U.S. Highlights

- New home sales fell in February, but remain fairly flat over the past three months. New home prices, meanwhile, continued to head lower last month, and are now down 13% from their 2022 peak.

- U.S. GDP growth in the fourth quarter of 2023 was revised up from 3.2% (annualized) previously, to an even better 3.4%.

- Given signs that inflation may have firmed up at the start of this year, Fed officials, including Fed Governor Waller, continued to argue for patience when it comes to reducing the policy rate.

Canadian Highlights

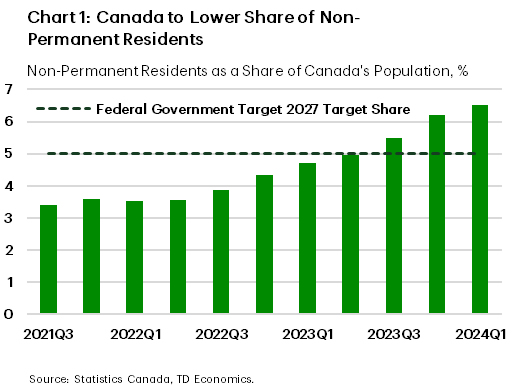

- The federal government hopes to reduce the non-permanent resident share of Canada’s population from 6.5% to 5% by 2027. If achieved, this would reduce pressure on housing and other infrastructure, but also potentially weigh on economic growth.

- In the near-term, however, the economy looks to have got off to a strong start in 2024. GDP surged 0.6% m/m in January and preliminary estimates point to another above-trend gain in February.

- With provincial budget season nearly wrapped up, the Big 4 provinces are expecting a deteriorated fiscal backdrop this year, on the back of weak revenues and decent spending gains.

U.S. – Fed in No Rush to Cut Interest Rates

The last week of March has been fairly quiet in a holiday-shortened week. With no primary data reports published so far, attention gravitated toward Fed speeches and second-tier reports. Equity markets, such as the S&P 500, struggled for direction, but managed to push higher later in the week.

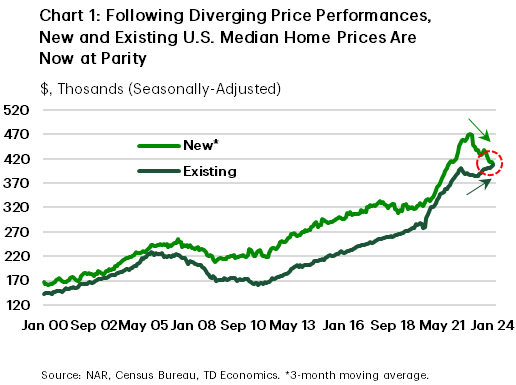

Signals from the housing market were mixed. Following a strong showing in existing home sales in February, new home sales fell a modest 0.3% last month. But, on a three-month moving average basis, the typically volatile series shows a mostly flat trend. What’s more interesting is the fact that the median new home price continues to decline, and has fallen roughly 13% from its peak at the end of 2022. At present, new and existing single-family home prices are essentially at parity (Chart 1). However, we expect there could be more weakness in new home prices ahead given there is 8.4 months of supply in that market, compared to a much tighter balance of 3 months in the existing home market .

Other secondart-tier releases lent support to a positive economic narrative. An upward revision to fourth-quarter GDP from 3.2% (annualized) previously to 3.4% marked a welcome surprise. Turning to more recent data, durable goods orders improved in February for a change. Total orders rose 1.4% following a downwardly revised 6.9% drop in January, and when excluding the volatile transportation category orders rose 0.5% after falling in the previous two months. Meanwhile, initial jobless claims edged lower last week to 210 thousand, reaffirming the notion of a still-robust labor market.

