Pen has enough momentum to close the gap on Macron in the second round, a political risk premium could be priced back into the euro, keeping it under pressure heading into the second round.

Buckle up, it could be a wild ride.