- We continue to think the OCR will remain at 5.5% at the February Monetary Policy Statement.

- Resilience in domestic inflation pressures and the labour market will be of concern to the RBNZ.

- But very weak economic momentum, lower headline inflation and a flatter housing market of late are important mitigants.

- We see another hawkish Statement that even might bring forward potential tightening and continues to lean heavily against expectations of policy easing this year.

- Data on inflation, the labour and housing markets, together with the details of the Budget, will be important in making the case for further tightening, if required.

- We don’t see scope for interest rate cuts in 2024.

Where the RBNZ was in November.

Expectations have fluctuated wildly in New Zealand since the RBNZ November Monetary Policy Statement. Back then the RBNZ surprised almost all with the threat of further tightening in 2024 if inflation pressures didn’t recede fast enough. Central to their thesis was concern that:

- domestic inflation pressures were only slowly subsiding;

- the labour market was taking longer to adjust than expected;

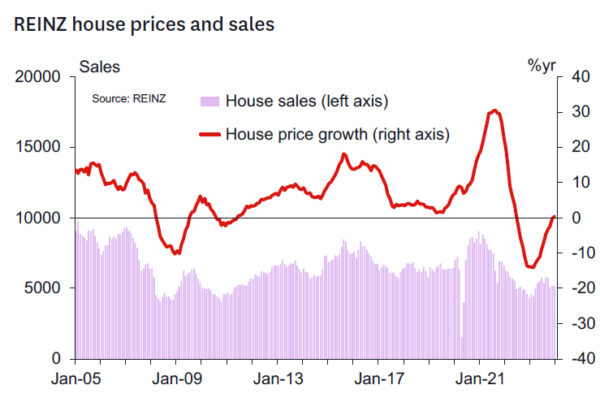

- the housing market was showing signs of resurgence driven by strong net migration;

- migration was putting a floor under growth at the time when policy was trying to increase excess capacity;

- growth was in aggregate stronger than consistent with inflation pressures easing quick enough. The Governor indicated the revised forecast had the minimum sized recession consistent with bringing inflation into line;

- a reinvigorated focus on returning inflation to the middle of the target range by H2 2025 whereas earlier the sense had been that anything inside the 1-3% range might be close enough;

- a concern that fiscal policy might not do enough to assist the disinflation process.

The outcome was a threat of higher rates in Q3 2024 should the outlook not evolve according to plan. There was very limited scope for any further delay in the disinflationary process or any resilience in the economy or labour market.

Having said that, the November Statement did not focus on a potential tightening as soon as its February meeting. The RBNZ’s forecasts implied the potential for action in the September quarter of 2024. Some market participants and commentators concluded that the less imminent timeframe for interest rate increases meant that the RBNZ’s rhetoric was likely an empty threat designed to manage easing expectations. We didn’t believe that then and don’t believe it now.

But we saw a hurdle for the data to jump over to get to the view we held back in November that a February tightening would occur. We expected ongoing resilience in growth, migration, the labour market and especially the housing market. We anticipated that inflation would remain sticky and only slowly fall. We didn’t see inflation getting back inside the 1-3% range until 2025. Hence even after a further 25bp tightening, we thought it would be 2025 before easing could begin and from there it would be a slow cycle down to a higher terminal rate (3.5%) than was seen pre-Covid.

Implicit in our view was that the RBNZ preferred a strategy of “longer” versus “higher” for the interest rate cycle. Hence, we had moved away from the view we held in mid 2023 that a 6% OCR would be required to break the back of inflation in the face of a historically strong migration cycle. We still think that would have been a superior strategy as it would have allowed for earlier easing than what we face now. But that’s a choice for the RBNZ to make.

Key developments since November 2023.

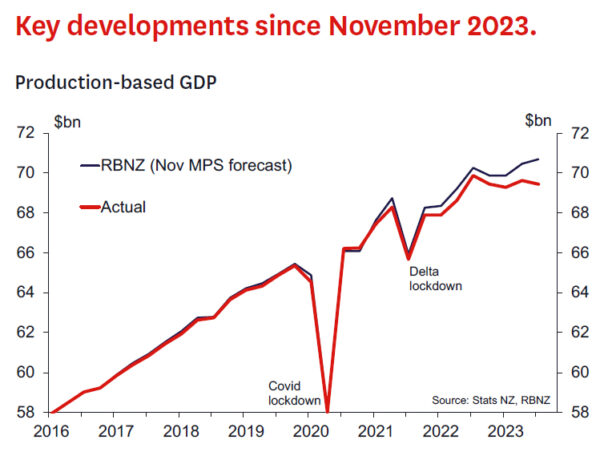

Since November last year we revised down our expectations for the OCR and moved to the view that the peak OCR would be 5.5%. The key factor driving that change was a significant reassessment of the momentum of the economy. GDP was significantly revised down when it was released in December and growth in Q3 itself was weaker than even our below consensus view at the time. We concluded that with an economy contracting at 0.6% yoy and a real probability that 2023 was a year bookended by recessions that there was clear evidence that the 5.5% OCR was providing sufficient pressure on core inflation even despite our concerns that inflation would only slowly fall. Even though some components of demand such as private consumption were as expected in the September quarter, in light of revisions, momentum over the past year was nonetheless much weaker than the RBNZ had expected.

