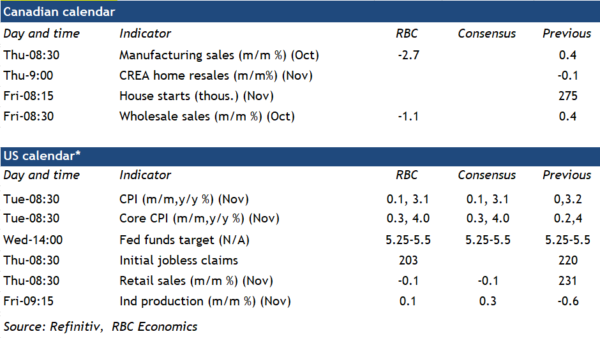

Another busy week of data releases should show further signs that the economic growth backdrop in Canada has softened. Preliminary estimates from Statistics Canada a month ago pointed to a 2.7% drop in manufacturing sales in October. Part of that decline was due to a sharp drop in petroleum prices, overall manufacturing output prices were down ~1%, suggesting sale volumes (excluding price impacts) also declined for a third straight month. The early estimate for ‘core’ (excluding petroleum) wholesale sales data, was also lower (-1.1%.) And total hours worked were unchanged in October before pulling back 0.7% in November. Retail sales edged higher after earlier declines, but early data is still pointing on balance to downside risk to Statistics Canada’s advance estimate that GDP increased 0.2% in October, and is consistent with the BoC’s assessment earlier this week (alongside a third straight hold on interest rates) that inflation pressures are easing as the economy softens.

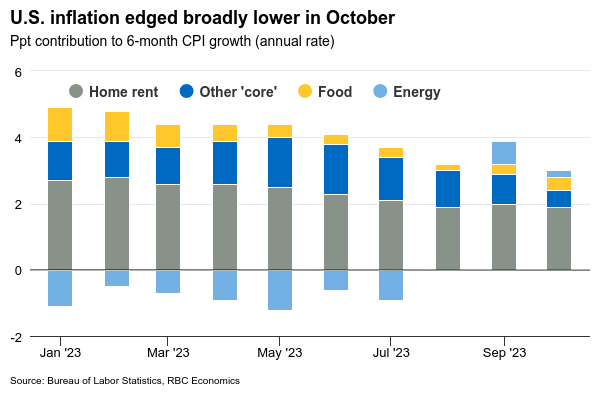

The U.S. Fed is also expected to hold interest rates unchanged for a third straight decision. The U.S. economy has been an island of resilience relative to slower growth in other advanced economies – and a drop in the unemployment rate in November retraced about half of what had been a notable 0.4 percentage point rise over the prior three months. But price growth has moderated with the November inflation data likely to indicate a continued easing of inflationary pressures. We look for the headline inflation to slow from 3.2% year-over-year in October to 3.1%, with a significant reduction in gas prices contributing to a 6% year-over-year decline in the energy CPI. Core inflation is expected to hold steady at 4% year-over-year, but with a 0.3% month-over-month increase that would leave a gradual drift down towards the Fed’s 2% inflation objective largely intact.

Week ahead data watch

U.S retail sales likely ticked down (-0.1%) again in November, the same pace as in October. Gasoline prices went lower by ~7%, lowering sales at pump down sharply. Auto sales also dipped during that month, contributing to part of the slowdown.

The Canadian real estate association (CREA) home resale and price numbers will be watched closely for further signs housing markets are slowing (again). Unit resales in Canada fell 12% from July to October and early market reports suggest activity remained quiet in November.