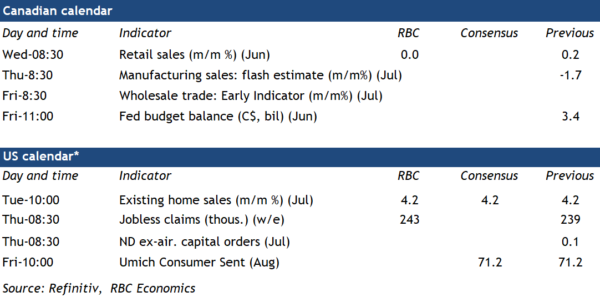

The latest retail sales numbers will be scrutinized for signs of continued excess demand in the economy—particularly after a surprisingly firm increase in Canadian CPI in July. In Q1, exceptionally strong household consumption pushed GDP growth above expectations. In Q2, retail sales have softened. Sales volumes (excluding price impacts) were down almost 2% at an annualized rate over April and May compared to the Q1 average. And Statistics Canada’s advance estimate for June was little changed. Our own RBC cardholder data suggests consumer spending has been somewhat stronger than that, with purchases of discretionary services (not counted in the monthly retail sales data) particularly firm.

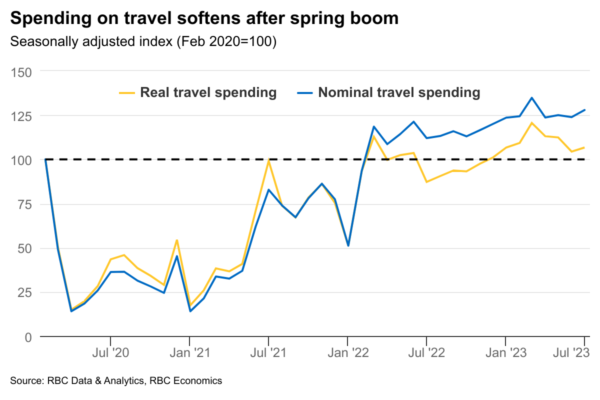

The same data indicates spending remained relatively firm in July. Still, industry reports suggest auto sales declined (on a seasonally-adjusted basis), despite improving availability of stock. And the early summer travel boom is losing momentum as Canadians tighten their belts to adjust to the Bank of Canada’s ten interest rate hikes.

Labour markets remain relatively firm, but the unemployment rate edged up half a percentage point over the last three months. The retail sales number will be one of the final data points to come in ahead of the BoC’s September meeting. Inflation data is still running firm, but early signs of softening in the demand backdrop would help reassure the central bank that a resurgence in inflation isn’t underway. It would also improve the case for skipping another interest rate hike in September.

Week ahead data watch

The flash estimate for July manufacturing sales will be scrutinized for signs of easing after a sharp decline in June sales (-1.7%.) The port strike in B.C. may have disrupted manufacturer shipments in July, but we expect it had a lesser impact on current production (i.e. GDP). Manufacturer’ inventories of production inputs were in much better shape ahead of the strike thanks to improved global supply chain conditions. As a result, production for the most part likely continued. There may, though, have been some temporary delays of shipments of finished products.