USD Softer Ahead of ECB Monetary Policy Meeting

Trump Administration Endorses Dollar Weakness and gets tough on trade

The USD tumbled against all majors on Wednesday. The US Secretary of the Treasury issued comments in support of a weaker dollar. The combination of a lower currency and a tough stance on trade has sparked concerns that a global trade war could ignite. The US dollar has lacked traction in 2018 as domestic political uncertainty and economic recovery abroad continue to put downward pressure on the greenback. The highlight for the market on Thursday will be the press conference from European Central Bank (ECB) President Mario Draghi.

- The ECB minutes from December diverged form what Draghi said.

- The World Economic Forum in Davos continues in Switzerland

- US Commerce Secretary talked up hardline approach to trade

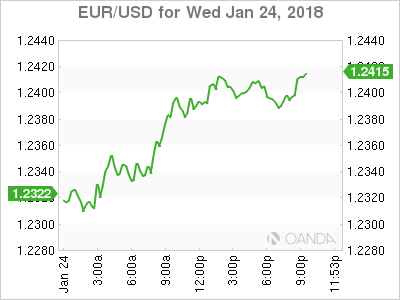

The EUR/USD gained 0.82 percent on Wednesday. The single currency is trading at 1.24 after some comments from US officials showed the current administration has diverged from the past in seeking a strong dollar policy and in fact could be ramping up for a trade war. US Secretary of the Treasury Steven Mnuchin said he welcomed the weakness in the US given the positive impact on trade. The words from the Secretary were shocking given his predecessors comments on a strong currency. Trade has been at the forefront after the US has imposed tariffs on certain products with President Donald Trump scheduled to talk at Davos on Friday. The US leader is anticipated to continue to paradox of highlighting stronger growth, which should value the currency higher, while at the same time seeking trade advantages in his America first strategy.

The European Central Bank (ECB) will publish its minimum bid rate on Thursday, January 25 at 7:45 am EST. There is no change expected with the attention of the market focused on the words of ECB President Mario Draghi who will host a press conference at 8:30 am EST.

The EUR touched a three year high versus the USD and given the minutes showed a more hawkish ECB, Draghi could go even deeper into neutral territory and talk down both the currency by highlighting the still low European inflation. Given that most of this EUR move was sparked by US dollar weakness Mr Draghi is facing an uphill battle.

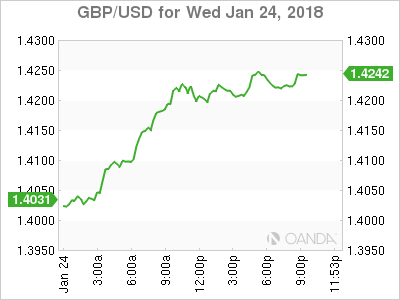

The GBP/USD gained 1.53 percent in the last 24 hours. The currency pair is trading at 1.4210 and reached levels not seen since the aftermath of the Brexit referendum. The higher chances of a softer exit and the weakness of the US dollar left the pound in current levels with the assumption that the ECB is close to announcing an end of QE this year with a small possibility of higher rates before the end of 2018. Mario Draghi has tried to shied away from saying that in so many words, with his actual statements remaining neutral despite evidence that there is a strong economic recovery underway, particularly by looking at Germany. That the engine of the European recovery is Germany will not be a surprise but this time it seems the there are multiple signs of optimism in the EU.

The GBP was the strongest performer on Thursday against the dollar, but similar to the EUR move it was based more on USD weakness than any particular British indicator. The political uncertainty which ended in a 1 day shutdown of the Federal Government was not the perfect start for for Washington taking into consideration the primaries in the fall.

Market events to watch this week:

Thursday, January 25

7:45am EUR Minimum Bid Rate

8:30 am CAD Core Retail Sales m/m

8:30 am EUR ECB Press Conference

Friday, January 26

4:30 am GBP Prelim GDP q/q

8:30 am CAD CPI m/m

8:30 am USD Advance GDP q/q

8:30 am USD Core Durable Goods Orders m/m