Here are the latest developments in global markets:

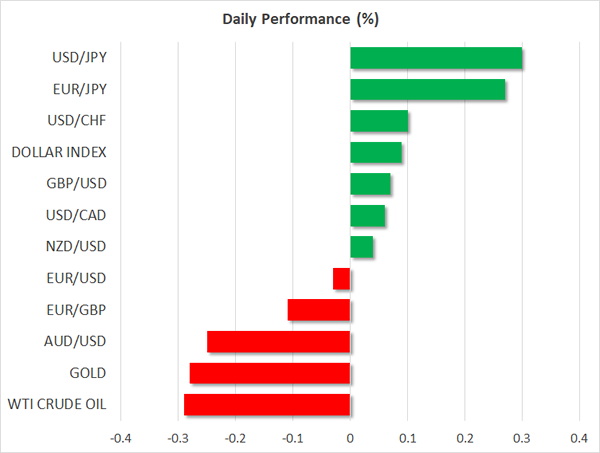

FOREX: The dollar index traded 0.1% higher during the Asian trading session Friday, after posting notable losses on Thursday.

STOCKS: The three major US equity indices – Dow Jones, S&P 500, and Nasdaq Composite – closed at fresh records again yesterday, with the Dow finishing above the 25,000 milestone for the first time. Futures tracking the Dow, S&P, and Nasdaq 100 are currently in the green as well. This positive sentiment rolled over into Asian trading, with Japan’s Nikkei 225 and Topix indices both gaining 0.9%, closing at fresh multi-decade highs. In Hong Kong, the Hang Seng was marginally higher, while in Europe, futures tracking the Euro Stoxx 50 were up by 0.1%.

COMMODITIES: Both WTI and Brent crude oil were down by 0.3% as the Asian session was coming to a halt, both giving back gains they posted on Thursday following a larger-than-anticipated drawdown in US crude inventories. Importantly though, oil prices remain elevated, trading near highs last seen in 2015, amid political tensions in Iran. Gold corrected lower by 0.3%, last trading at $1318 per ounce, after it found resistance around $1325 yesterday.

Major movers: Dollar tumbles despite strong data; yen on backfoot as risk appetite firms

The US dollar index tumbled by 0.4% on Thursday, unable to draw support from the stronger-than-anticipated ADP employment report released yesterday. The report showed that the private sector added 250k jobs in December, much more than the anticipated 190k. This figure is typically considered as a gauge of the nonfarm payrolls print, due out today. That said, one must note that the correlation between these two prints has fallen significantly in recent years.

The yen was on the defensive on Friday, with both dollar/yen and euro/yen being up roughly 0.3%. Given the absence of any major news from Japan, the currency’s underperformance is likely owed to the risk-on appetite of investors. Rising sentiment for risk in markets usually weighs on the yen, which is seen as a safe-haven asset.

The commodity-related currencies were mixed against the greenback. Aussie/dollar was down more than 0.2%, last trading at 0.7840 after touching the 0.7868 mark earlier. The tumble in the pair followed the release of Australia’s trade balance for November, which showed a surprising deficit instead of a surplus, likely generating concerns that GDP growth in Q4 may be weaker than previously anticipated. Both kiwi/dollar and dollar/loonie were higher, but only marginally.