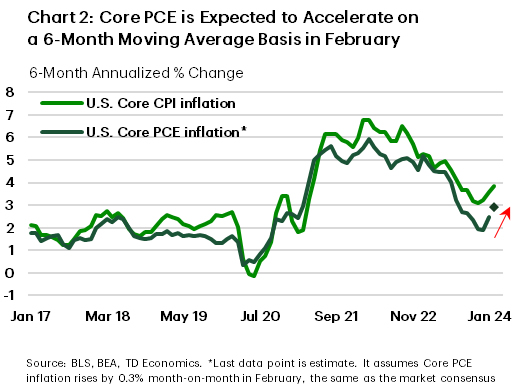

Financial markets are closed tomorrow for Good Friday, but the key personal income and spending (PCE) report for February will still be released. Markets expect real spending to improve by 0.1% m/m in February following an equal-sized drop in January. At the same time, the monthly gain in core PCE inflation, the Fed’s preferred inflation measure, is expected to ease to 0.3% m/m from 0.4% m/m in the month prior. Assuming the data comes in as expected, annual core inflation would hold at 2.8%. However, it would be at 2.9% over the most recent six month period, suggesting progress on inflation has stalled (Chart 2). This supports a more patient Fed when it comes to reducing the policy rate.

Several Fed officials, including Fed Governor Waller, drove this point home this week. Chair Powell is speaking tomorrow too but we anticipate no major change to the narrative that the Fed can be patient until it sees sustained progress on inflation before cutting interest rates. Next week’s highly anticipated employment report will help fill an added piece to the Fed’s policymaking puzzle.

Canada – Governments Steal The Show

Recent Canadian economic developments have been dominated by governments. The federal government made considerable waves late last week with its plan to shrink the share of non-permanent residents in Canada’s population from its current level of 6.5% to 5% by 2027 (Chart 1). Even with a growing population, this implies a net drawdown of these types of newcomers over the next several years.

Just this week, fresh population data showed that over 800k non-permanent residents came to Canada in 2023 – by far the largest inflow on record back to the 1970s. This category helped the country’s population balloon by a massive 3.2% in 2023. If the federal government succeeds in achieving its target, the result will be a huge step down in Canada’s population growth over the medium term. This will offer significant assistance in aligning new housing supply with demand, while reducing pressure on rents and other infrastructure.

The federal government’s policy could also potentially weigh on economic growth and inflation, possibly pointing to a lower level of interest rates than would otherwise be the case over the medium term. However, in the very near-term, economic growth has gotten off to a surprisingly strong start in 2024. Industry-based GDP data for January showed that the economy expanded by a hearty 0.6% month-on-month, led by a rebound in public sector production after the resolution of strikes in Quebec. February’s preliminary estimate is also solid, pointing to 0.4% monthly gain. Combined, these numbers suggest that first quarter economic growth could be well above our recent forecast.

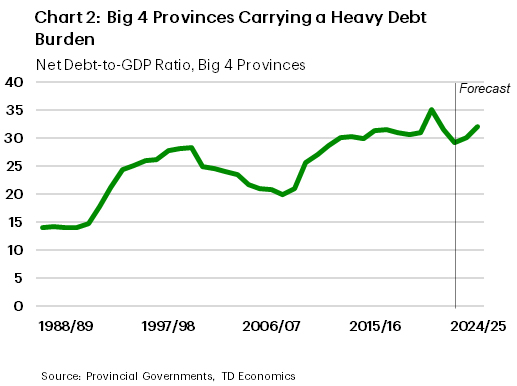

With the release of Ontario’s budget this week, we nearly have the full picture of the provincial budget season. We only await fiscal blueprints from Manitoba next week, and then the federal government on April 16th. Still, information at hand allows for a few key takeaways. First, the fiscal backdrop is set to deteriorate meaningfully this year. Across the Big 4 provinces (B.C., Ontario, Quebec, and Alberta), deficits are expected to total -1% of GDP. That’s the largest shortfall (outside of the pandemic) since 2012/13. Anticipated deficits for this fiscal year across the Big 4 come courtesy of what’s expected to be considerably slower revenue gains alongside decent spending growth, with the latter having the potential to support the economy during its rough patch.

Meanwhile, net debt-to-GDP (the common measure of a government’s debt burden) is expected to rise to 31% across the Big 4 (Chart 2). That’s not quite the highest on record, but it’s close. With these elevated debt burdens come rising interest costs. For example, Quebec and Ontario combined expect to spend nearly $25 billion on debt servicing charges. These costs are higher than what these governments will spend on many other major programs. Notably, high debt loads will also leave provinces vulnerable to unexpected events.