- Canada’s economy likely added fewer jobs in December

- Local dollar shows some weakness ahead of Friday’s data due at 13:30 GMT

Unemployment rate to rise furhter

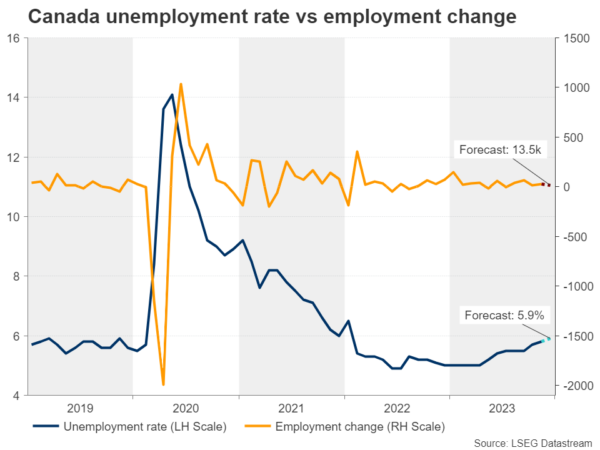

According to market forecasts, the unemployment rate in Canada increased to 5.8% in November 2023, higher than the 5.7% figure that was recorded in the previous month. The rate reached its highest point since January 2022, and it increased even further in December, reaching 5.9%. During the month of December, it is anticipated that the economy added only 13.5k new jobs. Despite this, wage growth is still growing at 5%, so investors will be keeping a close eye on that number and the most recent Ivey PMI indicator, which will be released on Friday as well.

Will the BoC raise rates in January?

As anticipated by the market, the Bank of Canada maintained its target for the overnight rate at 5% for the third consecutive meeting in December 2023. Consequently, the cost of borrowing money will remain at a level that was is the highest it has been in 22 years. Policymakers have noted the fact that there are additional indications that monetary policy is reducing price pressures and restraining spending. However, they continue to be concerned about the risks that could affect the outlook for inflation and are prepared to raise the policy rate even further if it becomes necessary. It is the goal of the central bank to see a further and sustainable decrease in core inflation, and it continues to concentrate on the equilibrium between demand and supply in the economy, inflation expectations, wage growth, and the pricing behaviour of corporations. The BoC also announced that it will continue to implement its policy of quantitative tightening.

BoC policy is unlikely to benefit the loonie

As rate cut bets for the Bank of Canada have also been ratcheted up recently, the Canadian dollar will be keeping a close eye on the domestic labor market. Compared to the other commodity-linked currencies, the Canadian dollar is expected to have gained approximately 2.5% against its US counterpart in 2023. This performance is a bit stronger than that of the Australian and New Zealand dollars, which are also commodity-linked currencies.

On the other hand, there is a possibility that the year 2024 will be much more difficult for the loonie if the BoC is forced to begin reducing interest rates due to the stagnation of economic development.

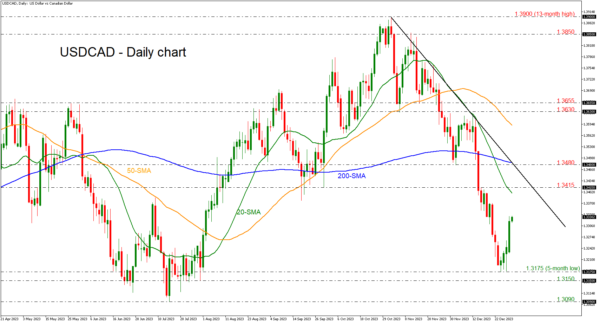

Dollar/loonie is surging after the significant bounce off the five-month low of 1.3175. A fresh move towards the 1.3415 resistance is possible in the near term, reaching the steep descending trend line if the US dollar can extend its bullish streak. However, should the pair reverse back down again, the five-month low of 1.3174 could provide initial support. More downside movements would turn the spotlight on the 1.3150 barrier and the 1.3090 bottom, taken from the low on July 14.