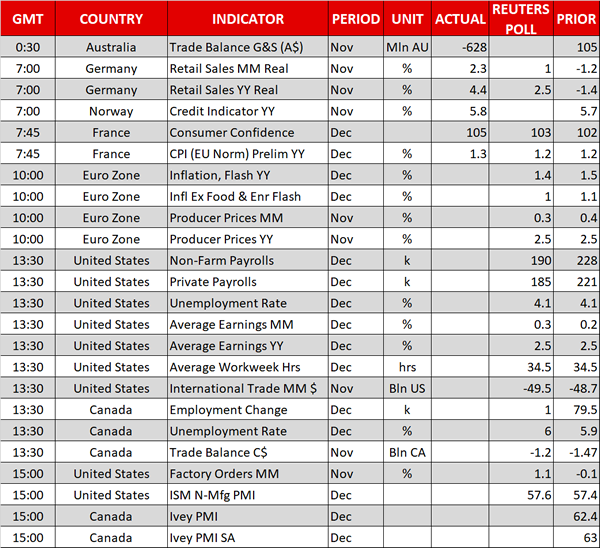

Day ahead: US jobs data eagerly awaited with eurozone inflation also in focus

Eurozone flash inflation figures for the month of December will be made public at 1000 GMT. Headline and core inflation – the latter being the measure that excludes volatile food and energy items – are both anticipated to grow at a slightly softer pace relative to November’s respective readings and well below the European Central Bank’s target for inflation of below but close to 2%. An upside surprise in the data could lead market participants to revise their expectations for an end to the ECB’s QE program sooner rather than later, pushing the euro higher. Forex market participants will of course position themselves accordingly in case of a negative surprise as well.

All eyes today will be falling on the US nonfarm payrolls report for the month of December scheduled for release at 1330 GMT; a strong report is expected to lift the dollar and vice versa. The number of positions added to the economy during the month is projected to stand at 190k, below November’s 228k, and the unemployment rate is anticipated to remain at 4.1%, its lowest since January 2001. However, most attention could yet again be falling on wage growth: month-on-month, average earnings are forecast to grow at a slightly faster pace than in November and expand at the same 2.5% year-on-year rate as in the preceding month. An uptick in wage growth is likely to lead to rising price pressures, lending support to the Fed’s decision to deliver gradual rate hikes moving forward (or even support the case for more interest rate rises than would otherwise be delivered).

Important for loonie traders would be the release of Canada’s December jobs report due at the same time as the NFP report (1330 GMT). Data on the nation’s trade balance will also be made public alongside employment figures, while the Ivey PMI out on 1500 GMT might also attract some interest.

Other data of significance out of the US would pertain to November international trade figures (1330 GMT), November factory orders and durable goods (1500 GMT), and December’s ISM non-manufacturing PMI (1500 GMT).

In terms of policymakers’ appearances, Philadelphia Fed President Patrick Harker will be speaking on the US economic outlook at 1515 GMT and Cleveland Fed President Loretta Mester will be participating in a panel discussion titled “Coordinating Conventional and Unconventional Monetary Policies for Macroeconomic Stability” at 1730 GMT. Bank of England chief economist Andy Haldane will be chairing panel discussions at the Allied Social Sciences Association Annual Meeting; the relevant event begins at 1930 GMT.

In oil markets, the US Baker Hughes oil rig count due at 1800 GMT will be gathering attention.

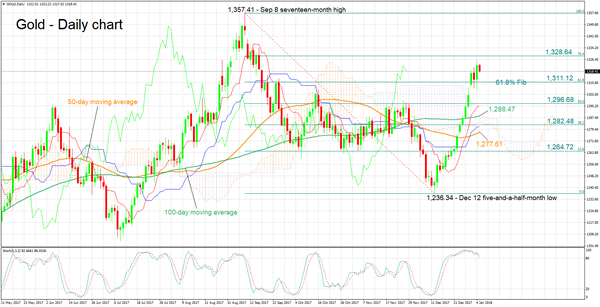

Technical Analysis: Gold remains close to 3½-month high; warning sign by stochastics in very short-term

The overall bias for gold remains positive with the precious metal hitting a three-and-a-half-month high of 1325.88 during Thursday’s trading after advancing significantly over the last three weeks (and after recording a five-and-a-half-month low of 1,236.34 on December 12). The case for an overall bullish bias is also supported by the Tenkan-sen line being above the Kijun-sen one. However, the stochastics are giving a warning sign in the very short-term: the %K line has crossed below the slow %D line and both lines are pointing downwards, this being a bearish signal.

A strong jobs report out of the US is expected to lead to dollar strength and consequently weaken the dollar-denominated metal. In this case, the yellow metal might find support around the 61.8% Fibonacci retracement level at 1,311.12 of the September 8 to December 12 downleg.

A disappointment on the jobs front and thus dollar weakness, is likely to push gold higher. In such an event, the range around the 76.4% Fibonacci retracement level at 1,328.64 could act as a barrier to the upside. The area around this mark also encapsulates yesterday’s high of 1325.88, something which perhaps increases its significance.