Some of yesterday’s move in the Dollar Index has been undone by some heavy USD selling after Israel attacked Syria amid some rising tensions between Druze-Militias and the Syrian Government Forces.

It seems that a ceasefire has currently been reached, calmying the tensions – This is however a story to follow for the upcoming days.

US Producer Price Index data had been released just before the intensification of the Middle East turmoil and had previously led to some more USD buying – The report was pretty positive as PPI came out unchanged vs a revised + 0.3% release from last month and a 0.2% rise expected.

FED Chair Jerome Powell is also speaking right now for those interested.

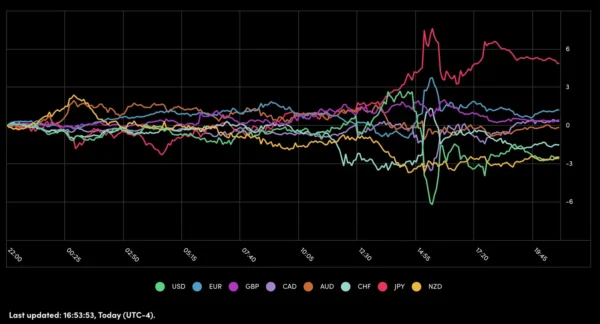

A bizarre reaction from the US Dollar at the attacks

Dollar Index 30m Chart – July 16, 2025 – Source: TradingView

Observe the consecutive reactions after the PPI release and the Middle East Headlines –The US Dollar finishes the session down 0.35% after hitting new highs of 98.90 (right now 98.29)

After marking its top, the huge selling candle touched 97.71, down at one point 1.15% before reverting higher.

Other markets cared much less about the headlines, particularly US Indices which have all risen today even after some heavy flash selling – The Dow actually felt the most relief, up 0.53% on the session

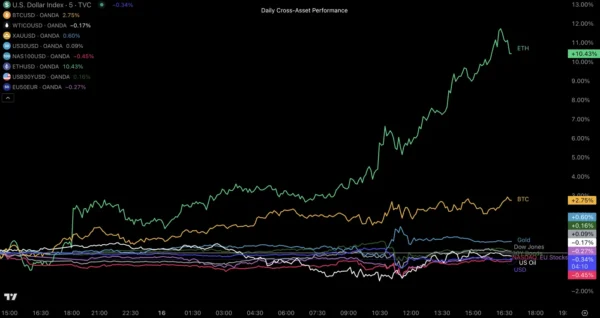

Daily Cross-Asset performance

Cross-Asset Daily Performance, July 16, 2025 – Source: TradingView

The story repeats, and Ethereum is again the best performer of the day, up close to 12% at one point – It’s closing the session still up around 11%, touching highs of $3,425.

You can check our latest Ethereum in-depth analysis here.

Apart from that Equities rose after a volatile session due to the factors mentioned in the intro and the USD is actually the worst performer of the session.

A picture of today’s performance for major currencies

Currency Performance, July 16 – Source: OANDA Labs

The Yen is the winner of the session seeing some major risk-off flows towards it after the Middle East attacks as markets went towards the most “value” risk-off currency, particularly as Technical tops (in USDJPY) were right around.

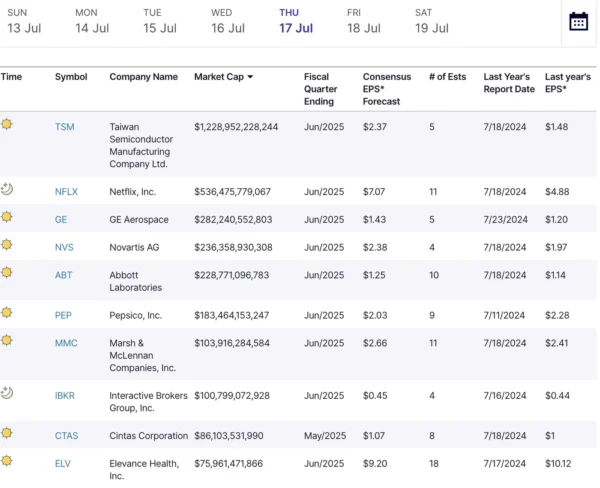

Earnings Season: Who is releasing their numbers tomorrow?

Earnings Calendar for July 17th – Source: Nasdaq.com

Expect earnings from the TSM (Taiwan Semiconductor Manufacturing Company), Netflix, Abbott and Pepsico.

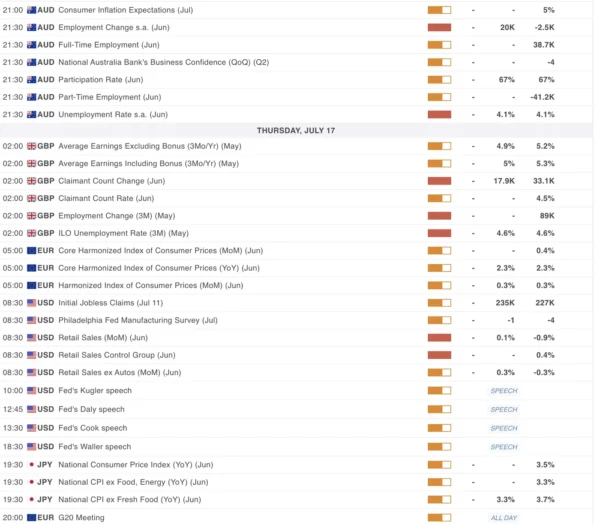

A look at Economic Data releasing in the overnight and upcoming Session

For all Market moving events, check the MarketPulse Economic Calendar

The overnight session is not finished for AUD Traders as some data is expcted at 21:00 ET (Inflation Expectations) and even bigger data right after at 21:30 ET in Australian Employment.

The UK will also see its own Employment Data overnight at 2:00 A.M. ET – Check out the MarketPulse Calendar (select UK if needed) to spot the expectations for the key data for the GBP.

The North-American Session should be dynamic between the Retail Sales and might also be shaken by an army of FED Speakers .

It’s always good to check out what the FED has to say around this time of the cycle as despite just providing more ideas on Cuts and Hikes, you can also observe how they envision the impact of tariffs (They’re fairly good economists I would say).

And for JPY Traders, don’t forget the Monthly CPI report which may add just more volatility to USDJPY and other Yen focused pairs – Any major beat should trigger some anticipated reactions from the Bank of Japan.

Safe Trades!