In March Brent crude oil has once again nosedived below $80, levelling all the systematic price growth from December 2022 to March 2023 in one fell swoop.

There are no fundamental reasons severe enough for such a substantial drop in prices. However, fears of a possible recession in the financial sector, which could spill over to other economic sectors and lead to a global slowdown, push energy prices down.

Where is the promised expansion of China’s economy? This article attempts to answer the question.

What happened with oil supply and demand?

According to the latest IEA report, oil supply has increased only slightly. OPEC+ added about 170,000 bpd.

As a result oil supply has jumped to 830,000 bpd, mainly thanks to the US and Canada. IEA expectations for oil production this year remain optimistic at +1.6M bpd.

US commercial crude oil inventories have risen to 480.1 mb. The Strategic Petroleum Reserve hasn’t changed and remains at 371.6 mb.

The US has been draining its storage facilities for 1.5 years – from June 2020, till December 2022. With the cold winter, energy shortages, and the acute period of overcoming dependence on Russian oil and gas over, the realization that the US will not be left with no oil at all has ushered the market into a new phase.

Unexpected OPEC+ decision

At the beginning of April, some OPEC+ countries decided to cut oil production by approximately 1.5M bpd. Russia and Saudi Arabia accounted for the most significant reductions by 500K bpd each.

The OPEC was in no hurry to enter a market with supply restrictions. Now mostly, Saudi Arabia gave a signal to the future interference. For OPEC, the most comfortable price is around $90-$100. So, in the worst-case scenario, if prices do not stabilize, OPEC will enter the arena once more.

In reaction to the OPEC+ decision, the price instantly jumped to $85 and broke several resistance levels, including the cluster between $80 and $80.50 and then $83.

For a short-term trader, it’s clear that the price may soon close this gap, but from the fundamental point of view, we may face a bullish reversal.

The consequences of oil price growth

Everything has its price. The growth in oil prices may lead to the following consequences:

- Inflation growth. It means that the Fed won’t have room for further rate hikes.

- EURUSD decreasing

- American stock markets decline. Here it’s better to pay attention to energy companies because high oil prices may positively impact their financial results.

How much will China take?

Judging by the external macroeconomic backdrop, China’s economy is starting to pick up gradually:

- The February PMI showed a substantial gain of 52.6 points, and the PMI for the services sector went above the 56-point level.

- Industrial production also started rising in February (+2.4% VS +1.3% in January).

- After several months of decline, retail sales showed strong growth of 3.5% for the first time.

The Energy Information Administration expects China’s oil demand to grow by 730,000 b/d this year.

However, concerns have been raised that China continues to actively build up its oil reserves, importing mostly Russian grades at a reasonably high discount – imports from Russia to China amount to about 1.94M bpd.

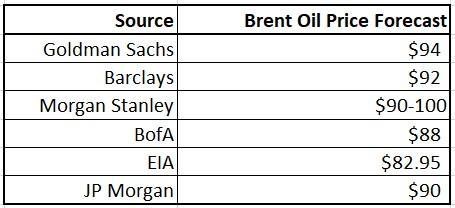

Consequently, most analysts still prefer to lower the average oil price in 2023.

The price value in March should be considered only a market reaction to an unexpectedly surfaced black swan in the form of a bank collapse – a sort of energy market RISK-OFF.

The probability of growth resumption and price stabilization at $80-90 is relatively high. But, given the fullness of Chinese storage facilities, the prospect of reaching $100 per barrel remains murky.