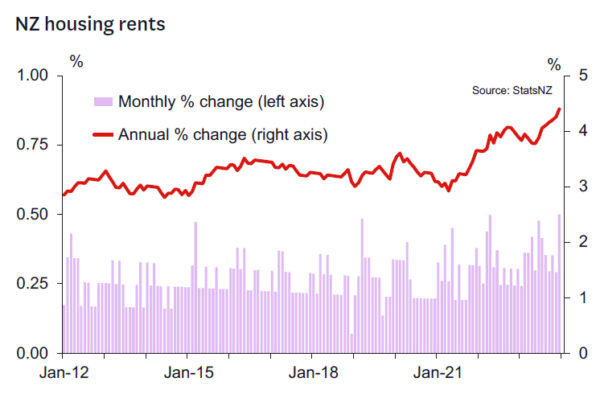

Markets were also especially moved by the weakening in traded goods prices, airfares and food prices shown in the new monthly selected price indices. We were less impressed as these were always going to fall in the near term – whether now or in a quarter or two was of little consequence for the appropriate policy rate today. Certainly, it was helpful for expectations management that these factors drove the headline rate down a bit faster than expected. But the key information in those releases was (and will continue to be) those slow moving components such as rents which continued to be strong beyond what might normally be expected for inflation to stably return to the target range.

Hence, we were very sceptical when markets swung to expecting rate cuts as early as May 2024. We could see a case for an earlier easing in August if things went very well, but the core view was that the OCR would need to stay at 5.5% in 2024 to lean against sticky inflation, strong migration and the RBNZ’s strategy of going “longer” as opposed to “higher”.

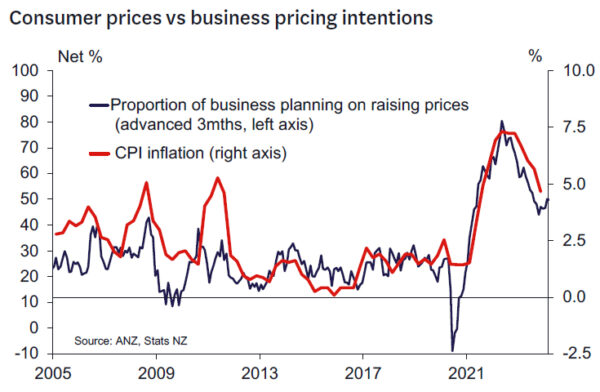

And as it turns out things have not gone very well. When the December quarter CPI was released in late January, those key domestic inflation components were revealed to be markedly stronger than forecast. Last week’s Q4 2023 labour market data revealed that the labour market has remained relatively resilient. Both core inflation and the labour market are adjusting, but at a slow rate. Business confidence indicators suggest optimism in the business sector and pricing intentions indicators might suggest a risk of inflation getting stuck at too high levels. Together, these observations are consistent with the idea that an OCR of 5.5% is tight, but perhaps not extremely tight. Hence, it’s going to take time to get inflation back in its box.

However, it is not all bad. One thing in favour of an optimistic view that inflation will adjust is that the housing market has not yet kicked on from the green shoots seen up to September 2023. This is important as a key element of the slow disinflation thesis is that strong population growth coming from net migration would see housing recover and aid a recovery in consumption and investment earlier than needed to ensure inflation durably returned to target.

We think the jury is still out with respect to the performance of the housing market and still see strong signs that housing will have a decent year. The new government’s investor tax policies, population growth, rents and a likely weakening in construction this year all tell us prices should rise. But it may be that interest rates are high enough to keep them in check – we need to see more data to decide.

What to expect from the RBNZ now?

So where are we now? While some commentators and markets have quickly jumped ship from “team easing” to “team tightening,” we still find ourselves somewhere in the middle. We think the “longer” strategy can still work but the time is shortening to continue giving the data the benefit of the doubt.

We are perhaps even slightly more confident that the recent drop in headline inflation will allow for a return to the target range before 2025. But we think progress will be slower beyond that without a significant near term easing in the labour market. If this economy keeps adding jobs at the current interest rate, then a higher rate may well be required.

Monetary policy also needs mates and more supportive fiscal policy. The Government has indicated a policy of fiscal restraint and consolidation. It will be important the Government backs its rhetoric with action as current Treasury projections seem consistent with ongoing fiscal deficits and an avalanche of bonds. Just reducing spending and cutting taxes likely won’t cut it.

We also don’t think the RBNZ is ready to abruptly change strategy from longer to higher. We think the RBNZ want to encourage monetary conditions to fully reflect their view that the OCR will remain at the current level for longer as opposed to the fanciful ideas of near-term easing being pushed by markets as late as 2 weeks ago.

We think the RBNZ will be on edge. The RBNZ will likely threaten further tightening and may ultimately deliver action this year should inflation pressures not recede fast enough. The RBNZ’s new mandate allows little scope for further waiting and hoping. Action in the next 6 months will determine inflation outcomes in the second half of 2025.

But we do think the RBNZ has time to let the data talk. Economic momentum is very weak, and the possibility of a rapid labour market adjustment remains real as firms react to the weakness in demand seen in the last six months of last year. And we don’t know what the Government is going to do with fiscal policy.

Hence, we see another hawkish Statement later this month, that could potentially threaten policy tightening sooner than indicated in November. We see that as consistent with continuing with the “longer” strategy while managing the risks that the current OCR might not deliver sufficient disinflation. A sudden switch in strategy to one of higher interest rates seems dangerous this late in the cycle. And in the context of likely developments in interest rates in other advanced economies over the second half of this year, a further hike in domestic interest rates would inevitably put upward pressure on the exchange rate – at least in the near term.

We recognise that such late cycle tightenings have happened before (for example immediately before the Global Financial Crisis and during the Asian Financial Crisis). While this could happen again, we think the RBNZ will be more cautious than that right now given that global central banks look set to head into their easing cycles later this year. And it’s important to remember that the RBNZ has been pleasantly surprised with the decline in headline CPI inflation recently.

We don’t think the RBNZ will panic just yet. But forget about easings in 2024 – it just isn’t happening based on what we see now. And we might be back to tightening should conditions prove necessary. Maybe the RBNZ will give us a clue this week in speeches if there’s a change in strategy coming. Let’s see.