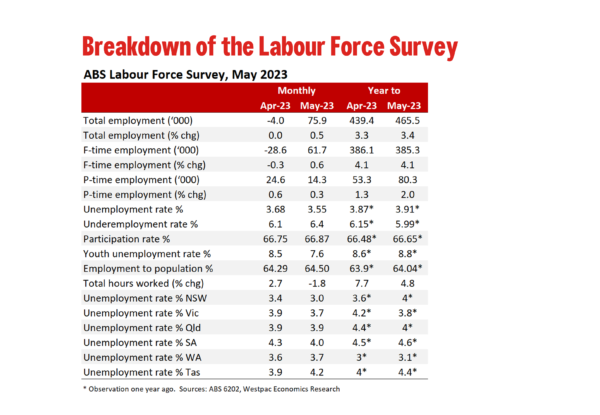

Total employment: +75.9k from –4k (revised from –4.3k); unemployment rate: 3.6% from 3.7%; participation rate: 66.9% from 66.7%.

Total employment gained 75.9k or 0.5% in May, higher than Westpac’s near top-of-the-market forecast for a +40k gain, but well above the market median forecast for a more modest +17.5k lift. This has seen the three-month average growth rate lift from +42.9k/mth to +47.6k/mth.

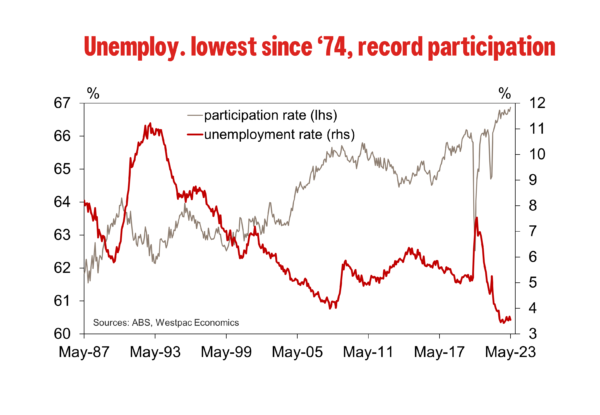

Other areas of the survey also exhibited strength too, including the lift in the participation rate (66.7% to 66.9%) and the employment-to-population ratio (64.3% to 64.5%), both representing fresh record highs. The rise in participation saw the labour force expand by a sizeable 59.4k in May, but with employment also lifting strongly, the unemployment rate dipped from 3.7% to 3.6%. At two decimal places, the unemployment rate is currently at 3.55%, so only just rounding up to 3.6%.

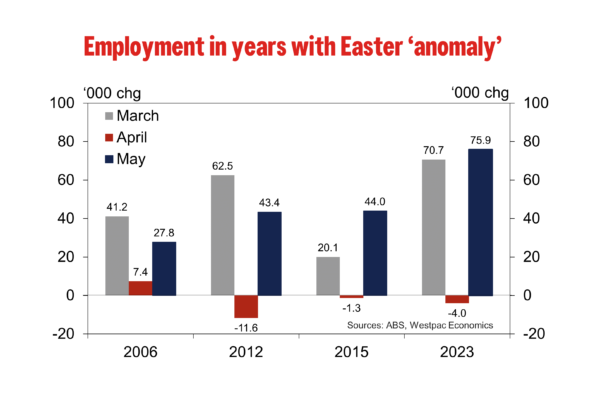

We do stress that some level of caution is warranted in the interpretation of the May results. In particular, the prior survey in April reported a surprise decline in employment of –4.0k and a rise in the unemployment rate from 3.5% to 3.7%. However, we noted that the April 2023 survey is among a small set of years in which the survey period fully coincided with all Easter holidays (as opposed to only a partial overlap).

This seasonal ‘anomaly’ has only been observed three other times over the last 20 years (2015, 2012 and 2006), making it difficult to adjust for. Jobs growth exhibited a clear pattern across all those years with pronounced softness in April followed by a bounce-back in May – a dynamic we expected to play out again in 2023.

However, even in taking this into account the May Labour Force Survey provided a stronger-than-expected update, as evinced by average monthly employment gains remaining robust and the unemployment rate holding near historic lows, suggesting that if the labour market were softening, it is only doing so to a marginal degree. We are processing the numbers and working through how they will impact on our current labour market forecasts.